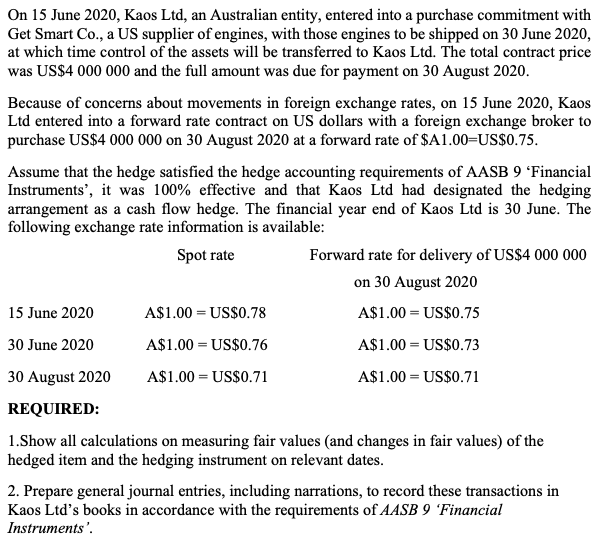

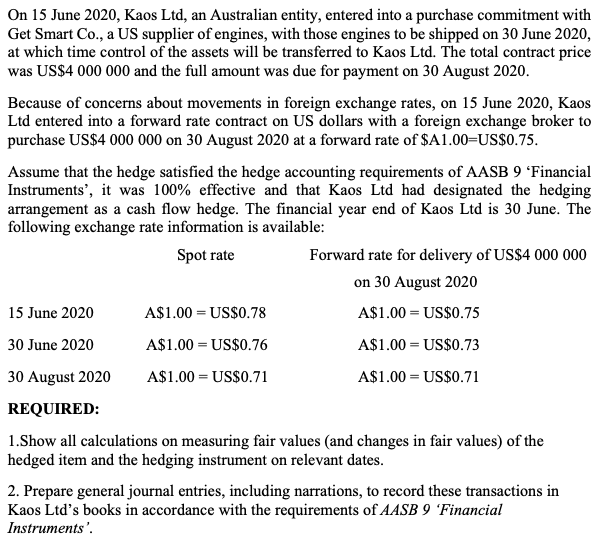

On 15 June 2020, Kaos Ltd, an Australian entity, entered into a purchase commitment with Get Smart Co., a US supplier of engines, with those engines to be shipped on 30 June 2020, at which time control of the assets will be transferred to Kaos Ltd. The total contract price was US$4 000 000 and the full amount was due for payment on 30 August 2020. Because of concerns about movements in foreign exchange rates, on 15 June 2020, Kaos Ltd entered into a forward rate contract on US dollars with a foreign exchange broker to purchase US$4 000 000 on 30 August 2020 at a forward rate of $A1.00=US$0.75. Assume that the hedge satisfied the hedge accounting requirements of AASB 9 Financial Instruments, it was 100% effective and that Kaos Ltd had designated the hedging arrangement as a cash flow hedge. The financial year end of Kaos Ltd is 30 June. The following exchange rate information is available: Spot rate Forward rate for delivery of US$4 000 000 on 30 August 2020 15 June 2020 A$1.00 = US$0.78 A$1.00 = US$0.75 30 June 2020 A$1.00 = US$0.76 A$1.00 = US$0.73 30 August 2020 A$1.00 = US$0.71 A$1.00 = US$0.71 REQUIRED: 1.Show all calculations on measuring fair values and changes in fair values) of the hedged item and the hedging instrument on relevant dates. 2. Prepare general journal entries, including narrations, to record these transactions in Kaos Ltd's books in accordance with the requirements of AASB 9 Financial Instruments'. On 15 June 2020, Kaos Ltd, an Australian entity, entered into a purchase commitment with Get Smart Co., a US supplier of engines, with those engines to be shipped on 30 June 2020, at which time control of the assets will be transferred to Kaos Ltd. The total contract price was US$4 000 000 and the full amount was due for payment on 30 August 2020. Because of concerns about movements in foreign exchange rates, on 15 June 2020, Kaos Ltd entered into a forward rate contract on US dollars with a foreign exchange broker to purchase US$4 000 000 on 30 August 2020 at a forward rate of $A1.00=US$0.75. Assume that the hedge satisfied the hedge accounting requirements of AASB 9 Financial Instruments, it was 100% effective and that Kaos Ltd had designated the hedging arrangement as a cash flow hedge. The financial year end of Kaos Ltd is 30 June. The following exchange rate information is available: Spot rate Forward rate for delivery of US$4 000 000 on 30 August 2020 15 June 2020 A$1.00 = US$0.78 A$1.00 = US$0.75 30 June 2020 A$1.00 = US$0.76 A$1.00 = US$0.73 30 August 2020 A$1.00 = US$0.71 A$1.00 = US$0.71 REQUIRED: 1.Show all calculations on measuring fair values and changes in fair values) of the hedged item and the hedging instrument on relevant dates. 2. Prepare general journal entries, including narrations, to record these transactions in Kaos Ltd's books in accordance with the requirements of AASB 9 Financial Instruments