Answered step by step

Verified Expert Solution

Question

1 Approved Answer

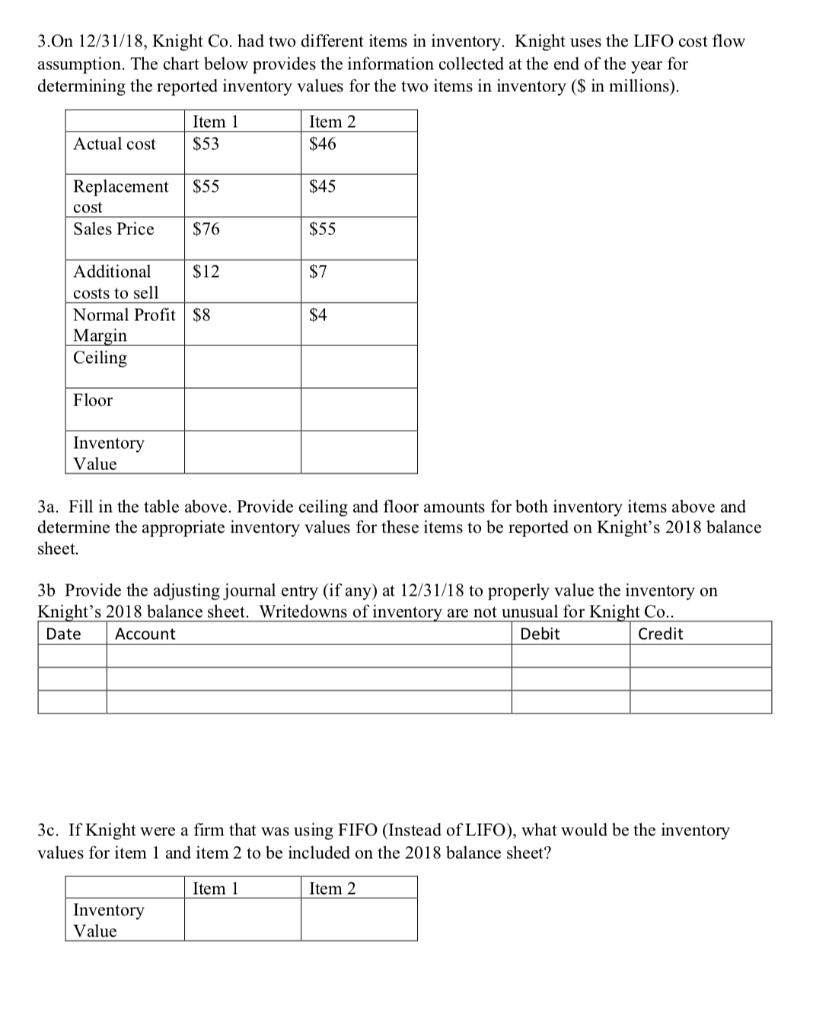

3.On 12/31/18, Knight Co. had two different items in inventory. Knight uses the LIFO cost flow assumption. The chart below provides the information collected

3.On 12/31/18, Knight Co. had two different items in inventory. Knight uses the LIFO cost flow assumption. The chart below provides the information collected at the end of the year for determining the reported inventory values for the two items in inventory ($ in millions). Actual cost Replacement cost Sales Price Floor Additional costs to sell Normal Profit $8 Margin Ceiling Inventory Value Item 1 $53 $55 $76 $12 Inventory Value Item 2 $46 $45 $55 $7 $4 3a. Fill in the table above. Provide ceiling and floor amounts for both inventory items above and determine the appropriate inventory values for these items to be reported on Knight's 2018 balance sheet. 3b Provide the adjusting journal entry (if any) at 12/31/18 to properly value the inventory on Knight's 2018 balance sheet. Writedowns of inventory are not unusual for Knight Co.. Date Account Debit Credit 3c. If Knight were a firm that was using FIFO (Instead of LIFO), what would be the inventory values for item 1 and item 2 to be included on the 2018 balance sheet? Item 1 Item 2

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

3 Item1 Item2 Act ual cost 53 46 Repl acement 55 45 cost Sales Price 76 55 Additio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started