Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 2 January 20x1, Tuas Leasing Ltd (TLL) negotiated a contract with Pasir Ris Ltd (PRL) for the use of a construction vehicle by

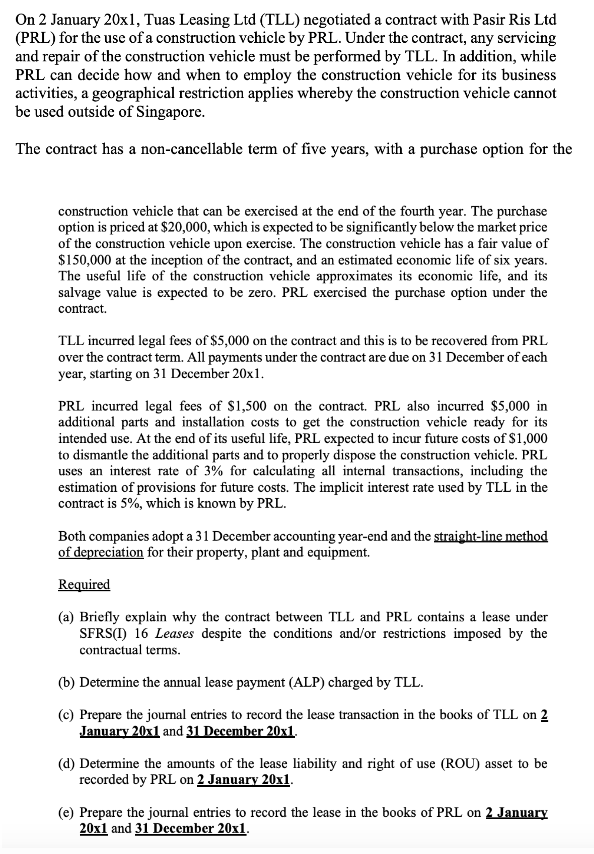

On 2 January 20x1, Tuas Leasing Ltd (TLL) negotiated a contract with Pasir Ris Ltd (PRL) for the use of a construction vehicle by PRL. Under the contract, any servicing and repair of the construction vehicle must be performed by TLL. In addition, while PRL can decide how and when to employ the construction vehicle for its business activities, a geographical restriction applies whereby the construction vehicle cannot be used outside of Singapore. The contract has a non-cancellable term of five years, with a purchase option for the construction vehicle that can be exercised at the end of the fourth year. The purchase option is priced at $20,000, which is expected to be significantly below the market price of the construction vehicle upon exercise. The construction vehicle has a fair value of $150,000 at the inception of the contract, and an estimated economic life of six years. The useful life of the construction vehicle approximates its economic life, and its salvage value is expected to be zero. PRL exercised the purchase option under the contract. TLL incurred legal fees of $5,000 on the contract and this is to be recovered from PRL over the contract term. All payments under the contract are due on 31 December of each year, starting on 31 December 20x1. PRL incurred legal fees of $1,500 on the contract. PRL also incurred $5,000 in additional parts and installation costs to get the construction vehicle ready for its intended use. At the end of its useful life, PRL expected to incur future costs of $1,000 to dismantle the additional parts and to properly dispose the construction vehicle. PRL uses an interest rate of 3% for calculating all internal transactions, including the estimation of provisions for future costs. The implicit interest rate used by TLL in the contract is 5%, which is known by PRL. Both companies adopt a 31 December accounting year-end and the straight-line method of depreciation for their property, plant and equipment. Required (a) Briefly explain why the contract between TLL and PRL contains a lease under SFRS(I) 16 Leases despite the conditions and/or restrictions imposed by the contractual terms. (b) Determine the annual lease payment (ALP) charged by TLL. (c) Prepare the journal entries to record the lease transaction in the books of TLL on 2 January 20x1 and 31 December 20x1. (d) Determine the amounts of the lease liability and right of use (ROU) asset to be recorded by PRL on 2 January 20x1. (e) Prepare the journal entries to record the lease in the books of PRL on 2 January 20x1 and 31 December 20x1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started