Question

On 1/1/22, Imani and Ahmad formed AI Partnership, a limited partnership. Imani will be the general partner and Ahmad will be a limited partner. He

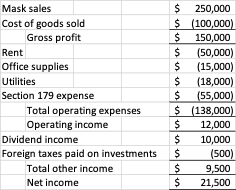

On 1/1/22, Imani and Ahmad formed AI Partnership, a limited partnership. Imani will be the general partner and Ahmad will be a limited partner. He will not participate in management of the partnership but will simply hold the interest as a passive investment. Ahmad has no other sources of passive investment. Imani and Ahmad will each have a 50% profit/loss and capital interest. The partnership will make custom masks and sell them on Amazon. Imani's initial contribution to the partnership was a commercial grade sewing machine worth $50,000 (adjusted basis $35,000). Imani had a $20,000 non-recourse loan which the partnership assumed. Ahmad, an attorney, contributed $10,000 of legal services and $40,000 of cash. During 2022, AI Partnership, borrowed $10,000 on an operating line of credit which Ahmed personally guaranteed and $5,000 on another recourse loan related the purchase of additional equipment (with no personal guarantee). During the first year of operation, AI Partnership distributed $10,000 to each partner. The 2022 profit and loss statement (tax basis) is below.

Required:

- Does either partner recognize income on the initial formation of the partnership?

- What is AI Partnerships ordinary income and separately stated items?

- What is Ahmad and Imanis initial partnership basis?

- What is Ahmad and Imanis partnership basis at the end of 2022?

- What total amount of taxable income does Ahmad and Imani have for 2022?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started