Answered step by step

Verified Expert Solution

Question

1 Approved Answer

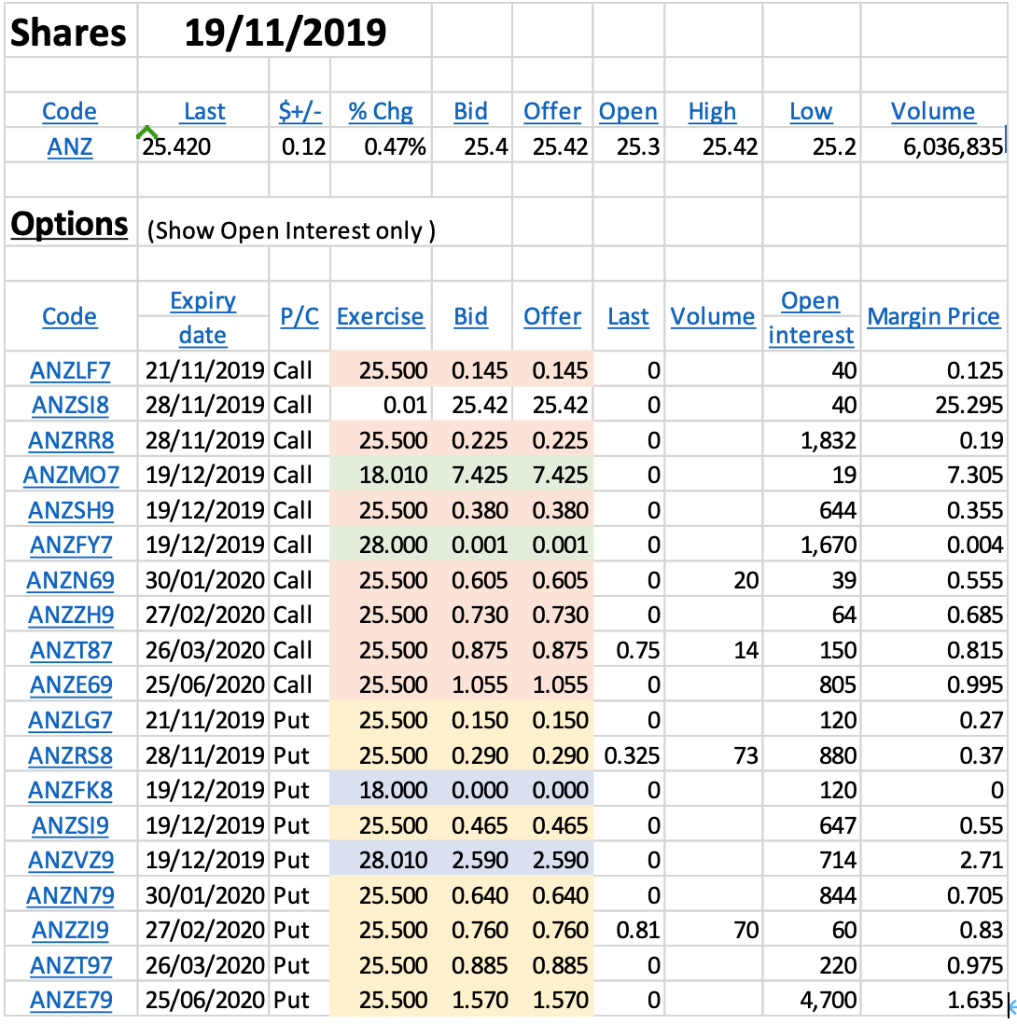

on 19/11/2019. Use labelled diagrams to show that they conform to theory in questions 2 and 3. 2.Explain the differing offer prices of ANZ put

on 19/11/2019. Use labelled diagrams to show that they conform to theory in questions 2 and 3.

2.Explain the differing offer prices of ANZ put options with exercise prices of $25.50 and different expiry dates.

3.Explain why the offer prices of ANZ call options with exercise prices of $18.01, 25.50 and 28.00 are successively lower.

| Shares | 2019-11-19 | ||||||||||||

| Code | Last | $+/- | %Chg | Bid | Offer | Open | High | Low | Volume | ||||

| ANZ | 25.42 | 0.12 | 0.47% | 25.4 | 25. 42 | 25.3 | 25.42 | 25.2 | 6,036,835 | ||||

| Qptions | (Show Open Interest only) | ||||||||||||

| Code | Expiry date | P/C | Exercise | Bid offer | Volume | ||||||||

| ANZLFZ | 21/11/2019 | call | 25.5 . 0.145 0.145 | Last | Openinterest | Margin Price | |||||||

