Answered step by step

Verified Expert Solution

Question

1 Approved Answer

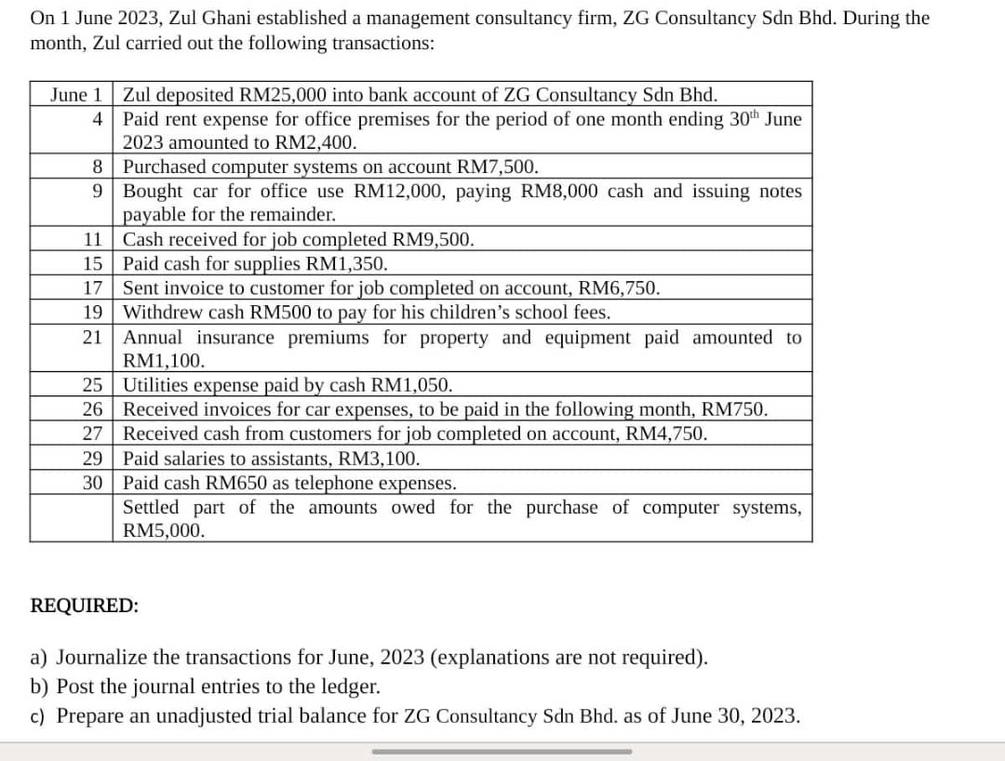

On 1 June 2023, Zul Ghani established a management consultancy firm, ZG Consultancy Sdn Bhd. During the month, Zul carried out the following transactions:

On 1 June 2023, Zul Ghani established a management consultancy firm, ZG Consultancy Sdn Bhd. During the month, Zul carried out the following transactions: June 1 Zul deposited RM25,000 into bank account of ZG Consultancy Sdn Bhd. 4 Paid rent expense for office premises for the period of one month ending 30th June 2023 amounted to RM2,400. 8 Purchased computer systems on account RM7,500. 9 Bought car for office use RM12,000, paying RM8,000 cash and issuing notes payable for the remainder. 11 Cash received for job completed RM9,500. 15 Paid cash for supplies RM1,350. 17 Sent invoice to customer for job completed on account, RM6,750. 19 Withdrew cash RM500 to pay for his children's school fees. 21 Annual insurance premiums for property and equipment paid amounted to RM1,100. 25 Utilities expense paid by cash RM1,050. 26 Received invoices for car expenses, to be paid in the following month, RM750. Received cash from customers for job completed on account, RM4,750. 27 29 Paid salaries to assistants, RM3,100. 30 Paid cash RM650 as telephone expenses. Settled part of the amounts owed for the purchase of computer systems, RM5,000. REQUIRED: a) Journalize the transactions for June, 2023 (explanations are not required). b) Post the journal entries to the ledger. c) Prepare an unadjusted trial balance for ZG Consultancy Sdn Bhd. as of June 30, 2023.

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answers a Journalize the transactions for June 2023 1 June 1 Cash asset Bank asset Zul deposited RM25000 into the bank account of ZG Consultancy Sdn Bhd Debit Cash RM25000 Credit Bank RM25000 4 June 4 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started