Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1.1.2021, Mr. Sam of Kerala consigned to Mr. Alex of Chennai goods for sale at invoice price. Mr. Alex is entitled to a

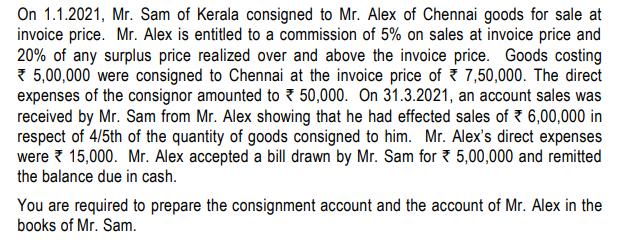

On 1.1.2021, Mr. Sam of Kerala consigned to Mr. Alex of Chennai goods for sale at invoice price. Mr. Alex is entitled to a commission of 5% on sales at invoice price and 20% of any surplus price realized over and above the invoice price. Goods costing *5,00,000 were consigned to Chennai at the invoice price of 7,50,000. The direct expenses of the consignor amounted to 50,000. On 31.3.2021, an account sales was received by Mr. Sam from Mr. Alex showing that he had effected sales of 6,00,000 in respect of 4/5th of the quantity of goods consigned to him. Mr. Alex's direct expenses were 15,000. Mr. Alex accepted a bill drawn by Mr. Sam for 5,00,000 and remitted the balance due in cash. You are required to prepare the consignment account and the account of Mr. Alex in the books of Mr. Sam.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started