Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 May 20.18 Venus Traders entered into a new two-year advertising agreement with Tino Advertising Agency. The advertising agreement was effective with immediate effect

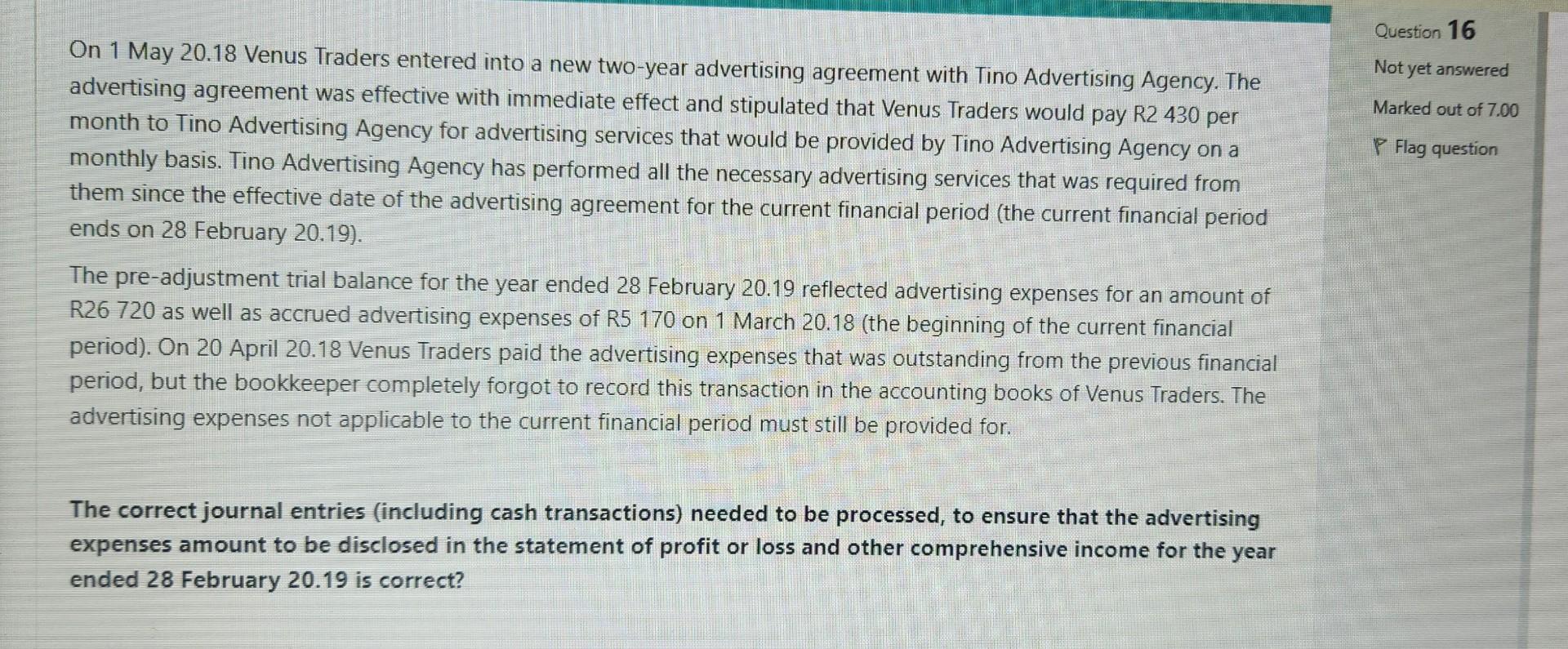

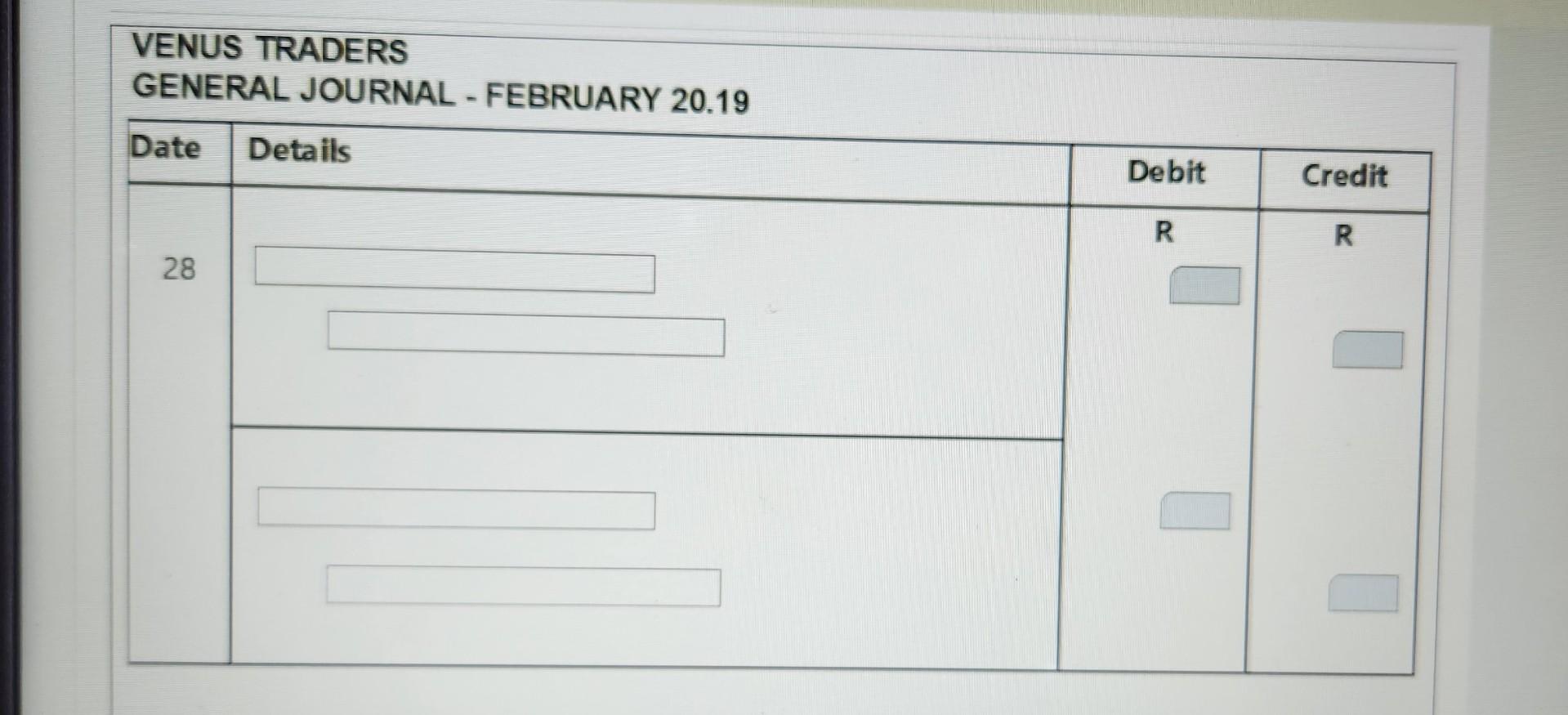

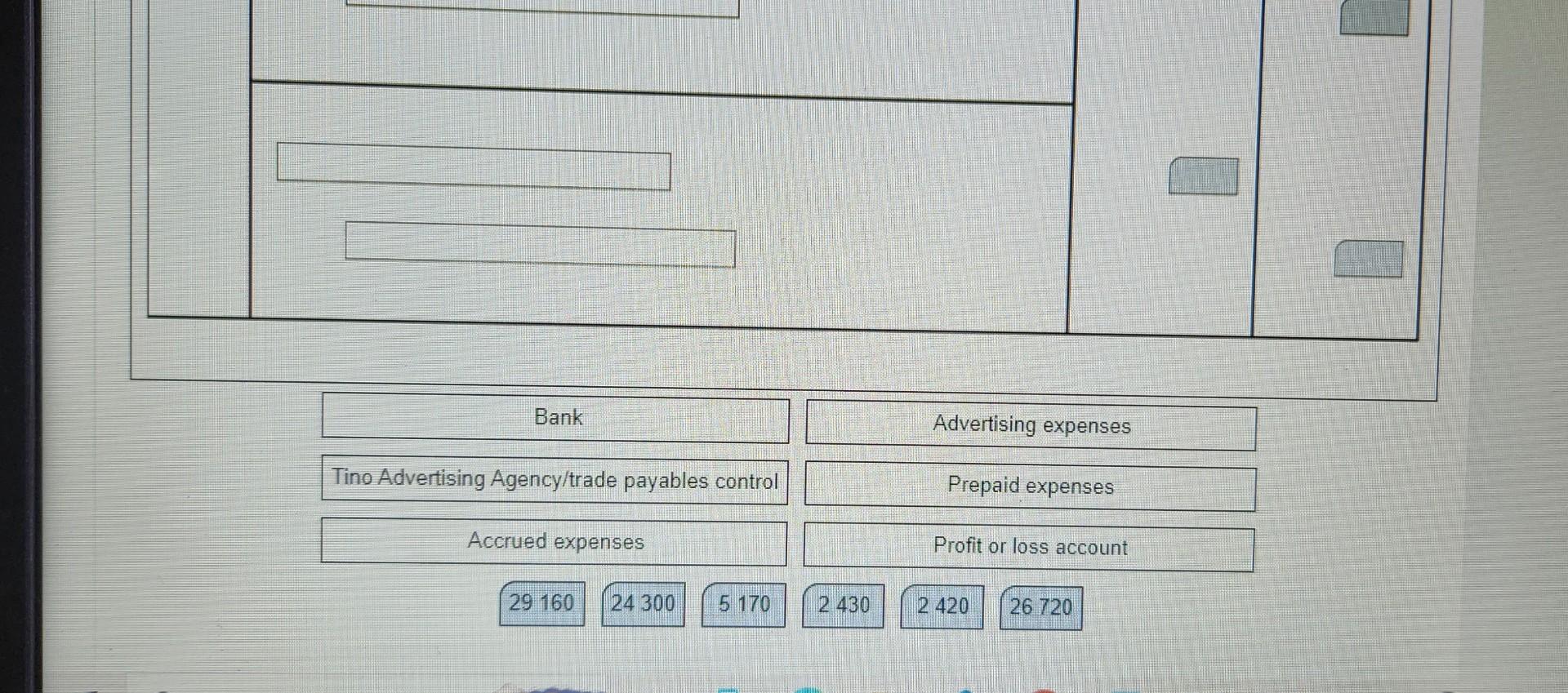

On 1 May 20.18 Venus Traders entered into a new two-year advertising agreement with Tino Advertising Agency. The advertising agreement was effective with immediate effect and stipulated that Venus Traders would pay R2 430 per month to Tino Advertising Agency for advertising services that would be provided by Tino Advertising Agency on a monthly basis. Tino Advertising Agency has performed all the necessary advertising services that was required from them since the effective date of the advertising agreement for the current financial period (the current financial period ends on 28 February 20.19). The pre-adjustment trial balance for the year ended 28 February 20.19 reflected advertising expenses for an amount of R26 720 as well as accrued advertising expenses of