Question

On 12/1/21, Northridge Co., a U.S. machine manufacturer, sells machines to York Co., a British company, for 100,000 British Pound () on credit. Payment

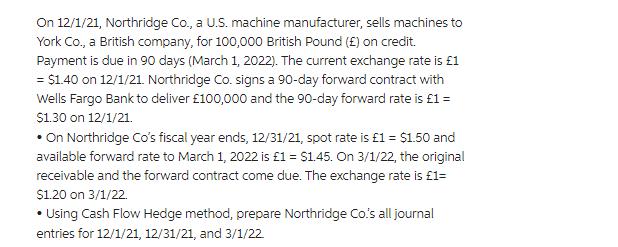

On 12/1/21, Northridge Co., a U.S. machine manufacturer, sells machines to York Co., a British company, for 100,000 British Pound () on credit. Payment is due in 90 days (March 1, 2022). The current exchange rate is 1 = $1.40 on 12/1/21. Northridge Co. signs a 90-day forward contract with Wells Fargo Bank to deliver 100,000 and the 90-day forward rate is 1 = $1.30 on 12/1/21. On Northridge Co's fiscal year ends, 12/31/21, spot rate is 1 = $1.50 and available forward rate to March 1, 2022 is 1 = $1.45. On 3/1/22, the original receivable and the forward contract come due. The exchange rate is 1= $1.20 on 3/1/22. Using Cash Flow Hedge method, prepare Northridge Co's all journal entries for 12/1/21, 12/31/21, and 3/1/22

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A B 1 2 3 4 5 6 12312018 Accounts Receivables 1000001...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting the basis for business decisions

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

16th edition

0077664078, 978-0077664077, 78111048, 978-0078111044

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App