Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 15th September 2008, your client holds the following Equity linked notes: 1. HK$1,000,000 face value - Equity linked-note issued by JP Morgan with

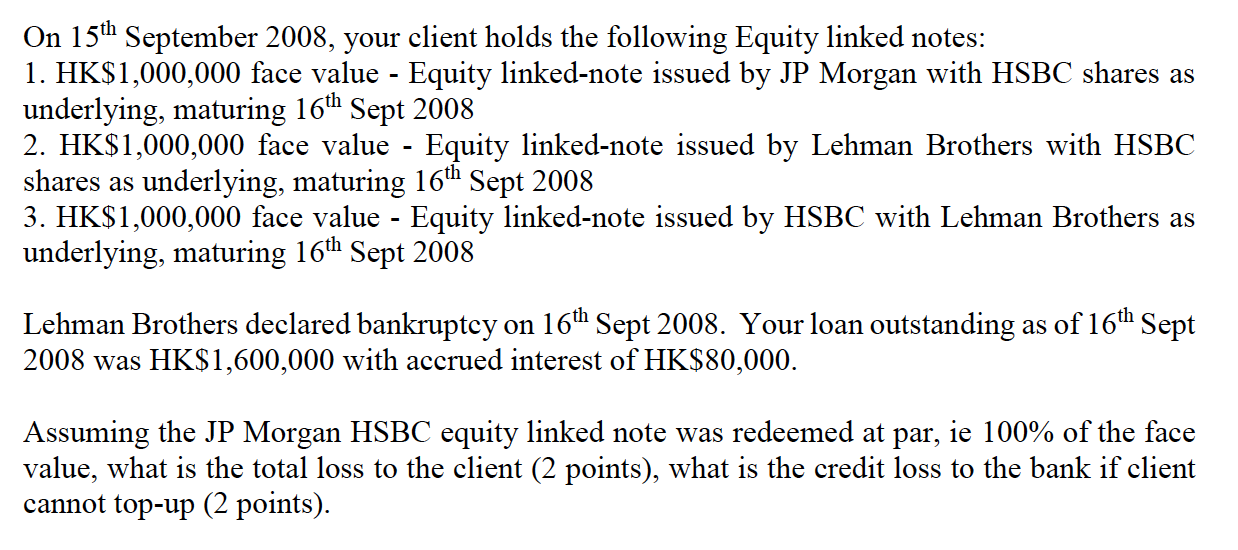

On 15th September 2008, your client holds the following Equity linked notes: 1. HK$1,000,000 face value - Equity linked-note issued by JP Morgan with HSBC shares as underlying, maturing 16th Sept 2008 2. HK$1,000,000 face value - Equity linked-note issued by Lehman Brothers with HSBC shares as underlying, maturing 16th Sept 2008 3. HK$1,000,000 face value - Equity linked-note issued by HSBC with Lehman Brothers as underlying, maturing 16th Sept 2008 Lehman Brothers declared bankruptcy on 16th Sept 2008. Your loan outstanding as of 16th Sept 2008 was HK$1,600,000 with accrued interest of HK$80,000. Assuming the JP Morgan HSBC equity linked note was redeemed at par, ie 100% of the face value, what is the total loss to the client (2 points), what is the credit loss to the bank if client cannot top-up (2 points).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing the Equity Linked Note Situation Based on the information provided heres the breakdown of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started