Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 23 June 2014, Subsidiary Ltd sold inventory which cost $12,000 to Parent Ltd for $16,000. By 30 June 2014, Parent Ltd had sold

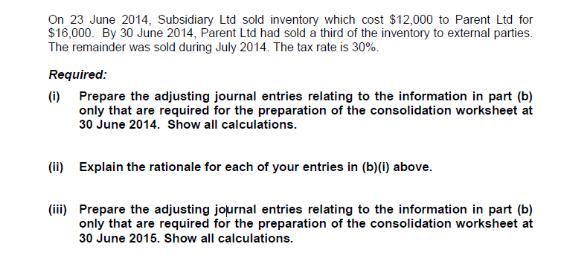

On 23 June 2014, Subsidiary Ltd sold inventory which cost $12,000 to Parent Ltd for $16,000. By 30 June 2014, Parent Ltd had sold a third of the inventory to external parties. The remainder was sold during July 2014. The tax rate is 30%. Required: (i) Prepare the adjusting journal entries relating to the information in part (b) only that are required for the preparation of the consolidation worksheet at 30 June 2014. Show all calculations. (ii) Explain the rationale for each of your entries in (b)(i) above. (iii) Prepare the adjusting journal entries relating to the information in part (b) only that are required for the preparation of the consolidation worksheet at 30 June 2015. Show all calculations.

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

i Adjusting Journal Entries at 30 June 2014 a Eliminate unrealized profit in the beginning inventory inventory sold from Subsidiary Ltd to Parent Ltd ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started