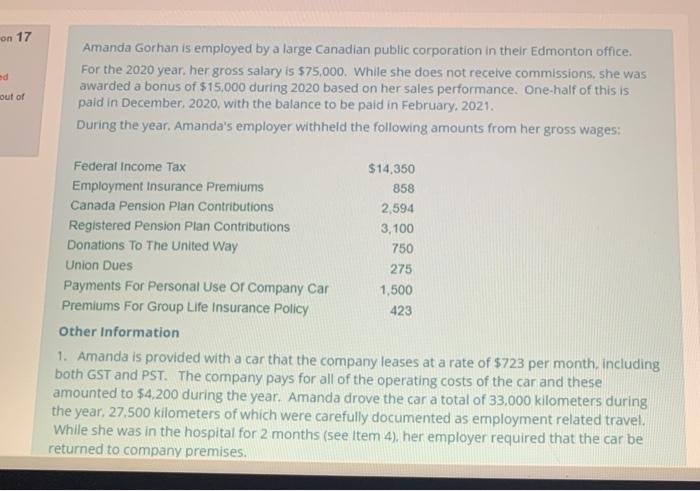

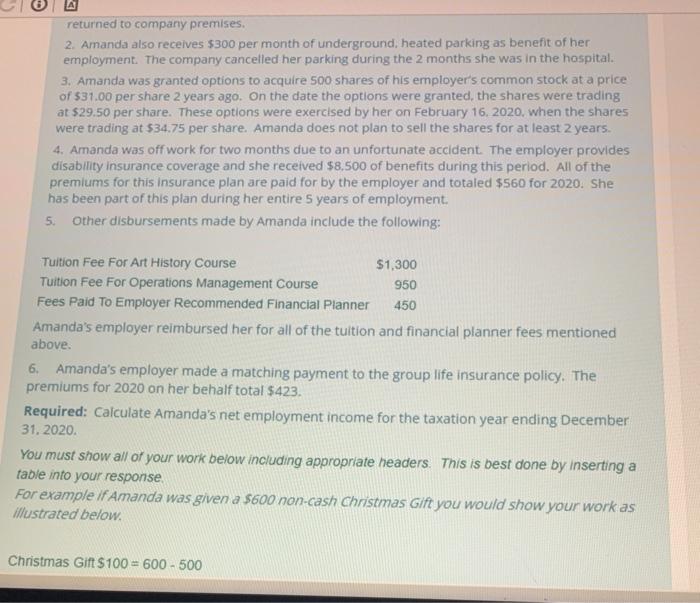

on 17 Amanda Gorhan is employed by a large Canadian public corporation in their Edmonton office. For the 2020 year, her gross salary is $75,000. While she does not receive commissions, she was awarded a bonus of $15,000 during 2020 based on her sales performance. One-half of this is paid in December, 2020, with the balance to be paid in February, 2021. During the year. Amanda's employer withheld the following amounts from her gross wages: out of Federal Income Tax $14,350 Employment Insurance Premiums 858 Canada Pension Plan Contributions 2,594 Registered Pension Plan Contributions 3,100 Donations To The United Way 750 Union Dues 275 Payments For Personal use of Company Car 1,500 Premiums For Group Life Insurance Policy 423 Other Information 1. Amanda is provided with a car that the company leases at a rate of $723 per month, including both GST and PST. The company pays for all of the operating costs of the car and these amounted to $4,200 during the year. Amanda drove the car a total of 33.000 kilometers during the year. 27.500 kilometers of which were carefully documented as employment related travel. While she was in the hospital for 2 months (see item 4). her employer required that the car be returned to company premises. A returned to company premises 2. Amanda also receives $300 per month of underground, heated parking as benefit of her employment. The company cancelled her parking during the 2 months she was in the hospital. 3. Amanda was granted options to acquire 500 shares of his employer's common stock at a price of $31.00 per share 2 years ago. On the date the options were granted, the shares were trading at $29.50 per share. These options were exercised by her on February 16, 2020, when the shares were trading at $34.75 per share. Amanda does not plan to sell the shares for at least 2 years. 4. Amanda was off work for two months due to an unfortunate accident. The employer provides disability insurance coverage and she received $8.500 of benefits during this period. All of the premiums for this Insurance plan are paid for by the employer and totaled $560 for 2020. She has been part of this plan during her entire 5 years of employment 5. Other disbursements made by Amanda include the following: Tuition Fee For Art History Course $1,300 Tuition Fee For Operations Management Course 950 Fees Paid To Employer Recommended Financial Planner 450 Amanda's employer reimbursed her for all of the tuition and financial planner fees mentioned above. 6. Amanda's employer made a matching payment to the group life insurance policy. The premiums for 2020 on her behalf total $423 Required: Calculate Amanda's net employment income for the taxation year ending December 31, 2020 You must show all of your work below including appropriate headers. This is best done by inserting a table into your response For example if Amanda was given a $600 non-cash Christmas Gift you would show your work as illustrated below. Christmas Gift $100 = 600 - 500 on 17 Amanda Gorhan is employed by a large Canadian public corporation in their Edmonton office. For the 2020 year, her gross salary is $75,000. While she does not receive commissions, she was awarded a bonus of $15,000 during 2020 based on her sales performance. One-half of this is paid in December, 2020, with the balance to be paid in February, 2021. During the year. Amanda's employer withheld the following amounts from her gross wages: out of Federal Income Tax $14,350 Employment Insurance Premiums 858 Canada Pension Plan Contributions 2,594 Registered Pension Plan Contributions 3,100 Donations To The United Way 750 Union Dues 275 Payments For Personal use of Company Car 1,500 Premiums For Group Life Insurance Policy 423 Other Information 1. Amanda is provided with a car that the company leases at a rate of $723 per month, including both GST and PST. The company pays for all of the operating costs of the car and these amounted to $4,200 during the year. Amanda drove the car a total of 33.000 kilometers during the year. 27.500 kilometers of which were carefully documented as employment related travel. While she was in the hospital for 2 months (see item 4). her employer required that the car be returned to company premises. A returned to company premises 2. Amanda also receives $300 per month of underground, heated parking as benefit of her employment. The company cancelled her parking during the 2 months she was in the hospital. 3. Amanda was granted options to acquire 500 shares of his employer's common stock at a price of $31.00 per share 2 years ago. On the date the options were granted, the shares were trading at $29.50 per share. These options were exercised by her on February 16, 2020, when the shares were trading at $34.75 per share. Amanda does not plan to sell the shares for at least 2 years. 4. Amanda was off work for two months due to an unfortunate accident. The employer provides disability insurance coverage and she received $8.500 of benefits during this period. All of the premiums for this Insurance plan are paid for by the employer and totaled $560 for 2020. She has been part of this plan during her entire 5 years of employment 5. Other disbursements made by Amanda include the following: Tuition Fee For Art History Course $1,300 Tuition Fee For Operations Management Course 950 Fees Paid To Employer Recommended Financial Planner 450 Amanda's employer reimbursed her for all of the tuition and financial planner fees mentioned above. 6. Amanda's employer made a matching payment to the group life insurance policy. The premiums for 2020 on her behalf total $423 Required: Calculate Amanda's net employment income for the taxation year ending December 31, 2020 You must show all of your work below including appropriate headers. This is best done by inserting a table into your response For example if Amanda was given a $600 non-cash Christmas Gift you would show your work as illustrated below. Christmas Gift $100 = 600 - 500