R5 170 on 1 March 20.18 (the beginning of the current financial period). On 20 April 20.18 Venus Traders paid the advertising expenses that was outstanding from the previous financial period, but the bookkeeper completely forgot to record this transaction in the accounting books of Venus Traders. The advertising expenses not applicable to the current financial period must still be provided for. The correct journal entries (including cash transactions) needed to be processed, to ensure that the advertising expenses amount to be disclosed in the statement of profit or loss and other comprehensive income for the year ended 28 February 20.19 is correct? VENUS TRADERS GENERAL JOURNAL - FEBRUARY 20.19 On 1 May 20.18 Venus Traders entered into a new two-year advertising agreement with Tino Advertising Agency. The advertising agreement was effective with immediate effect and stipulated that Venus Traders would pay R2 430 per month to Tino Advertising Agency for advertising services that would be provided by Tino Advertising Agency on a monthly basis. Tino Advertising Agency has performed all the necessary advertising services that was required from them since the effective date of the advertising agreement for the current financial period (the current financial period ends on 28 February 20.19). The pre-adjustment trial balance for the year ended 28 February 20.19 reflected advertising expenses for an amount of R26 720 as well as accrued advertising expenses of R5 170 on 1 March 20.18 (the beginning of the current financial period). On 20 April 20.18 Venus Traders paid the advertising expenses that was outstanding from the previous financial period, but the bookkeeper completely forgot to record this transaction in the accounting books of Venus Traders. The advertising expenses not applicable to the current financial period must still be provided for. The correct journal entries (including cash transactions) needed to be processed, to ensure that the advertising expenses amount to be disclosed in the statement of profit or loss and other comprehensive income for the year ended 28 February 20.19 is correct? VENUS TRADERS GENERAL JOURNAL - FEBRUARY 20.19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started