Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 2 January 2 0 X 4 , Yvan Ltd . , a public company, entered into a five - year equipment lease with Jeffery

On January X Yvan Ltd a public company, entered into a fiveyear equipment lease with Jeffery Leasing Inc. The lease calls for annual lease payments of $ payable at the beginning of each lease year. Yvans IBR is Yvan does not know the lessors interest rate. The fair value of the equipment is $ Yvan depreciates equipment on a straightline basis, taking a full years depreciation in the year of acquisition.

PV of $ PVA of $ and PVAD of $Use appropriate factors from the tables provided.

Required:

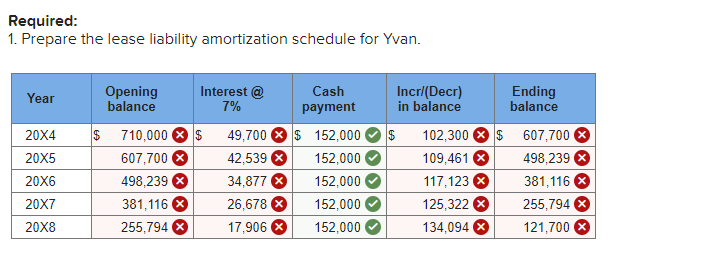

Prepare the lease liability amortization schedule for Yvan.

Prepare the journal entries relating to the leased asset and the lease liability for X and X for Yvan.

What amounts will appear on Yvans statement of financial position and statement of comprehensive income as at December X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started