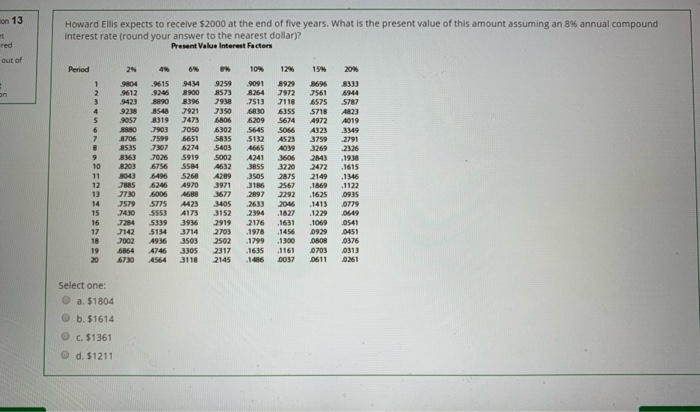

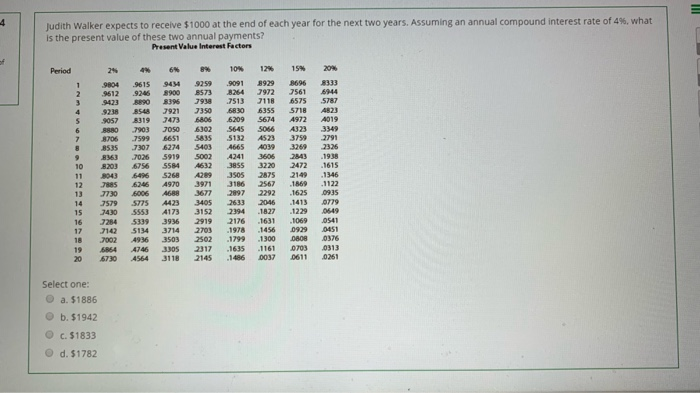

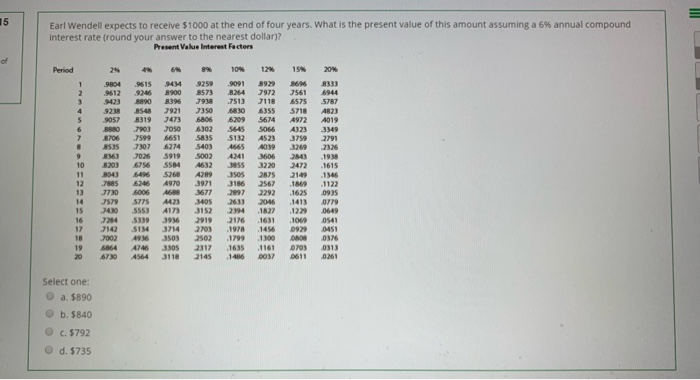

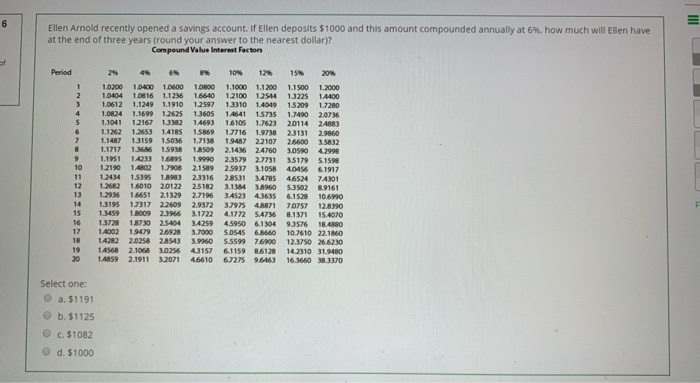

on 13 Howard Ellis expects to receive $2000 at the end of five years. What is the present value of this amount assuming an 8% annual compound interest rate (round your answer to the nearest dollar)? Present Value Interest Factors red out of Period ** 10% 15 20% 4% .9615 9259 3696 8900 8890 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 7972 7118 6355 5674 .5056 4523 24 9804 9612 .9423 9238 9057 8880 8706 8535 8363 8203 8043 7885 3730 7579 .7430 7284 7142 3002 .7903 .7599 .7307 7026 6756 6496 6246 6006 5775 .5553 5339 5134 4936 8396 7921 7473 7050 6651 6274 5919 5584 5268 4970 A688 .9091 8264 7513 6830 6209 .5645 .5132 4665 4241 3855 3505 .3186 2897 7938 7350 6806 6302 5835 5403 5002 4632 4289 3971 3677 3405 3152 2919 2703 2502 2317 2145 7561 6575 5718 4972 A323 3759 3269 2643 2472 2149 .1869 . 1625 .1413 .1229 1069 0929 0809 0703 0611 .5787 4823 4019 .3349 2791 2326 .1938 .1615 1346 .1122 3220 2875 2567 2292 204 4423 4173 3936 3714 3503 3305 3118 2394 2176 .1978 .1799 .1635 .1486 .1631 1456 ,1300 .1161 0037 0779 0649 0541 0451 0376 0313 0261 6730 4564 Select one: 0 a $1804 b. $1614 O C. $1361 d. $1211 MI 4 Judith Walker expects to receive $1000 at the end of each year for the next two years. Assuming an annual compound interest rate of 4%, what is the present value of these two annual payments? Present Value Interest Factors + Period 25 10% 124 15 20% 1 2 3 9615 9245 8890 854 8319 -7903 -7599 7307 7026 .6756 6496 8929 3972 3118 6355 5674 5056 A523 4039 8333 6944 5787 4823 A019 3349 2791 2326 9804 9612 9423 9238 SOS 8880 8706 8535 8363 8203 8043 7885 7730 7579 3430 7284 .7142 2002 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 9414 8900 8386 7921 7473 3050 5651 6274 5919 5584 5268 1970 A688 4423 4173 3936 3714 3503 3305 3118 8% 9259 8573 7930 7350 6806 6302 5835 5403 5002 4632 4289 3971 3677 3405 3152 2919 2703 2502 2317 2145 9091 8264 7513 6830 6209 .5645 .5132 4665 4241 3855 3505 3186 2897 2633 2394 2176 .1978 .1799 .1635 3696 3561 6575 5718 4972 A323 3759 3269 2643 2472 2149 .1869 .1625 .1413 .1229 .1069 0929 0808 0703 0611 3220 2875 2567 2292 2046 1827 .1631 .1456 .1300 .1161 0037 6006 .5775 5553 5339 5134 4936 .1615 .1346 .1122 0935 0779 0549 0541 0451 0376 0313 0261 6730 4564 Select one: a. $1886 b. $1942 C. $1833 d. $1782 MI 15 Earl Wendell expects