Answered step by step

Verified Expert Solution

Question

1 Approved Answer

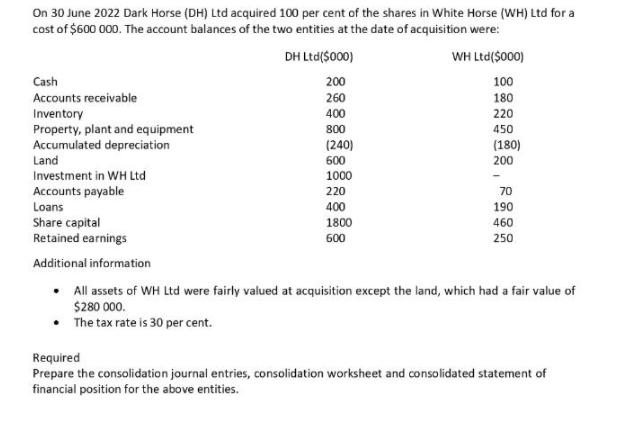

On 30 June 2022 Dark Horse (DH) Ltd acquired 100 per cent of the shares in White Horse (WH) Ltd for a cost of

On 30 June 2022 Dark Horse (DH) Ltd acquired 100 per cent of the shares in White Horse (WH) Ltd for a cost of $600 000. The account balances of the two entities at the date of acquisition were: DH Ltd($000) WH Ltd($000) Cash 200 100 Accounts receivable 260 180 Inventory 400 220 Property, plant and equipment Accumulated depreciation 800 450 (240) (180) Land 600 200 1000 220 Investment in WH Ltd Accounts payable Loans Share capital 70 400 190 1800 460 Retained earnings 600 250 Additional information All assets of WH Ltd were fairly valued at acquisition except the land, which had a fair value of $280 000. The tax rate is 30 per cent. Required Prepare the consolidation journal entries, consolidation worksheet and consolidated statement of financial position for the above entities.

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Computation of the value of Goodwill Fair value of the assets of WH Ltd So...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started