Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 2 January 20X1, Potter Corp was incorporated in the Province of Ontario. It was authorized to issue an unlimited number of no-par value

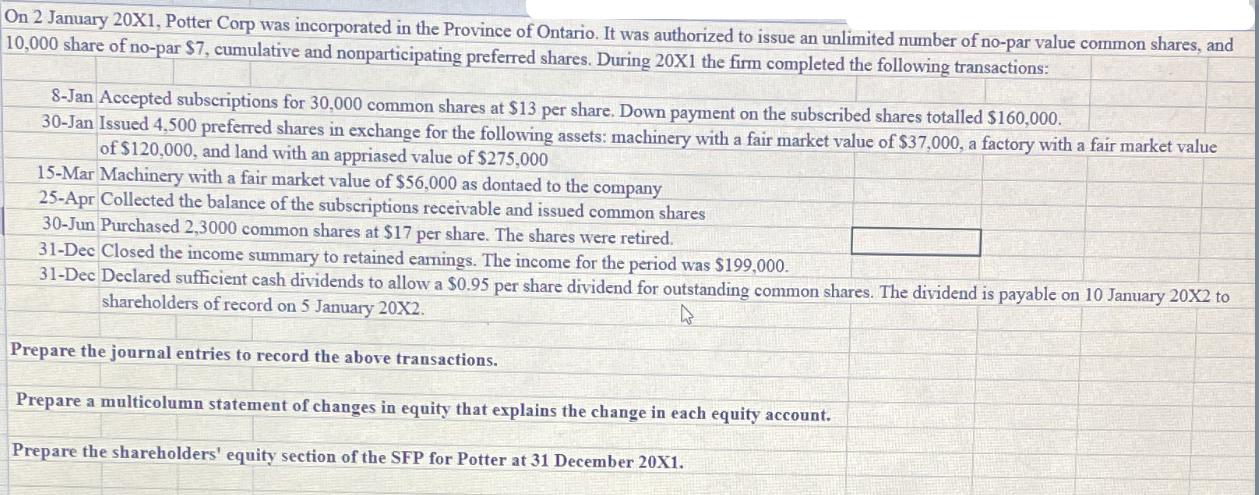

On 2 January 20X1, Potter Corp was incorporated in the Province of Ontario. It was authorized to issue an unlimited number of no-par value common shares, and 10,000 share of no-par $7, cumulative and nonparticipating preferred shares. During 20X1 the firm completed the following transactions: 8-Jan Accepted subscriptions for 30,000 common shares at $13 per share. Down payment on the subscribed shares totalled $160,000. 30-Jan Issued 4,500 preferred shares in exchange for the following assets: machinery with a fair market value of $37,000, a factory with a fair market value of $120,000, and land with an appriased value of $275,000 15-Mar Machinery with a fair market value of $56,000 as dontaed to the company 25-Apr Collected the balance of the subscriptions receivable and issued common shares 30-Jun Purchased 2,3000 common shares at $17 per share. The shares were retired. 31-Dec Closed the income summary to retained earnings. The income for the period was $199,000. 31-Dec Declared sufficient cash dividends to allow a $0.95 per share dividend for outstanding common shares. The dividend is payable on 10 January 20X2 to shareholders of record on 5 January 20X2. Prepare the journal entries to record the above transactions. Prepare a multicolumn statement of changes in equity that explains the change in each equity account. Prepare the shareholders' equity section of the SFP for Potter at 31 December 20X1.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entries 8Jan Cash 30000 shares 13 per share 160000 down payment 350000 Common Shares Subsc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started