| ANZSI8 | 28/11/19 | call | 0.01 | 25. 42 25.42 | 0 | 40 | 0.125 | ||||||

| ANZRR8 | 28/11/19 | call | 25.500 0.225 0.225 | 0 | 40 | 25.295 | |||||||

| ANZMO7 | 19/12/19 | call | 18.01 | 7.425 7.425 | 0 | 1,832 | 0.19 | ||||||

| ANZSH9 | 19/12/19 | call | 25.5 0.380 0.380 | 0 | 19 | 7.305 | |||||||

| ANZFY7 | 19/12/19 | call | 28 | 0.001 0.001 | 0 | 644 | 0.355 | ||||||

| ANZN69 | 30/01/20 | call | 25.500 0.605 0.605 | 0 | 1,670 | 0.004 | |||||||

| ANZZH9 | 27/02/20 | call | 25.500 0.730 0.730 | 0 | 20 | 39 | 0.555 | ||||||

| ANZT87 | 26/03/20 | call | 25.500 0.875 0.875 | 0.75 | 64 | 0.685 | |||||||

| ANZE69 | 25/06/20 | call | 25.500 1.055 1.055 | 0 | 14 | 150 | 0.815 | ||||||

| ANZLG7 | 21/11/19 | call | 25.500 0.150 0.150 | 0 | 805 | 0.995 | |||||||

| ANZRS8 | 28/11/19 | put | 25.500 0.290 0.290 | 0 | 73 | 880 | 0.37 | ||||||

| ANZFK8 | 19/12/19 | put | 18 | 0.000 0.000 | 0 | 120 | 0 | ||||||

| ANZSI9 | 19/12/19 | put | 25.5 0.465 0.465 | 0 | 647 | 0.55 | |||||||

| ANZVZ9 | 19/12/19 | put | 28.01 | 2.590 2.590 | 0 | 714 | 2.71 | ||||||

| ANZN79 | 30/01/20 | put | 25.5 0.640 0.640 | 0.81 | 844 | 0.705 | |||||||

| ANZZI9 | 27/02/20 | put | 25.500 0.760 0.760 | 0 | 70 | 60 | 0.83 | ||||||

| ANZT97 ANZE79 | 26/03/20 | put | 25.500 0.885 0.885 | 0 | 220 | 0.975 | |||||||

| 25/06/20 | put | 25.500 1.570 1.570 | 0 | 4,700 | 1.635 | ||||||||

Shares 19/11/2019 Low Code ANZ Last 25.420 $+/- %Chg 0.12 0.47% Bid Offer Open 25.4 25.42 25.3 High 25.42 Volume 6,036,835 25.2. Options (Show Open Interest only) Expiry Open Code P/C Exercise Bid Offer Last Volume Margin Price date interest ANZLFZ 21/11/2019 Call 25.500 0.145 0.145 0 40 0.125 ANZSI8 28/11/2019 Call 0.01 25.42 25.42 0 40 25.295 ANZRR8 28/11/2019 Call 25.500 0.225 0.225 0 1,832 0.19 ANZMO7 19/12/2019 Call 18.010 7.425 7.425 0 19 7.305 ANZSH9 19/12/2019 Call 25.500 0.380 0.380 0 644 0.355 ANZFY7 19/12/2019 Call 28.000 0.001 0.001 0 1,670 0.004 ANZN69 30/01/2020 Call 25.500 0.605 0.605 0 20 39 0.555 ANZZH9 27/02/2020 Call 25.500 0.730 0.730 0 64 0.685 ANZT87 26/03/2020 Call 25.500 0.875 0.875 0.75 150 0.815 ANZE69 25/06/2020 Call 25.500 1.055 1.055 0 805 0.995 ANZLG7 21/11/2019 Put 25.500 0.150 0.150 0 120 0.27 ANZRS8 28/11/2019 Put 25.500 0.290 0.290 0.325 73 880 0.37 ANZFK8 19/12/2019 Put 18.000 0.000 0.000 0 120 0 ANZSIS 19/12/2019 Put 25.500 0.465 0.465 0 647 0.55 ANZVZ9 19/12/2019 Put 28.010 2.590 2.590 0 714 2.71 ANZN79 30/01/2020 Put 25.500 0.640 0.640 844 0.705 ANZZI9 27/02/2020 Put 25.500 0.760 0.760 0.81 70 60 0.83 ANZT97 26/03/2020 Put 25.500 0.885 0.885 0 220 0.975 ANZE79 25/06/2020 Put 25.500 1.570 1.570 0 4,700 1.635 14 o Shares 19/11/2019 Low Code ANZ Last 25.420 $+/- %Chg 0.12 0.47% Bid Offer Open 25.4 25.42 25.3 High 25.42 Volume 6,036,835 25.2. Options (Show Open Interest only) Expiry Open Code P/C Exercise Bid Offer Last Volume Margin Price date interest ANZLFZ 21/11/2019 Call 25.500 0.145 0.145 0 40 0.125 ANZSI8 28/11/2019 Call 0.01 25.42 25.42 0 40 25.295 ANZRR8 28/11/2019 Call 25.500 0.225 0.225 0 1,832 0.19 ANZMO7 19/12/2019 Call 18.010 7.425 7.425 0 19 7.305 ANZSH9 19/12/2019 Call 25.500 0.380 0.380 0 644 0.355 ANZFY7 19/12/2019 Call 28.000 0.001 0.001 0 1,670 0.004 ANZN69 30/01/2020 Call 25.500 0.605 0.605 0 20 39 0.555 ANZZH9 27/02/2020 Call 25.500 0.730 0.730 0 64 0.685 ANZT87 26/03/2020 Call 25.500 0.875 0.875 0.75 150 0.815 ANZE69 25/06/2020 Call 25.500 1.055 1.055 0 805 0.995 ANZLG7 21/11/2019 Put 25.500 0.150 0.150 0 120 0.27 ANZRS8 28/11/2019 Put 25.500 0.290 0.290 0.325 73 880 0.37 ANZFK8 19/12/2019 Put 18.000 0.000 0.000 0 120 0 ANZSIS 19/12/2019 Put 25.500 0.465 0.465 0 647 0.55 ANZVZ9 19/12/2019 Put 28.010 2.590 2.590 0 714 2.71 ANZN79 30/01/2020 Put 25.500 0.640 0.640 844 0.705 ANZZI9 27/02/2020 Put 25.500 0.760 0.760 0.81 70 60 0.83 ANZT97 26/03/2020 Put 25.500 0.885 0.885 0 220 0.975 ANZE79 25/06/2020 Put 25.500 1.570 1.570 0 4,700 1.635 14 o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started