Question

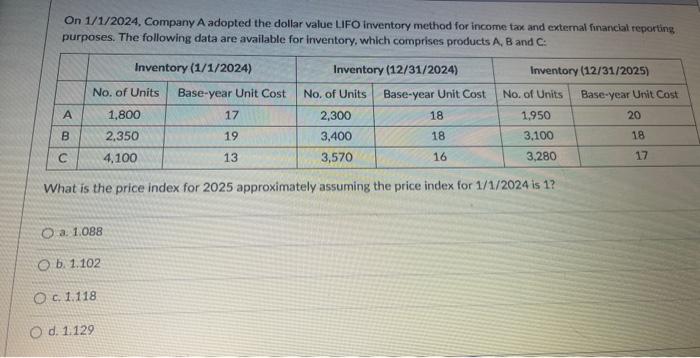

On 1/1/2024, Company A adopted the dollar value LIFO inventory method for income tax and external financial reporting purposes. The following data are available

On 1/1/2024, Company A adopted the dollar value LIFO inventory method for income tax and external financial reporting purposes. The following data are available for inventory, which comprises products A, B and C: Inventory (1/1/2024) A B No. of Units 1,800 2,350 4,100 C Base-year Unit Cost No. of Units 1,950 18 18 3,100 16 3,280 What is the price index for 2025 approximately assuming the price index for 1/1/2024 is 1? Base-year Unit Cost 17 19 13 O a 1.088 O b. 1.102 O c. 1.118 O d. 1.129 Inventory (12/31/2024) Inventory (12/31/2025) No. of Units 2,300 3,400 3,570 Base-year Unit Cost 20 18 17

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To determine the price index for 2025 assuming the price index for 112024 is 1 we would f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting 2014 FASB Update

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

15th edition

978-1118938782, 111893878X, 978-1118985311, 1118985311, 978-1118562185, 1118562186, 978-1118147290

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App