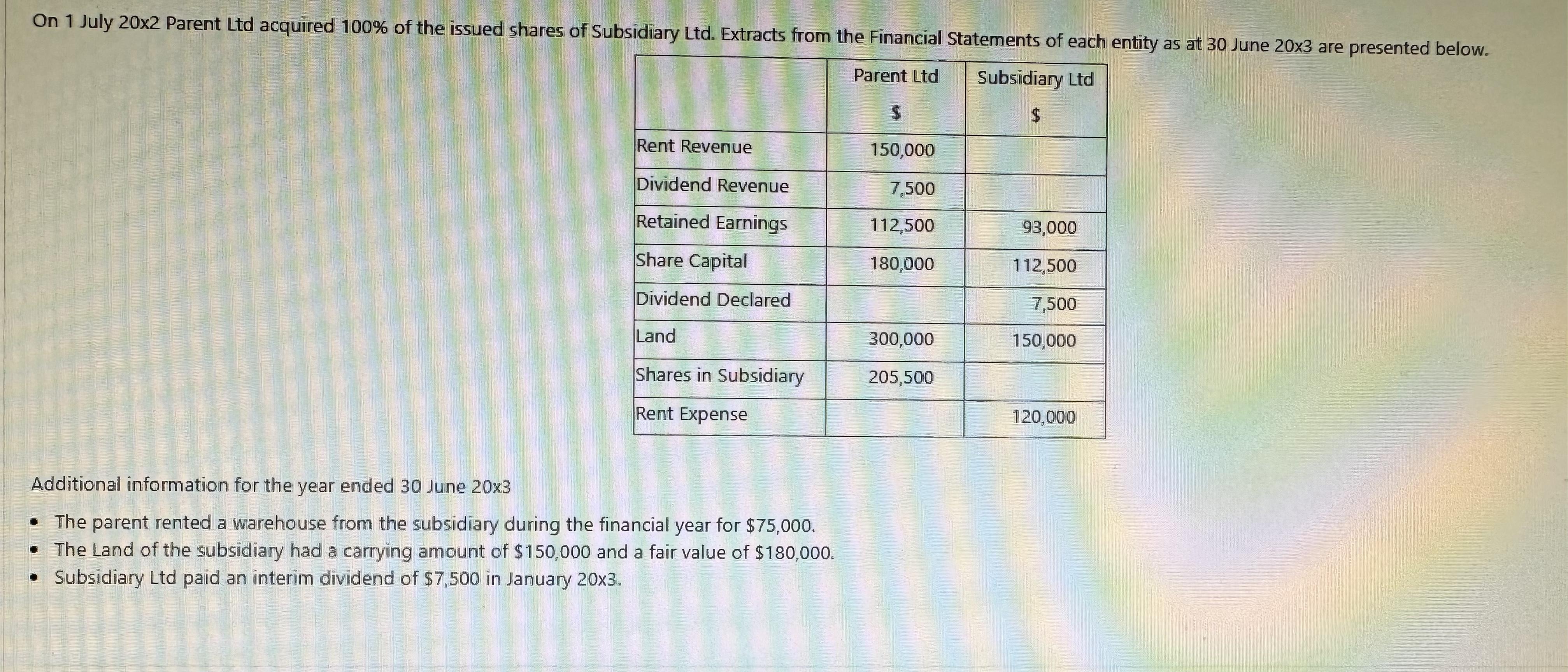

On 1 July 20x2 Parent Ltd acquired 100% of the issued shares of Subsidiary Ltd. Extracts from the Financial Statements of each entity as

On 1 July 20x2 Parent Ltd acquired 100% of the issued shares of Subsidiary Ltd. Extracts from the Financial Statements of each entity as at 30 June 20x3 are presented below. Subsidiary Ltd $ Rent Revenue Dividend Revenue Retained Earnings Share Capital Dividend Declared Land Shares in Subsidiary Rent Expense Additional information for the year ended 30 June 20x3 The parent rented a warehouse from the subsidiary during the financial year for $75,000. The Land of the subsidiary had a carrying amount of $150,000 and a fair value of $180,000. Subsidiary Ltd paid an interim dividend of $7,500 in January 20x3. Parent Ltd 150,000 7,500 112,500 180,000 300,000 205,500 93,000 112,500 7,500 150,000 120,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets analyze the information provided for Parent Ltd and Subsidiary Ltd as at 30 June 20x3 Parent Ltd Rent Revenue 150000 Dividend Revenue 7500 Retain...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started