Answered step by step

Verified Expert Solution

Question

1 Approved Answer

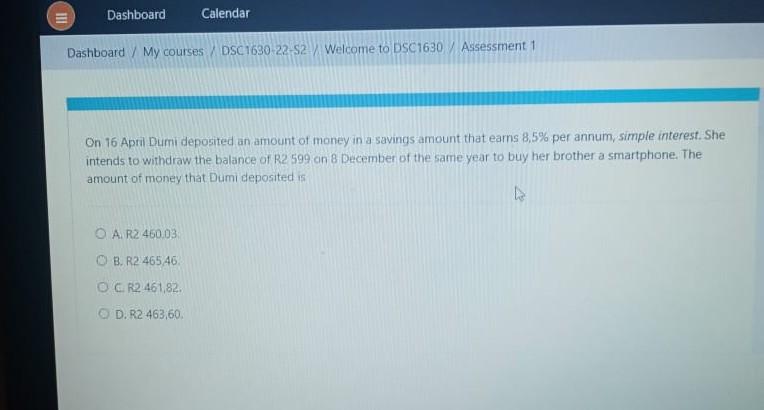

On 16 April Dumi deposited an amount of money in a savings amount that eams 8.5% per annum, simple interest. She intends to withdraw the

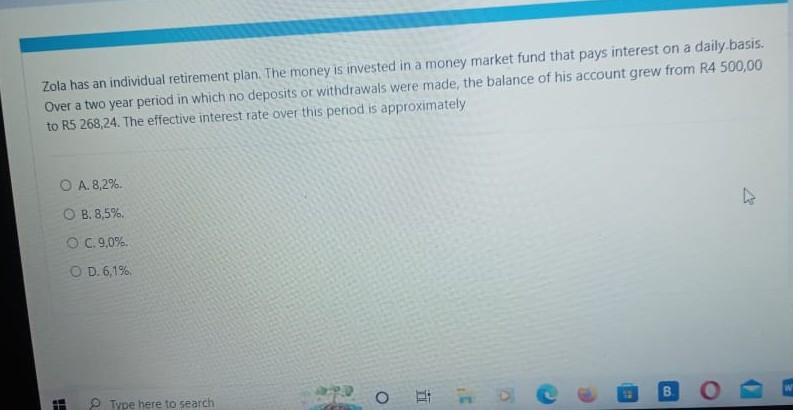

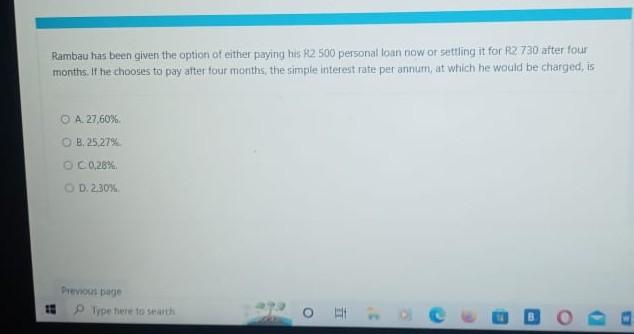

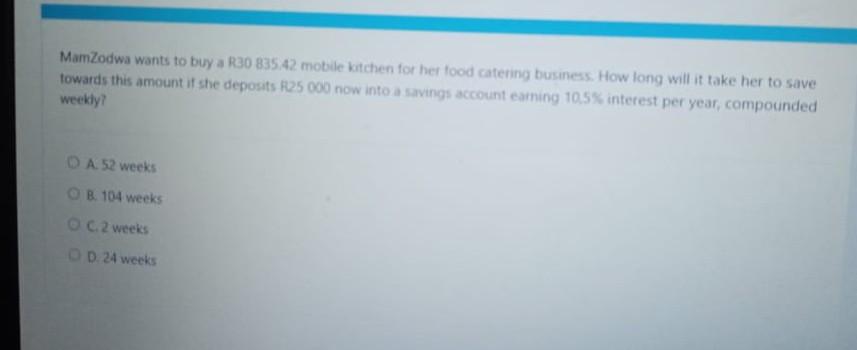

On 16 April Dumi deposited an amount of money in a savings amount that eams 8.5% per annum, simple interest. She intends to withdraw the balance of R2 599 on B December of the same year to buy her brother a smartphone. The amount of money that Dumi deposited is A. R2 46003 B. R2 46546 . C. R2 461,82 . D. R2 463,60 . Zola has an individual retirement plan. The money is invested in a money market fund that pays interest on a daily.basis. Over a two year period in which no deposits or withdrawals were made, the balance of his account grew from R4 500,00 to R5268,24. The effective interest rate over this period is approximately. A. 8,2% B. 8,5% C. 9.0% D. 6,1% Rambau has been given the option of either paying his {2500 personal loan now or settling it for R2 730 after four months. If he chooses to pay atter four merths, the simple interest rate per annum, at which he wauld be charged, is A. 27.60%. B. 25,27% C0,26\%: D. 2.30%. Mamzodwa wants to buy a R30 835.42 mobile kitchen for her food catering business. How long will it take her to save towards this amount if she deposits 125000 now into a kavings account eaming 10.5% interest per year, compounded weekly? A. 52 weeks B. 104 weeks C. 2 weeks D. 24 weeks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started