Question

On 1/1/2014, Lion Group purchased 60% (60,000 shares) of Iguana Ltd. for $50 per share, which was a $5 per share control premium. Buildings and

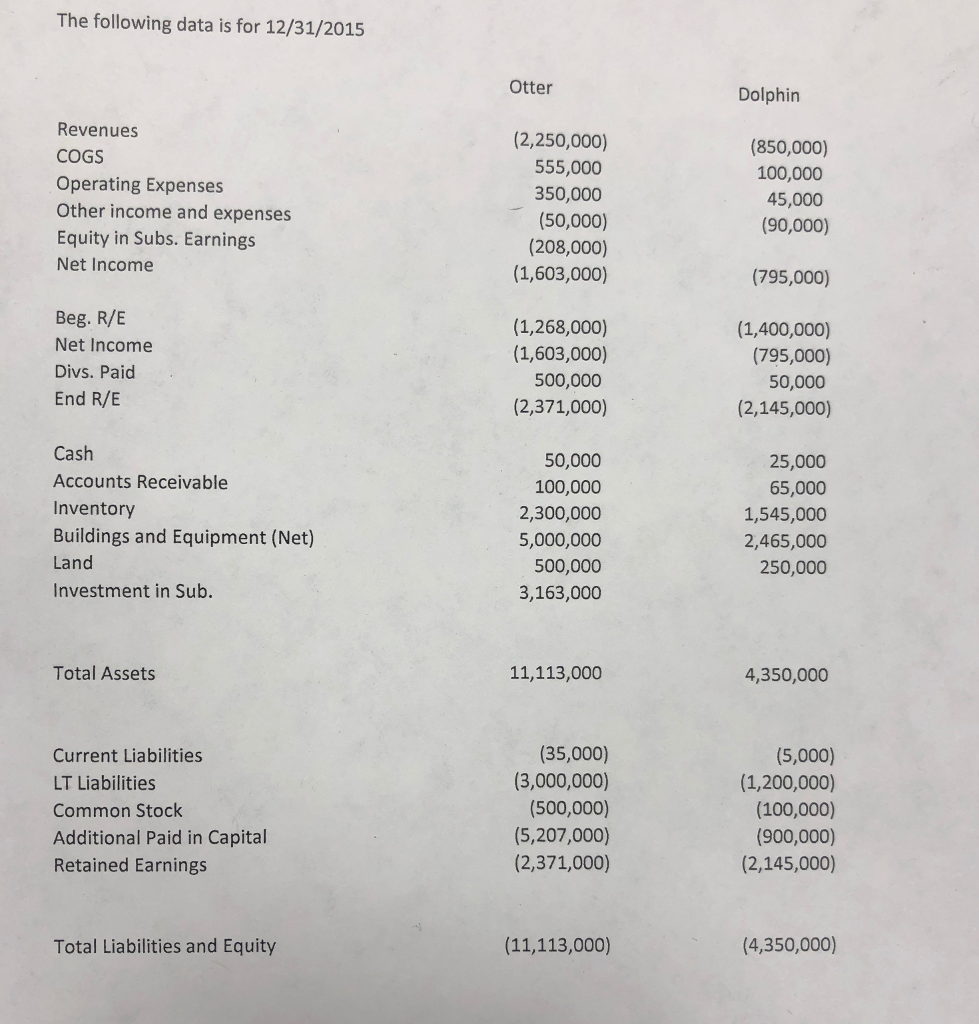

On 1/1/2014, Lion Group purchased 60% (60,000 shares) of Iguana Ltd. for $50 per share, which was a $5 per share control premium. Buildings and Equipment were undervalued by $1,000,000 and had a 10 year remaining life; IPR&D was allocated $550,000 with a two year remaining life; the remainder was goodwill. Dolphin sold inventory with of $100,000 for $150,000 in 2014 ($30,000 remained in ending inventory) and $120,000 cost for $160,000 in 2015 ($40,000 remainder in ending inventory). Dolphin sold Equipment with a net BV of $450,000 and a 5 year remaining life to Otter for $500,000 in 2014. Dolphin had net income of $450,000 and paid dividends of $50,000 in 2014.

PREPARE THE ORIGINAL PURCHASE PRICE ANALYSIS AT 1/1/2014 AND THE CONSOLIDATION WORKSHEET FOR 12/31/2015. SHOW CALCULATIONS FOR EQUITY IN THE EARNINGS OF SUB., THE INVESTMENT, AND NC INTEREST IN THE SUBS. INCOME

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started