Answered step by step

Verified Expert Solution

Question

1 Approved Answer

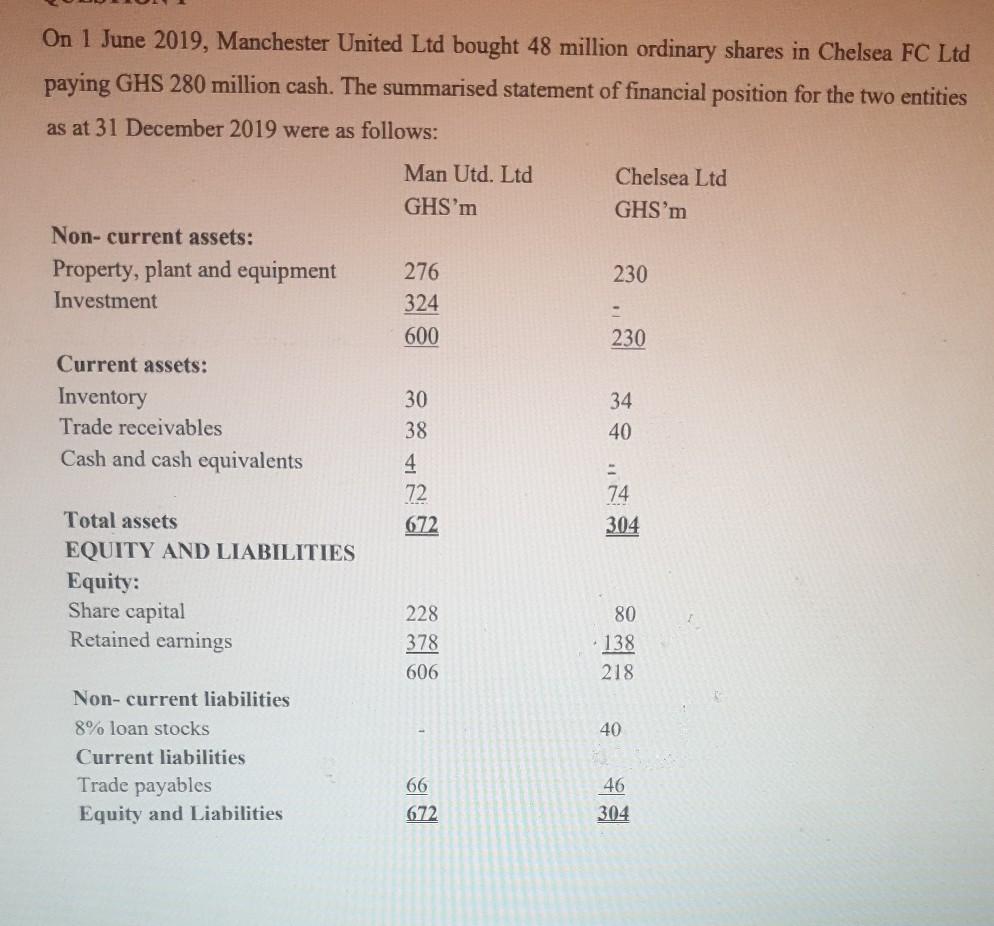

On 1 June 2019, Manchester United Ltd bought 48 million ordinary shares in Chelsea FC Ltd paying GHS 280 million cash. The summarised statement of

