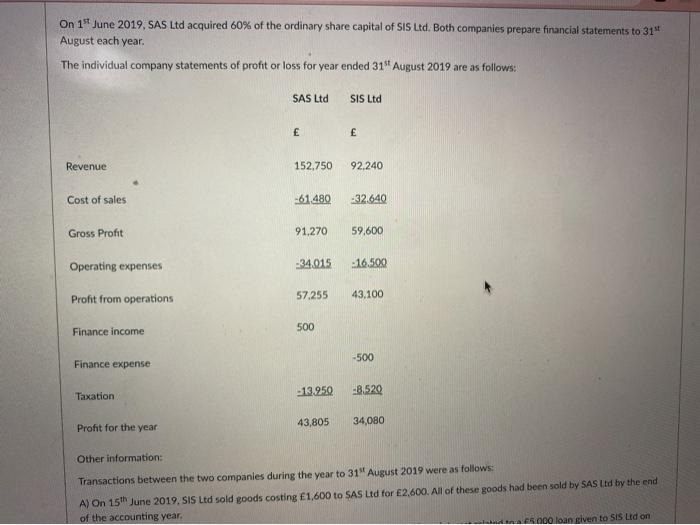

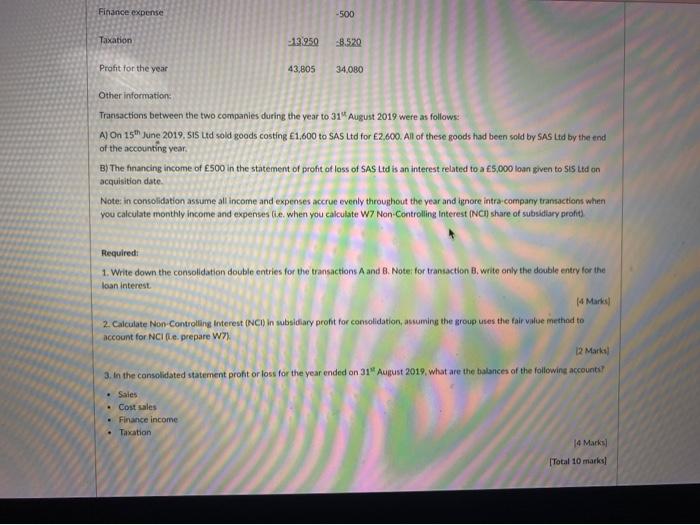

On 15 June 2019, SAS Ltd acquired 60% of the ordinary share capital of Sis Ltd. Both companies prepare financial statements to 31 August each year. The individual company statements of profit or loss for year ended 31 August 2019 are as follows: SAS Ltd SIS Ltd Revenue 152,750 92.240 Cost of sales -61480 -32.640 Gross Profit 91.270 59.600 Operating expenses -34.015 -16.500 Profit from operations 57.255 43.100 Finance income 500 -500 Finance expense Taxation -13.950 -8.520 43,805 34,080 Profit for the year Other information: Transactions between the two companies during the year to 31" August 2019 were as follows: A) On 15th June 2019. SIS Ltd sold goods costing 1,600 to SAS Ltd for E2,600. All of these goods had been sold by SAS itd by the end of the accounting year. 000 loan given to SIS Ltd on Finance expense -500 Taxation -13.950 -8.520 Profit for the year 43,805 34,080 Other information Transactions between the two companies during the year to 31 August 2019 were as follows: AJOn 15th June 2019, SIS Lid sold goods costing 1,600 to SAS Ltd for 2,600. All of these foods had been sold by Sas Ltd by the end of the accounting year B) The financing income of 500 in the statement of proft of loss of SAS Ltd is an interest related to a 5,000 loan Riven to Sis Ltd on Note: in consolidation assume all income and expenses accrue evenly throughout the year and ignore intra-company transactions when You calculate monthly income and expenses (le, when you calculate W7 Non-Controlling Interest (NCI) share of subsidiary profit) acquisition date Required: 1. Write down the consolidation double entries for the transactions and 8. Noter for transaction B, write only the double entry for the loan interest 14 Marks 2. Calculate Non-Controlling Interest (NC) in subsidiary proht for consolidation, assuming the group uses the fair value method to account for NCIe prepare W7) 12 Marks 3. In the consolidated statement profit or loss for the year ended on 31 August 2019, what are the balances of the following accounts Sales . Cost ales Finance income Taxation 14 Marks) Total 10 marks