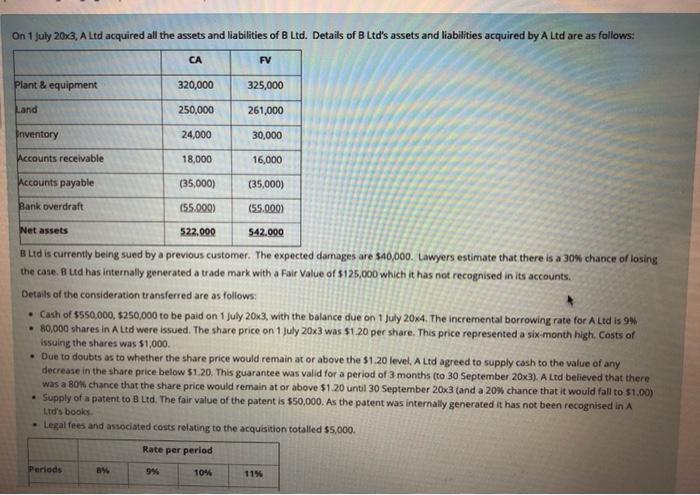

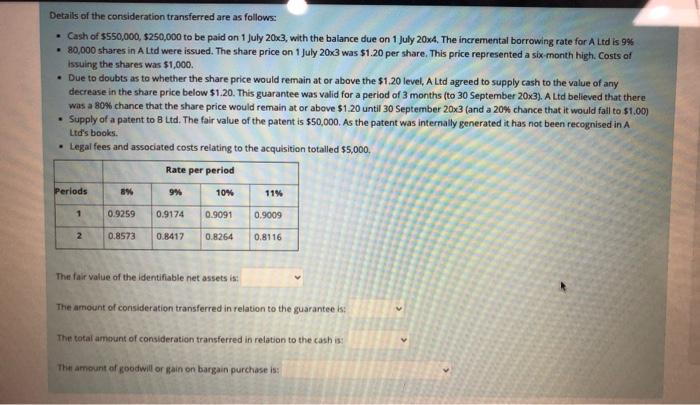

On 1 July 20x3, A Ltd acquired all the assets and liabilities of B Ltd. Details of BLtd's assets and liabilities acquired by A Ltd are as follows: CA FV Plant & equipment 320,000 325,000 hand 250,000 261,000 Inventory 24,000 30,000 Accounts receivable 18,000 16,000 Accounts payable (35,000) (35,000) Bank overdraft 155.000) (55.000) Net assets 522.000 542.000 BLtd is currently being sued by a previous customer. The expected damages are $40,000. Lawyers estimate that there is a 30% chance of losing the case. Butd has internally generated a trade mark with a Fair Value of $125,000 which it has not recognised in its accounts. Details of the consideration transferred are as follows: Cash of 5550,000, $250,000 to be paid on 1 July 2013, with the balance due on 1 July 20x4. The incremental borrowing rate for A Ltd is 9 . 80,000 shares in Altd were issued. The share price on 1 July 20x3 was $1.20 per share. This price represented a six-month high. Costs of kasuing the shares was $1,000 . Due to doubts as to whether the share price would remain at or above the 1.20 level. A Ltd agreed to supply cash to the value of any decrease in the share price below $1.20. This guarantee was valid for a period of 3 months (to 30 September 20x3). A Ltd believed that there was a B0% chance that the share price would remain at or above $1.20 until 30 September 20x3 (and a 20% chance that it would fall to 51.00) Supply of a patent to B Ltd. The fair value of the patent is $50,000. As the patent was internally generated it has not been recognised in A Legal fees and associated costs relating to the acquisition totalled $5.000. Rate per period Ltd's books Periods ay 9% 10% 11% Details of the consideration transferred are as follows: . Cash of $550,000 $250,000 to be paid on 1 July 20x3, with the balance due on 1 July 20x4. The incremental borrowing rate for A Ltd is 9% . 80,000 shares in Altd were issued. The share price on 1 July 20x3 was $1.20 per share. This price represented a six-month high. Costs of Issuing the shares was $1,000. . Due to doubts as to whether the share price would remain at or above the $1.20 level, A Ltd agreed to supply cash to the value of any decrease in the share price below $1.20. This guarantee was valid for a period of 3 months (to 30 September 20x3). A Ltd believed that there was a 80% chance that the share price would remain at or above $1.20 until 30 September 2013 (and a 20% chance that it would fail to 51.00) Supply at a patent to B Ltd. The fair value of the patent is $50,000. As the patent was internally generated it has not been recognised in A Ltd's books. Legal fees and associated costs relating to the acquisition totalled $5,000, Rate per period Periods 9% 10% 8% 11% 1 0.9259 0.9174 0.9091 0.9009 2 0.8573 0.8417 0.8264 0.8116 The fair value of the identifiable net assets is: v The amount of consideration transferred in relation to the guarantee is: The total amount of consideration transferred in relation to the cash is: The amount