Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1/1/2021 Norton Company issued 8-year bonds payable with the face value of $100,000, and the stated rate of 10%. The bond pays interest

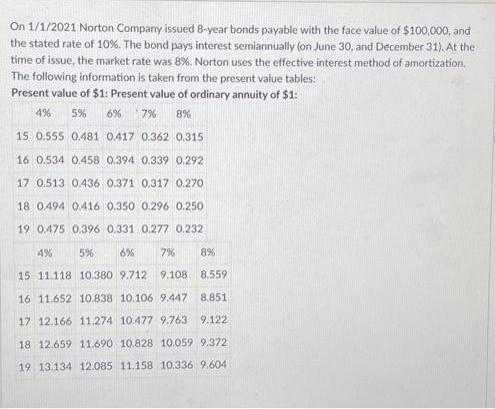

On 1/1/2021 Norton Company issued 8-year bonds payable with the face value of $100,000, and the stated rate of 10%. The bond pays interest semiannually (on June 30, and December 31). At the time of issue, the market rate was 8%. Norton uses the effective interest method of amortization. The following information is taken from the present value tables: Present value of $1: Present value of ordinary annuity of $1: 4% 5% 6% 7% 8% 15 0.555 0.481 0.417 0.362 0.315 16 0.534 0.458 0.394 0.339 0.292 17 0.513 0.436 0.371 0.317 0.270 18 0.494 0.416 0.350 0.296 0.250 19 0.475 0.396 0.331 0.277 0.232 4% 5% 6% 7% 8% 15 11.118 10.380 9.712 9.108 8.559 16 11.652 10.838 10.106 9.447 8.851. 17 12.166 11.274 10.477 9.763 9.122 18 12.659 11.690 10.828 10.059 9.372 19 13.134 12.085 11.158 10.336 9.604. On 1/1/2021 Norton Company issued 8-year bonds payable with the face value of $100,000, and the stated rate of 10%. The bond pays interest semiannually (on June 30, and December 31). At the time of issue, the market rate was 8%. Norton uses the effective interest method of amortization. The following information is taken from the present value tables: Present value of $1: Present value of ordinary annuity of $1: 4% 5% 6% 7% 8% 15 0.555 0.481 0.417 0.362 0.315 16 0.534 0.458 0.394 0.339 0.292 17 0.513 0.436 0.371 0.317 0.270 18 0.494 0.416 0.350 0.296 0.250 19 0.475 0.396 0.331 0.277 0.232 4% 5% 6% 7% 8% 15 11.118 10.380 9.712 9.108 8.559 16 11.652 10.838 10.106 9.447 8.851. 17 12.166 11.274 10.477 9.763 9.122 18 12.659 11.690 10.828 10.059 9.372 19 13.134 12.085 11.158 10.336 9.604. On 1/1/2021 Norton Company issued 8-year bonds payable with the face value of $100,000, and the stated rate of 10%. The bond pays interest semiannually (on June 30, and December 31). At the time of issue, the market rate was 8%. Norton uses the effective interest method of amortization. The following information is taken from the present value tables: Present value of $1: Present value of ordinary annuity of $1: 4% 5% 6% 7% 8% 15 0.555 0.481 0.417 0.362 0.315 16 0.534 0.458 0.394 0.339 0.292 17 0.513 0.436 0.371 0.317 0.270 18 0.494 0.416 0.350 0.296 0.250 19 0.475 0.396 0.331 0.277 0.232 4% 5% 6% 7% 8% 15 11.118 10.380 9.712 9.108 8.559 16 11.652 10.838 10.106 9.447 8.851. 17 12.166 11.274 10.477 9.763 9.122 18 12.659 11.690 10.828 10.059 9.372 19 13.134 12.085 11.158 10.336 9.604.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To journalize the sale of the bond entry on 112021 record the issuance of the bonds payable Below i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started