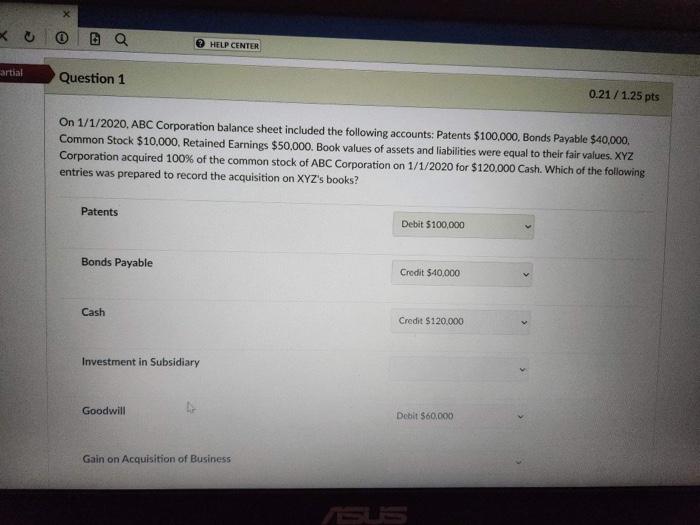

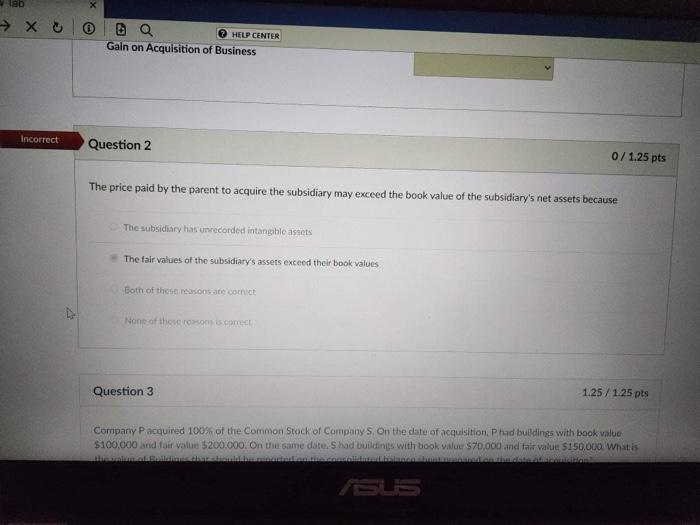

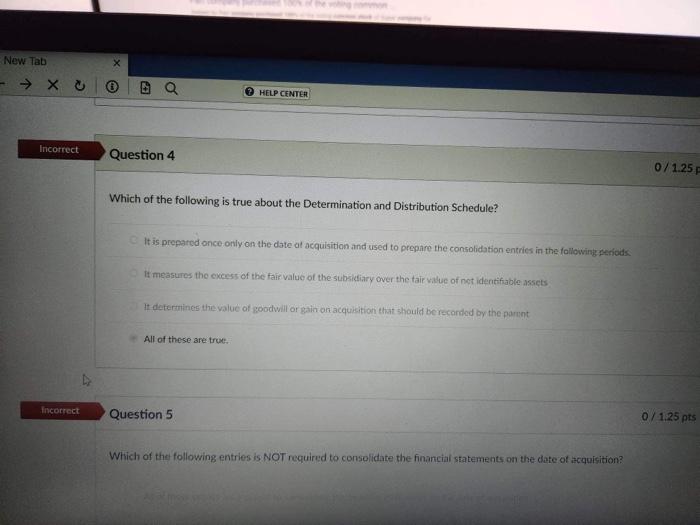

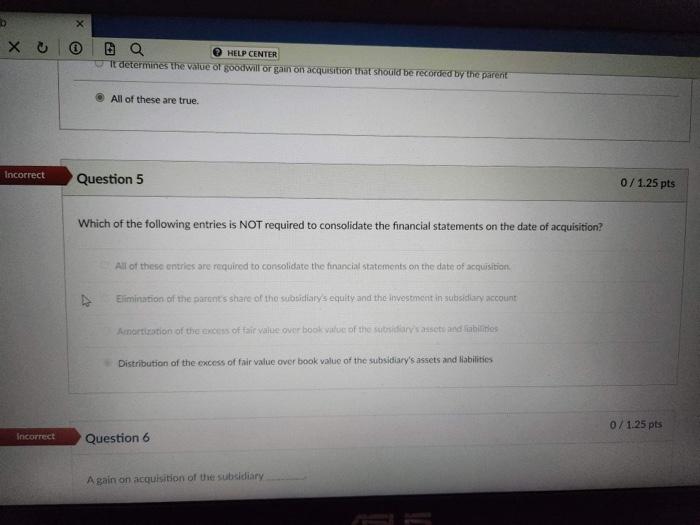

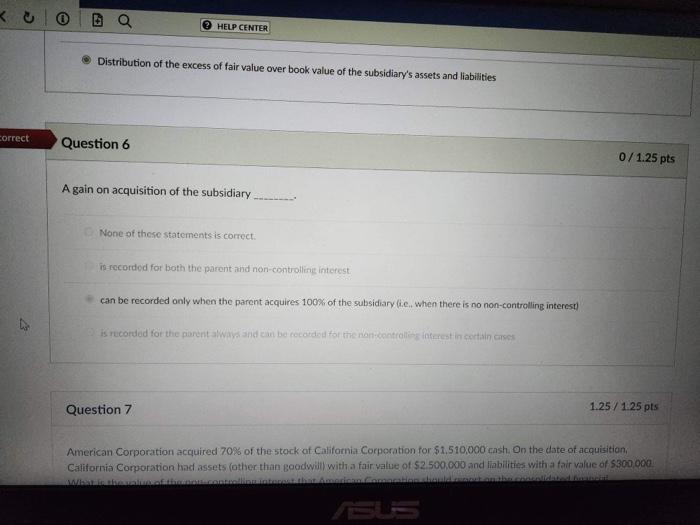

On 1/1/2020, ABC Corporation balance sheet included the following accounts: Patents $100,000, Bonds Payable $40,000, Common Stock $10,000, Retained Earnings $50,000. Book values of assets and liabilities were equal to their fair values. XYZ Corporation acquired 100% of the common stock of ABC Corporation on 1/1/2020 for $120,000 Cash. Which of the following entries was prepared to record the acquisition on XYZ 's books? Patents Bonds Payable Cash Investment in Subsidiary Goodwill Gain on Acquisition of Business The price paid by the parent to acquire the subsidiary may exceed the book value of the subsidiary's net assets because The subisidiary has enrecorded intangble assets The tair values of the subsidiary's assets exceed their book values Both of these reasonsare cocnct Question 3 1.25/1.25pts Compary Pacquired 1005s of the Common Stock of Company S, On the date of acquisition, P had bulldings with book value $100,000 and fair value $200,000. On the same date. Shad vuidings with book value $70,000 and tair vahue $150,000 What is Which of the following is true about the Determination and Distribution Schedule? It is prepared once-only on the date at acquisition and used to prepare the consolidation entries in the followirsb pesiods: It measures the exeess of the fair value of the subsiltiary over the tair walue of net identifiable assets It determines the walue of gobdwill or gain on acquisition that should be reconded by the parunt All of these are troe. Question 5 071,25 Which of the following entries is NOT required to consolidate the financiail statements on the dote of atcquisition? All of these are true. Question 5 Which of the following entries is NOT required to consolidate the financial statements on the date of acquisition? A. of these entrics are required to consolidate the financial statements on the date of acquistion. Eiimination of the partinks share of the subtsidiary's equityand the itwesement in subsidiay account Distribution of the excess of fair value over book value of the subsidiary's assets and liabilitics 0/1.25pts Question 6 A gain on acquisition of the subsidiary Distribution of the excess of fair value over book value of the subsidiary's assets and liabilities Question 6 A gain on acquisition of the subsidiary None of these statements is correct. is recorded for both the parent and non-controllisis interest can be recorded only when the parent acquires 100% of the subsidiary (i.e., when there is no non-controlling interest) Question 7 1.25/1.25pts American Corporation acquired 70% of the stock of California Corporation for $1,510,000cash. On the date of acquisitioni California Corporation had assets (other than goodwill with a fair value of $2.500,000 and liabilittes with a fair value of 5300,000