Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on 11 t red out of 2 Based on what you have studied in the course of investment management, you are required to solve the

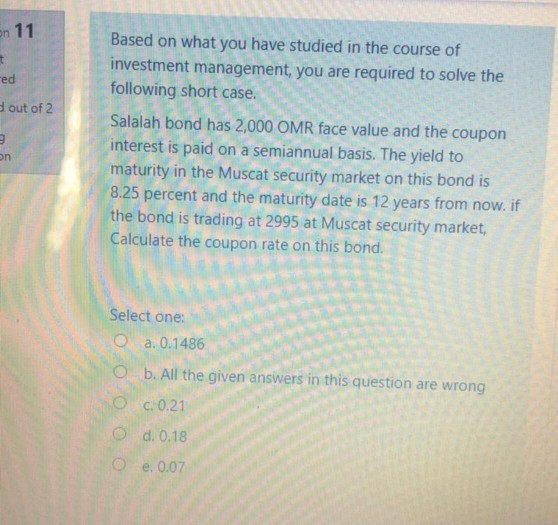

on 11 t red out of 2 Based on what you have studied in the course of investment management, you are required to solve the following short case. Salalah bond has 2,000 OMR face value and the coupon interest is paid on a semiannual basis. The yield to maturity in the Muscat security market on this bond is 8.25 percent and the maturity date is 12 years from now. if the bond is trading at 2995 at Muscat security market, Calculate the coupon rate on this bond. an Select one: a. 0.1486 Ob. All the given answers in this question are wrong O c 0.21 O d. 0.18 e. 0.07

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started