Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 November 2001, Jiwe Construction Company Ltd was awarded a contract to construct an office block for the Association of Women Accountants of

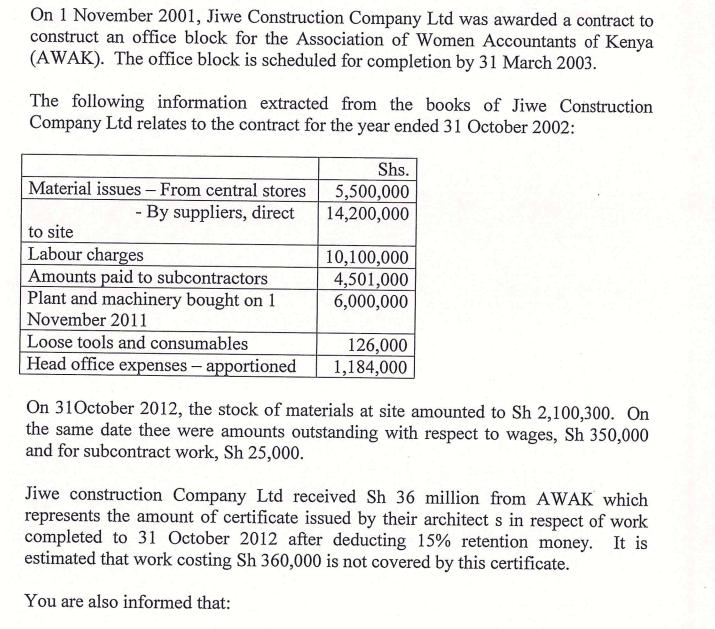

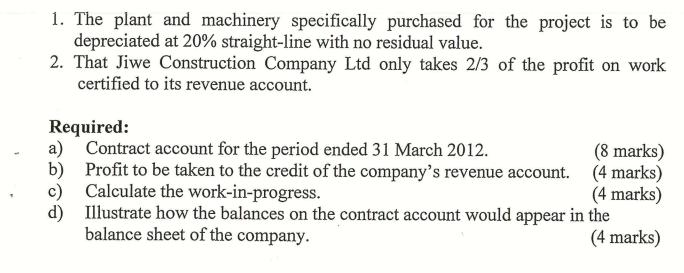

On 1 November 2001, Jiwe Construction Company Ltd was awarded a contract to construct an office block for the Association of Women Accountants of Kenya (AWAK). The office block is scheduled for completion by 31 March 2003. The following information extracted from the books of Jiwe Construction Company Ltd relates to the contract for the year ended 31 October 2002: Material issues - From central stores - By suppliers, direct to site Labour charges Amounts paid to subcontractors Plant and machinery bought on 1 November 2011 Loose tools and consumables Head office expenses - apportioned Shs. 5,500,000 14,200,000 10,100,000 4,501,000 6,000,000 126,000 1,184,000 On 31October 2012, the stock of materials at site amounted to Sh 2,100,300. On the same date thee were amounts outstanding with respect to wages, Sh 350,000 and for subcontract work, Sh 25,000. Jiwe construction Company Ltd received Sh 36 million from AWAK which represents the amount of certificate issued by their architect s in respect of work completed to 31 October 2012 after deducting 15% retention money. It is estimated that work costing Sh 360,000 is not covered by this certificate. You are also informed that: 1. The plant and machinery specifically purchased for the project is to be depreciated at 20% straight-line with no residual value. 2. That Jiwe Construction Company Ltd only takes 2/3 of the profit on work certified to its revenue account. Required: a) Contract account for the period ended 31 March 2012. b) Profit to be taken to the credit of the company's revenue account. Calculate the work-in-progress. d) Illustrate how the balances on the contract account would appear in the balance sheet of the company. (4 marks) (8 marks) (4 marks) (4 marks)

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started