Answered step by step

Verified Expert Solution

Question

1 Approved Answer

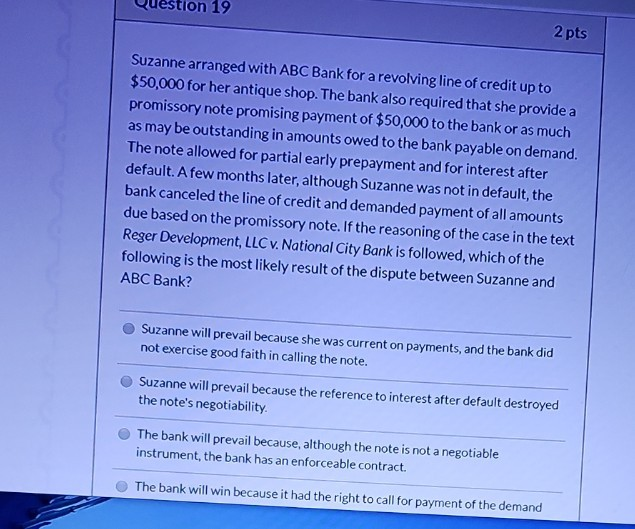

on 19 2 pts Suzanne arranged with ABC Bank for a revolving line of credit up to $50,000 for her antique shop. The bank also

on 19 2 pts Suzanne arranged with ABC Bank for a revolving line of credit up to $50,000 for her antique shop. The bank also required that she provide a promissory note promising payment of $50,000 to the bank or as much as may be outstanding in amounts owed to the bank payable on demand. The note allowed for partial early prepayment and for interest after default. A few months later, although Suzanne was not in default, the bank canceled the line of credit and demanded payment of all amounts due based on the promissory note. If the reasoning of the case in the text Reger Development, LLC v. National City Bank is followed, which of the following is the most likely result of the dispute between Suzanne and ABC Bank? Suzanne will prevail because she was current on payments, and the bank did not exercise good faith in calling the note. Suzanne will prevail because the reference to interest after default destroyed the note's negotiability The bank will prevail because, although the note is not a negotiable instrument, the bank has an enforceable contract. The bank will win because it had the right to call for payment of the demand on 19 2 pts Suzanne arranged with ABC Bank for a revolving line of credit up to $50,000 for her antique shop. The bank also required that she provide a promissory note promising payment of $50,000 to the bank or as much as may be outstanding in amounts owed to the bank payable on demand. The note allowed for partial early prepayment and for interest after default. A few months later, although Suzanne was not in default, the bank canceled the line of credit and demanded payment of all amounts due based on the promissory note. If the reasoning of the case in the text Reger Development, LLC v. National City Bank is followed, which of the following is the most likely result of the dispute between Suzanne and ABC Bank? Suzanne will prevail because she was current on payments, and the bank did not exercise good faith in calling the note. Suzanne will prevail because the reference to interest after default destroyed the note's negotiability The bank will prevail because, although the note is not a negotiable instrument, the bank has an enforceable contract. The bank will win because it had the right to call for payment of the demand

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started