of goodwill or gain on bargain purchase is On 1 July 20x3, A Ltd acquired all the assets and liabilities of B Ltd. Details of BLtd's assets and liabilities acquired by A Ltd are as follows: CA FV Plant & equipment 320,000 325,000 hand 250,000 261,000 Inventory 24,000 30,000 Accounts receivable 18,000 16,000 Accounts payable (35,000) (35,000) Bank overdraft 155.000) (55.000) Net assets 522.000 542.000 BLtd is currently being sued by a previous customer. The expected damages are $40,000. Lawyers estimate that there is a 30% chance of losing the case. Butd has internally generated a trade mark with a Fair Value of $125,000 which it has not recognised in its accounts. Details of the consideration transferred are as follows: Cash of 5550,000, $250,000 to be paid on 1 July 2013, with the balance due on 1 July 20x4. The incremental borrowing rate for A Ltd is 9 . 80,000 shares in Altd were issued. The share price on 1 July 20x3 was $1.20 per share. This price represented a six-month high. Costs of kasuing the shares was $1,000 . Due to doubts as to whether the share price would remain at or above the 1.20 level. A Ltd agreed to supply cash to the value of any decrease in the share price below $1.20. This guarantee was valid for a period of 3 months (to 30 September 20x3). A Ltd believed that there was a B0% chance that the share price would remain at or above $1.20 until 30 September 20x3 (and a 20% chance that it would fall to 51.00) Supply of a patent to B Ltd. The fair value of the patent is $50,000. As the patent was internally generated it has not been recognised in A Legal fees and associated costs relating to the acquisition totalled $5.000. Rate per period Ltd's books Periods ay 9% 10% 11% Details of the consideration transferred are as follows: . Cash of $550,000 $250,000 to be paid on 1 July 20x3, with the balance due on 1 July 20x4. The incremental borrowing rate for A Ltd is 9% . 80,000 shares in Altd were issued. The share price on 1 July 20x3 was $1.20 per share. This price represented a six-month high. Costs of Issuing the shares was $1,000. . Due to doubts as to whether the share price would remain at or above the $1.20 level, A Ltd agreed to supply cash to the value of any decrease in the share price below $1.20. This guarantee was valid for a period of 3 months (to 30 September 20x3). A Ltd believed that there was a 80% chance that the share price would remain at or above $1.20 until 30 September 2013 (and a 20% chance that it would fail to 51.00) Supply at a patent to B Ltd. The fair value of the patent is $50,000. As the patent was internally generated it has not been recognised in A Ltd's books. Legal fees and associated costs relating to the acquisition totalled $5,000, Rate per period Periods 9% 10% 8% 11% 1 0.9259 0.9174 0.9091 0.9009 2 0.8573 0.8417 0.8264 0.8116 The fair value of the identifiable net assets is: v The amount of consideration transferred in relation to the guarantee is: The total amount of consideration transferred in relation to the cash is: The amount of goodwill or gain on bargain purchase is