to receive $1000 at the end of four years. What is the present value of this amount assuming a 6% annual compound interest rate (round your answer to the nearest dollar)? Present Value Interest Factors of Period 109 12% 15 20% 9615 1 2 3 3900 8890 .7513 6830 6209 8319 5 6 7 24 9804 9612 94423 92.38 9057 8880 8706 8535 8363 8203 8043 7885 7730 3579 340 .7599 .7307 70.26 6756 8396 7921 7473 7050 6651 6214 5919 5584 5268 4970 8% 9259 8573 7998 7350 5806 6302 5835 5403 5002 A632 A29 3971 3677 3405 3152 2919 2703 2502 2317 2145 9 10 11 12 13 14 15 16 .5132 4665 4241 3855 3505 3186 2897 2633 2394 2176 1978 1799 1635 7972 7118 6355 5674 5066 A523 4039 1606 3220 2875 2567 2292 2046 .1827 1631 7561 6575 .5710 A972 A323 3759 3269 263 2472 2149 1869 .1625 .1413 6944 5787 A823 A019 3349 2791 2336 .1938 .1615 .1346 .1122 0935 0779 0649 0541 0451 0376 0313 0261 4173 5775 .5553 .5339 5114 39 18 19 20 7142 7002 6864 3714 3503 3305 3118 1300 1161 0037 1009 0929 DA 0703 0611 4564 Select one: a. 5890 b. 5840 C. 5792 d. 5735 6 Ellen Arnold recently opened a savings account. If Ellen deposits 51000 and this amount compounded annually at 6%, how much will Ellen have at the end of three years (round your answer to the nearest dollar)? Compound Value Interest Factors of 24 Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 1.0200 10400 1.0500 1.080 1.0404 1.0616 1.1236 16640 1.0612 1.1249 1.1910 1.2597 1.08.24 1.1699 1.2625 1.3605 1.1041 1.2167 1.3382 14693 1,1262 1.2653 14185 15869 1.1487 1.3159 1.5036 1.710 1.1717 1.366 1590 18509 1.1951 14233 16895 1.9990 1.2190 14802 1.7808 2.1589 1.2434 1.5395 1.8983 2.3316 1.2682 1.6010 20122 2.5182 1.2934 1.6651 2.1329 2.7196 1.3195 17317 2.2609 2.9372 1.3459 1.8009 2.3955 3.1722 13728 1.8730 25404 34259 14002 1.9479 2.6928 3.7000 14282 2.0256 28543 3.9960 14568 2.1068 3.0256 43157 14859 2.1911 3.2071 46610 10% 12 15 20% 1.1000 1.1200 1.1500 1.2000 1.2100 1.25414 1.3225 14400 1.3310 1.4049 15209 1.7280 1.4641 15735 1.7490 2.0736 1.6105 1.7623 20114 24883 17716 1.9738 2.3131 2.9860 19487 2.2107 26600 3.5832 2.14% 24760 3.0590 4.2998 2.3579 2.773135179 5.1598 2.5937 3.1058 4.0456 6.1917 2.8531 34785 4.6524 74301 3.1384 3.8960 5.3502 8.9161 34523 4.3635 6.1528 10.6990 3.7975 4.8871 70757 12.8.10 4.1772 SATM 8.1371 15.4070 4.5950 6.1304 9.3576 18.4880 5.0545 6.8660 10.7610 22.1860 5.5599 76900 12.3750 26.6230 6.1159 8.6128 14.2310 31.9480 6,7275 16.3660 38.3370 Select one: a. $1191 O b. $1125 O C. 51082 d. 51000