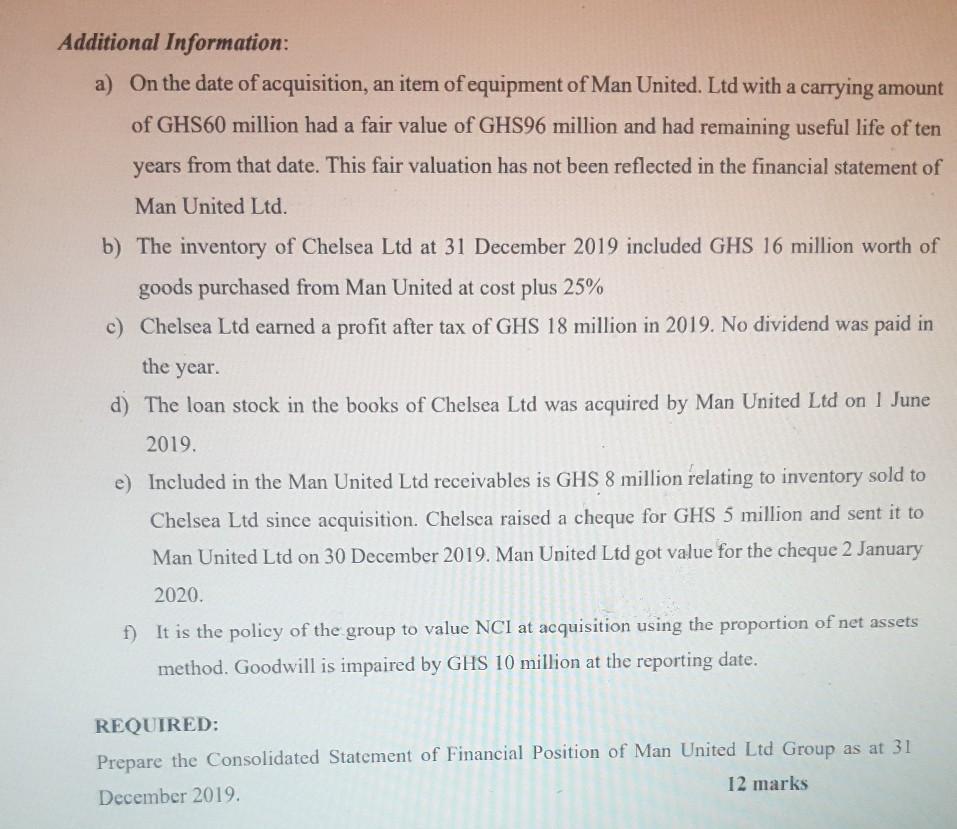

On 1 June 2019, Manchester United Ltd bought 48 million ordinary shares in Chelsea FC Ltd paying GHS 280 million cash. The summarised statement of financial position for the two entities as at 31 December 2019 were as follows: Man Utd. Ltd GHS'm Chelsea Ltd GHS'm Non- current assets: Property, plant and equipment Investment 230 276 324 600 230 Current assets: Inventory Trade receivables Cash and cash equivalents 30 38 34 40 4 72 672 74 304 Total assets EQUITY AND LIABILITIES Equity: Share capital Retained earnings 228 378 606 80 138 218 40 Non-current liabilities 8% loan stocks Current liabilities Trade payables Equity and Liabilities 66 46 304 672 Additional Information: a) On the date of acquisition, an item of equipment of Man United. Ltd with a carrying amount of GHS60 million had a fair value of GHS96 million and had remaining useful life of ten years from that date. This fair valuation has not been reflected in the financial statement of Man United Ltd. b) The inventory of Chelsea Ltd at 31 December 2019 included GHS 16 million worth of goods purchased from Man United at cost plus 25% c) Chelsea Ltd earned a profit after tax of GHS 18 million in 2019. No dividend was paid in the year. d) The loan stock in the books of Chelsea Ltd was acquired by Man United Ltd on 1 June 2019. e) Included in the Man United Ltd receivables is GHS 8 million relating to inventory sold to Chelsea Ltd since acquisition. Chelsea raised a cheque for GHS 5 million and sent it to Man United Ltd on 30 December 2019. Man United Ltd got value for the cheque 2 January 2020. f) It is the policy of the group to value NCI at acquisition using the proportion of net assets method. Goodwill is impaired by GHS 10 million at the reporting date. REQUIRED: Prepare the Consolidated Statement of Financial Position of Man United Ltd Group as at 31 December 2019. 12 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started