Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 3 February 2020, LEGION Berhad received a grant RM100,000 from Ministry of Agriculture to purchase a machinery at a cost of RM300,000 to

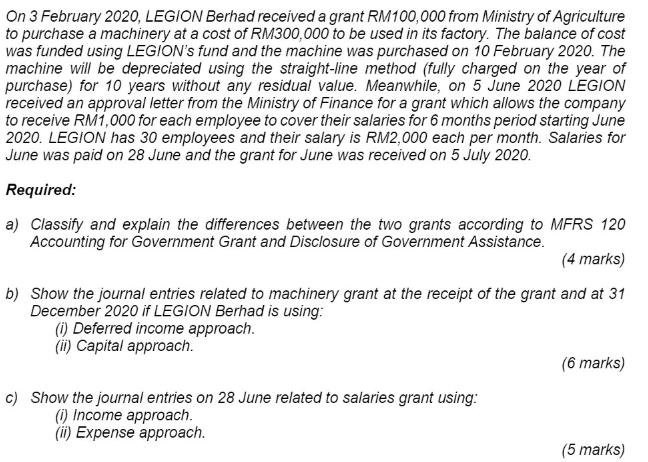

On 3 February 2020, LEGION Berhad received a grant RM100,000 from Ministry of Agriculture to purchase a machinery at a cost of RM300,000 to be used in its factory. The balance of cost was funded using LEGION's fund and the machine was purchased on 10 February 2020. The machine will be depreciated using the straight-line method (fully charged on the year of purchase) for 10 years without any residual value. Meanwhile, on 5 June 2020 LEGION received an approval letter from the Ministry of Finance for a grant which allows the company to receive RM1,000 for each employee to cover their salaries for 6 months period starting June 2020. LEGION has 30 employees and their salary is RM2,000 each per month. Salaries for June was paid on 28 June and the grant for June was received on 5 July 2020. Required: a) Classify and explain the differences between the two grants according to MFRS 120 Accounting for Government Grant and Disclosure of Government Assistance. (4 marks) b) Show the journal entries related to machinery grant at the receipt of the grant and at 31 December 2020 if LEGION Berhad is using: (i) Deferred income approach. (ii) Capital approach. c) Show the journal entries on 28 June related to salaries grant using: (i) Income approach. (ii) Expense approach. (6 marks) (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a According to MFRS 120 Accounting for Government Grant and Disclosure of Government Assistance the two grants received by LEGION Berhad can be classi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started