Question

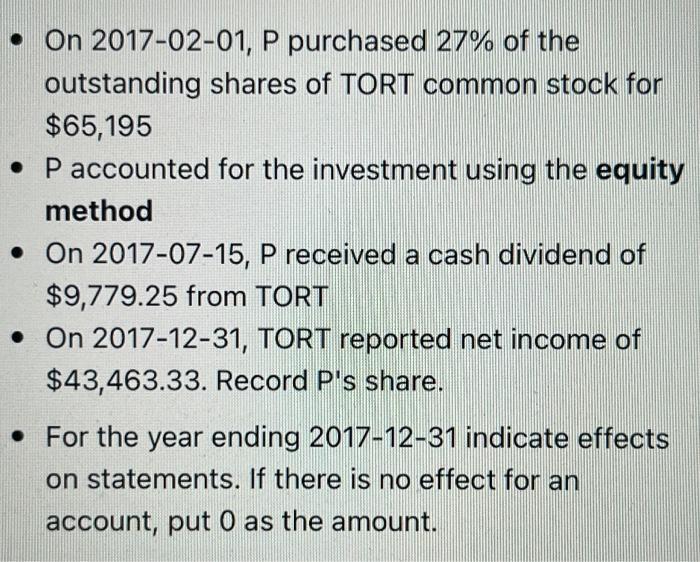

On 2017-02-01, P purchased 27% of the outstanding shares of TORT common stock for $65,195 . P accounted for the investment using the equity

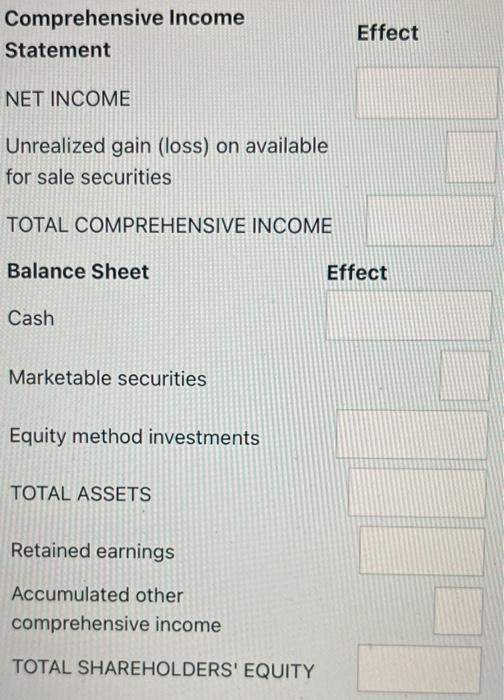

On 2017-02-01, P purchased 27% of the outstanding shares of TORT common stock for $65,195 . P accounted for the investment using the equity method . On 2017-07-15, P received a cash dividend of $9,779.25 from TORT On 2017-12-31, TORT reported net income of $43,463.33. Record P's share. . For the year ending 2017-12-31 indicate effects on statements. If there is no effect for an account, put O as the amount. Comprehensive Income Statement NET INCOME Unrealized gain (loss) on available for sale securities TOTAL COMPREHENSIVE INCOME Balance Sheet Cash Marketable securities Equity method investments TOTAL ASSETS Retained earnings Accumulated other comprehensive income TOTAL SHAREHOLDERS' EQUITY Effect Effect

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution The Equity Method is used when the investor has a significant degree of control betw...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

12th Canadian Edition

1119497043, 978-1119497042

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App