Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on 14 of 75. business is the best example of a limited partnership? dley and Nick operate a music studio and are both personally liable

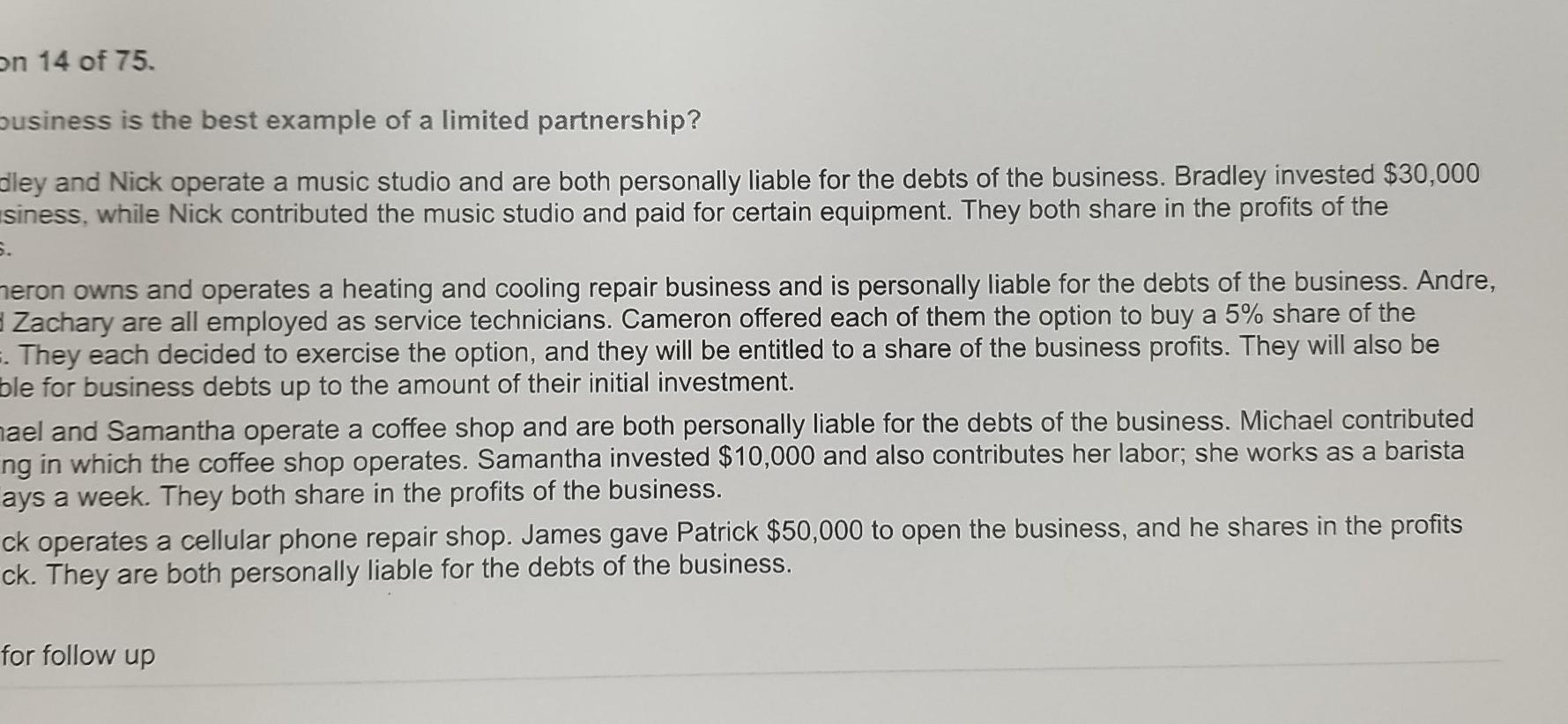

on 14 of 75. business is the best example of a limited partnership? dley and Nick operate a music studio and are both personally liable for the debts of the business. Bradley invested $30,000 usiness, while Nick contributed the music studio and paid for certain equipment. They both share in the profits of the s. meron owns and operates a heating and cooling repair business and is personally liable for the debts of the business. Andre, Zachary are all employed as service technicians. Cameron offered each of them the option to buy a 5% share of the =. They each decided to exercise the option, and they will be entitled to a share of the business profits. They will also be ble for business debts up to the amount of their initial investment. nael and Samantha operate a coffee shop and are both personally liable for the debts of the business. Michael contributed ng in which the coffee shop operates. Samantha invested $10,000 and also contributes her labor; she works as a barista ays a week. They both share in the profits of the business. ck operates a cellular phone repair shop. James gave Patrick $50,000 to open the business, and he shares in the profits ck. They are both personally liable for the debts of the business. for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started