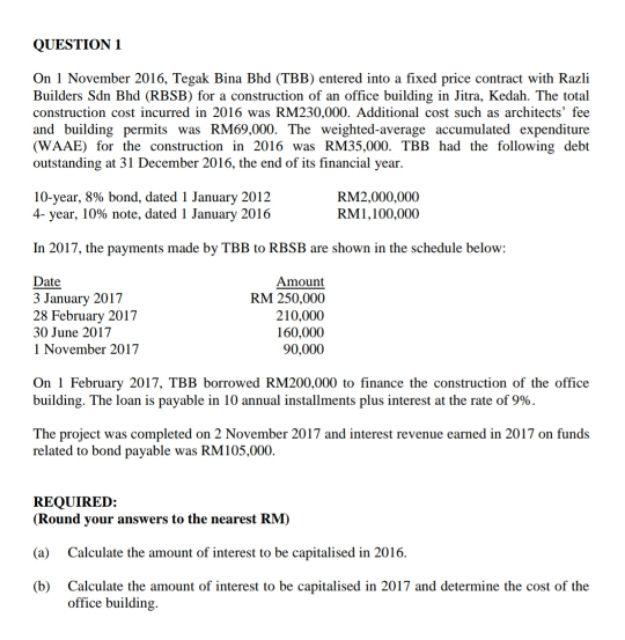

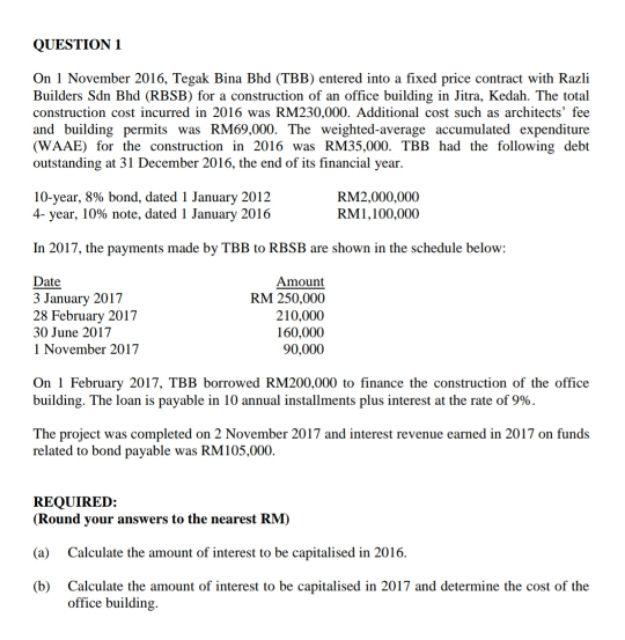

On 1 November 2016, Tegak Bina Bhd (TBB) entered into a fixed price contract with Razli Builders Sdn Bhd (RBSB) for a construction of an office building in Jitra, Kedah. The total construction cost incurred in 2016 was RM230,000. Additional cost such as architects' fee and building permits was RM69,000. The weighted-average accumulated expenditure (WAAE) for the construction in 2016 was RM35,000. TBB had the following debt outstanding at 31 December 2016 , the end of its financial year. In 2017, the payments made by TBB to RBSB are shown in the schedule below: On 1 February 2017. TBB borrowed RM200,000 to finance the construction of the office building. The loan is payable in 10 annual installments plus interest at the rate of 9%. The project was completed on 2 November 2017 and interest revenue earned in 2017 on funds related to bond payable was RM105,000. REQUIRED: (Round your answers to the nearest RM) (a) Calculate the amount of interest to be capitalised in 2016. (b) Calculate the amount of interest to be capitalised in 2017 and determine the cost of the office building. On 1 November 2016, Tegak Bina Bhd (TBB) entered into a fixed price contract with Razli Builders Sdn Bhd (RBSB) for a construction of an office building in Jitra, Kedah. The total construction cost incurred in 2016 was RM230,000. Additional cost such as architects' fee and building permits was RM69,000. The weighted-average accumulated expenditure (WAAE) for the construction in 2016 was RM35,000. TBB had the following debt outstanding at 31 December 2016 , the end of its financial year. In 2017, the payments made by TBB to RBSB are shown in the schedule below: On 1 February 2017. TBB borrowed RM200,000 to finance the construction of the office building. The loan is payable in 10 annual installments plus interest at the rate of 9%. The project was completed on 2 November 2017 and interest revenue earned in 2017 on funds related to bond payable was RM105,000. REQUIRED: (Round your answers to the nearest RM) (a) Calculate the amount of interest to be capitalised in 2016. (b) Calculate the amount of interest to be capitalised in 2017 and determine the cost of the office building