Answered step by step

Verified Expert Solution

Question

1 Approved Answer

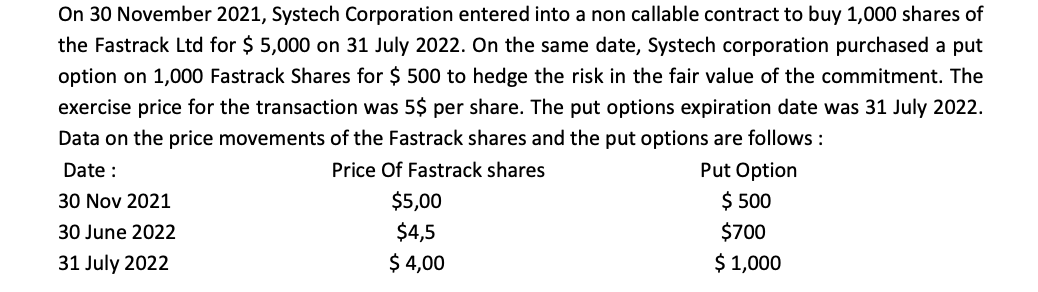

On 3 0 November 2 0 2 1 , Systech Corporation entered into a non callable contract to buy 1 , 0 0 0 shares

On November Systech Corporation entered into a non callable contract to buy shares of

the Fastrack Ltd for $ on July On the same date, Systech corporation purchased a put

option on Fastrack Shares for $ to hedge the risk in the fair value of the commitment. The

exercise price for the transaction was $ per share. The put options expiration date was July

Data on the price movements of the Fastrack shares and the put options are follows:

The Systech designated the options contract as a hedge of the risk changes in the fair value of the firm

commitment resulting from changes in the price of Fastrack shares. Systech excluded the time value of

the option contract from the hedging relationship. The Systech corporation closed the position on the

put option on July fulfilled its obligations under contract, and sold off its shares on the same

date. The Systech corporation year end is June

Instructions:

Prepared the journal entries No November June and July

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started