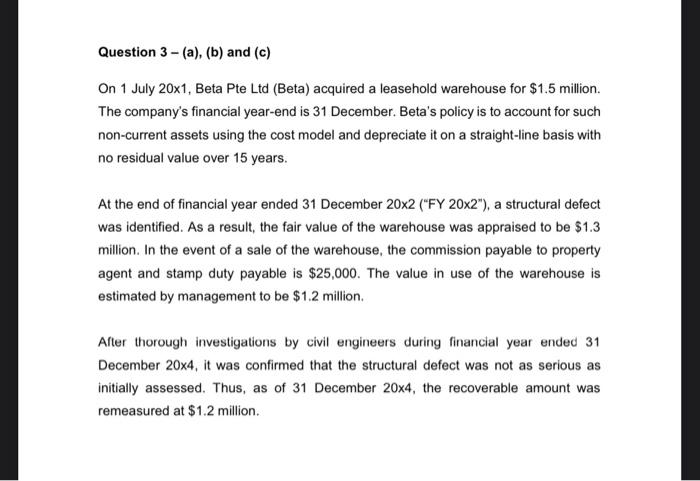

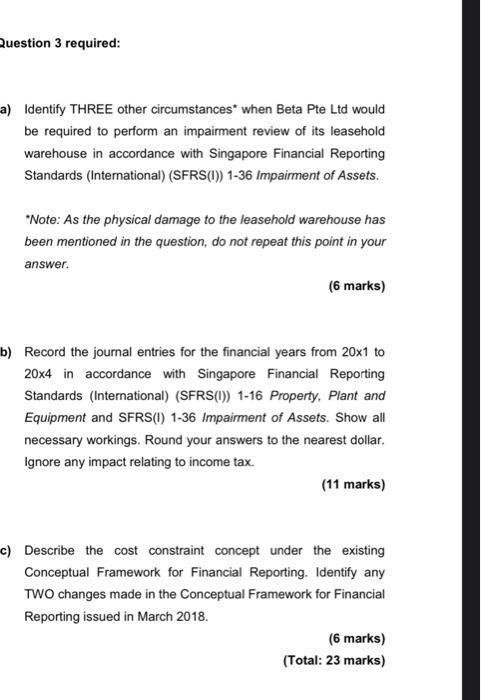

On 1 July 20x1, Beta Pte Ltd (Beta) acquired a leasehold warehouse for \\( \\$ 1.5 \\) million. The company's financial year-end is 31 December. Beta's policy is to account for such non-current assets using the cost model and depreciate it on a straight-line basis with no residual value over 15 years. At the end of financial year ended 31 December \\( 20 \\times 2 \\) (\"FY 20x2\"), a structural defect was identified. As a result, the fair value of the warehouse was appraised to be \\( \\$ 1.3 \\) million. In the event of a sale of the warehouse, the commission payable to property agent and stamp duty payable is \\( \\$ 25,000 \\). The value in use of the warehouse is estimated by management to be \\( \\$ 1.2 \\) million. After thorough investigations by civil engineers during financial year ended 31 December \\( 20 \\times 4 \\), it was confirmed that the structural defect was not as serious as initially assessed. Thus, as of 31 December \\( 20 \\times 4 \\), the recoverable amount was remeasured at \\( \\$ 1.2 \\) million. 2uestion 3 required: a) Identify THREE other circumstances* when Beta Pte Ltd would be required to perform an impairment review of its leasehold warehouse in accordance with Singapore Financial Reporting Standards (International) (SFRS(I)) 1-36 Impairment of Assets. \"Note: As the physical damage to the leasehold warehouse has been mentioned in the question, do not repeat this point in your answer. (6 marks) b) Record the journal entries for the financial years from \\( 20 \\times 1 \\) to \\( 20 \\times 4 \\) in accordance with Singapore Financial Reporting Standards (International) (SFRS(I)) 1-16 Property, Plant and Equipment and SFRS(I) 1-36 Impairment of Assets. Show all necessary workings. Round your answers to the nearest dollar. Ignore any impact relating to income tax. (11 marks) c) Describe the cost constraint concept under the existing Conceptual Framework for Financial Reporting. Identify any TWO changes made in the Conceptual Framework for Financial Reporting issued in March 2018. (6 marks) (Total: 23 marks)