Answered step by step

Verified Expert Solution

Question

1 Approved Answer

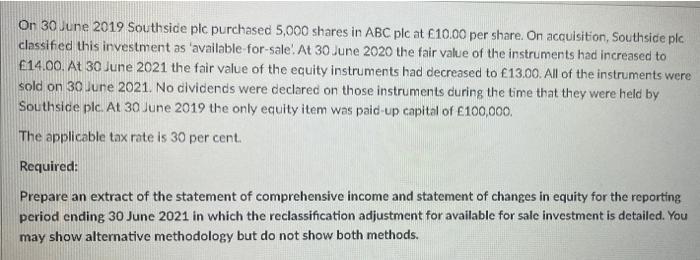

On 30 June 2019 Southside plc purchased 5,000 shares in ABC plc at 10.00 per share. On acquisition, Southside plc classified this investment as

On 30 June 2019 Southside plc purchased 5,000 shares in ABC plc at 10.00 per share. On acquisition, Southside plc classified this investment as 'available-for-sale. At 30 June 2020 the fair value of the instruments had increased to 14.00. At 30 June 2021 the fair value of the equity instruments had decreased to 13.00. All of the instruments were sold on 30 June 2021. No dividends were declared on those instruments during the time that they were held by Southside plc. At 30 June 2019 the only equity item was paid-up capital of 100,000. The applicable tax rate is 30 per cent. Required: Prepare an extract of the statement of comprehensive income and statement of changes in equity for the reporting period ending 30 June 2021 in which the reclassification adjustment for available for sale investment is detailed. You may show alternative methodology but do not show both methods.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

answer Step 1 The securities that are classified as securities available for sale are to be recorded ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started