Question

On 1 May 2018 G Ltd has shares that it intends to sell on 31 July 2018 (sell position). To hedge against an adverse movement

On 1 May 2018 G Ltd has shares that it intends to sell on 31 July 2018 (sell position). To hedge against an adverse movement in the market price of the shares, it is assumed that G Ltd sells 4 September 2018 SPI 200 futures contracts ($25 per SPI futures point) and pays an initial cash deposit (margin) of $25 000 to a broker. On 1 May 2018 the price of the September 2018 SPI 200 futures contracts is 1322. The September 2018 SPI 200 futures contracts are assumed to qualify as a hedge because there is a high correlation between the value of the parcel of shares and the value of the September 2018 SPI 200 futures contracts. Also it is assumed that the shares are market-to-market. G Ltd prepares its financial statements on 30 June. The shares are sold and the September 2018 SPI 200 futures contracts closed out on 31 July 2018.

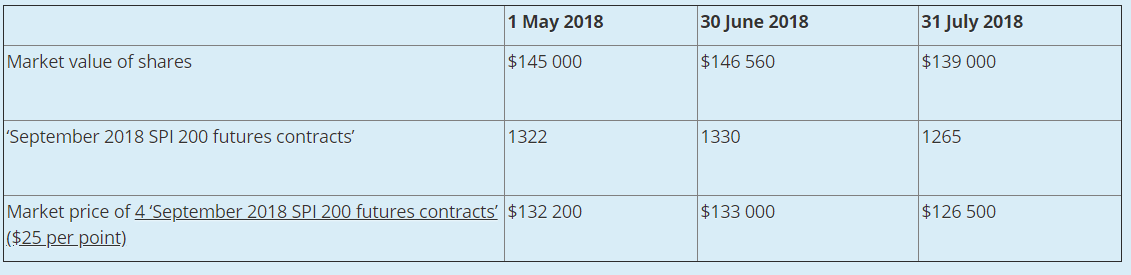

The relevant market prices are as follows:

Provide the general journal entries of G Ltd for investment purposes (hedge).

Provide the general journal entries of G Ltd for investment purposes (hedge).

1 May 2018 30 June 2018 31 July 2018 Market value of shares $145 000 $146 560 $139 000 September 2018 SPI 200 futures contracts' 1322 1330 1265 $133 000 $126 500 Market price of 4 'September 2018 SPI 200 futures contracts' $132 200 ($25 per point) 1 May 2018 30 June 2018 31 July 2018 Market value of shares $145 000 $146 560 $139 000 September 2018 SPI 200 futures contracts' 1322 1330 1265 $133 000 $126 500 Market price of 4 'September 2018 SPI 200 futures contracts' $132 200 ($25 per point)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started