Question

On 30 June 2014 TYO acquired 800,000 of PLO's 1 million shares. The purchase consideration was as follows: TYO issued 3 shares for every

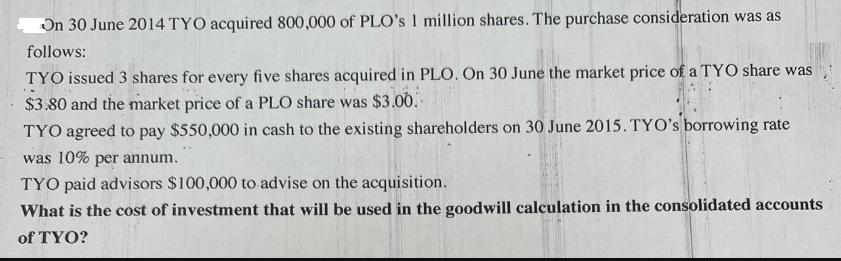

On 30 June 2014 TYO acquired 800,000 of PLO's 1 million shares. The purchase consideration was as follows: TYO issued 3 shares for every five shares acquired in PLO. On 30 June the market price of a TYO share was $3.80 and the market price of a PLO share was $3.00. TYO agreed to pay $550,000 in cash to the existing shareholders on 30 June 2015. TYO's borrowing rate was 10% per annum. TYO paid advisors $100,000 to advise on the acquisition. What is the cost of investment that will be used in the goodwill calculation in the consolidated accounts of TYO?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the cost of investment that will be used in the goodwill calculation i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting and Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

7th edition

1259722651, 978-1259722653

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App