Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zulu Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an

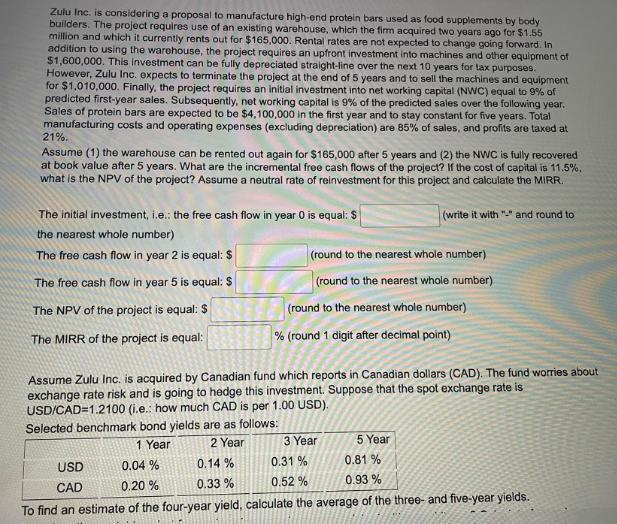

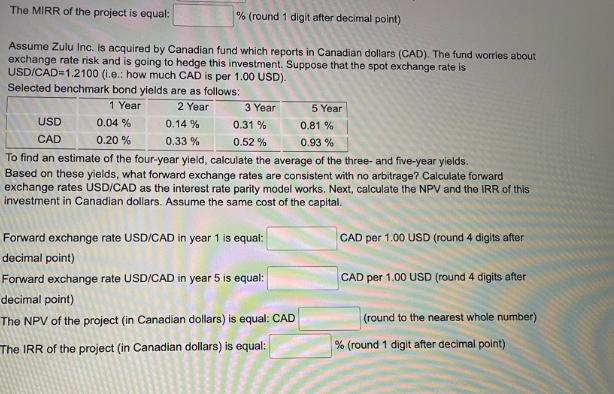

Zulu Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired two years ago for $1.55 million and which it currently rents out for $165,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1,600,000. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Zulu Inc. expects to terminate the project at the end of 5 years and to sell the machines and equipment for $1,010,000. Finally, the project requires an initial investment into net working capital (NWC) equal to 9% of predicted first-year sales. Subsequently, net working capital is 9% of the predicted sales over the following year. Sales of protein bars are expected to be $4,100,000 in the first year and to stay constant for five years. Total manufacturing costs and operating expenses (excluding depreciation) are 85% of sales, and profits are taxed at 21%. Assume (1) the warehouse can be rented out again for $165,000 after 5 years and (2) the NWC is fully recovered at book value after 5 years. What are the incremental free cash flows of the project? If the cost of capital is 11.5%. what is the NPV of the project? Assume a neutral rate of reinvestment for this project and calculate the MIRR. (write it with "-" and round to The initial investment, i.e.: the free cash flow in year 0 is equal: $ the nearest whole number) The free cash flow in year 2 is equal: $ The free cash flow in year 5 is equal: $ The NPV of the project is equal: $ The MIRR of the project is equal: (round to the nearest whole number) (round to the nearest whole number) (round to the nearest whole number) % (round 1 digit after decimal point) Assume Zulu Inc. is acquired by Canadian fund which reports in Canadian dollars (CAD). The fund worries about exchange rate risk and is going to hedge this investment. Suppose that the spot exchange rate is USD/CAD 1.2100 (i.e.: how much CAD is per 1.00 USD). Selected benchmark bond yields are as follows: 1 Year 2 Year 0.14% 0.33% 3 Year 0.31% 0.52% 5 Year USD 0.04% 0.81% CAD 0.20% 0.93% To find an estimate of the four-year yield, calculate the average of the three- and five-year yields. The MIRR of the project is equal: % (round 1 digit after decimal point) Assume Zulu Inc. is acquired by Canadian fund which reports in Canadian dollars (CAD). The fund worries about exchange rate risk and is going to hedge this investment. Suppose that the spot exchange rate is USD/CAD 1.2100 (i.e.: how much CAD is per 1.00 USD). Selected benchmark bond yields are as follows: 1 Year 2 Year USD CAD 3 Year 0.04% 0.14% 0.20% 0.33 % 0.93% To find an estimate of the four-year yield, calculate the average of the three- and five-year yields. Based on these yields, what forward exchange rates are consistent with no arbitrage? Calculate forward exchange rates USD/CAD as the interest rate parity model works. Next, calculate the NPV and the IRR of this investment in Canadian dollars. Assume the same cost of the capital. 0.31% 0.52% 5 Year Forward exchange rate USD/CAD in year 1 is equal: decimal point) Forward exchange rate USD/CAD in year 5 is equal: decimal point) The NPV of the project (in Canadian dollars) is equal: CAD The IRR of the project (in Canadian dollars) is equal: 0.81 % CAD per 1.00 USD (round 4 digits after CAD per 1.00 USD (round 4 digits after (round to the nearest whole number) % (round 1 digit after decimal point)

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Incremental free cash flows of the project Year 0 2685000 Year 1 360000 Year 2 360000 Year 3 360000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started