Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 2 July 2015, H Ltd. purchased the entire issued ordinary share capital of S Ltd. On this date, S Ltd. had a retained

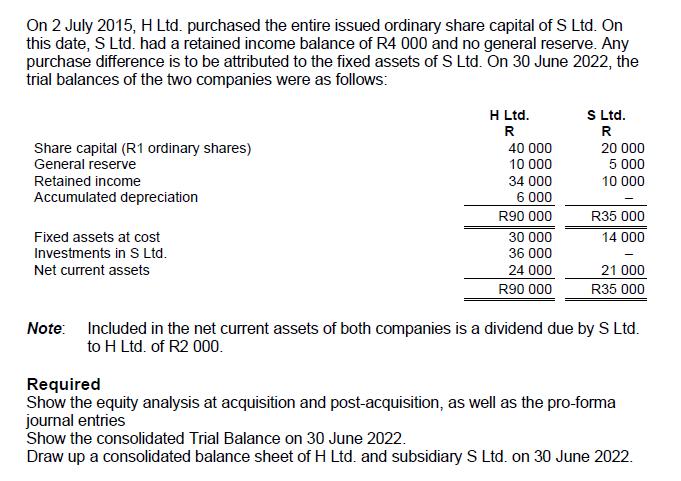

On 2 July 2015, H Ltd. purchased the entire issued ordinary share capital of S Ltd. On this date, S Ltd. had a retained income balance of R4 000 and no general reserve. Any purchase difference is to be attributed to the fixed assets of S Ltd. On 30 June 2022, the trial balances of the two companies were as follows: Share capital (R1 ordinary shares) General reserve Retained income Accumulated depreciation Fixed assets at cost Investments in S Ltd. Net current assets H Ltd. S Ltd. R R 40 000 20 000 10 000 5 000 34 000 10 000 6 000 R90 000 R35 000 30 000 14 000 36 000 24 000 21 000 R90 000 R35 000 Note: Included in the net current assets of both companies is a dividend due by S Ltd. to H Ltd. of R2 000. Required Show the equity analysis at acquisition and post-acquisition, as well as the pro-forma journal entries Show the consolidated Trial Balance on 30 June 2022. Draw up a consolidated balance sheet of H Ltd. and subsidiary S Ltd. on 30 June 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Equity Analysis at Acquisition At the acquisition date H Ltd acquired the entire issued ordinary sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started