Question

On 30 June 2023, the end of the current reporting period, XYZ Ltd made a decision, using the information obtained over the past few years,

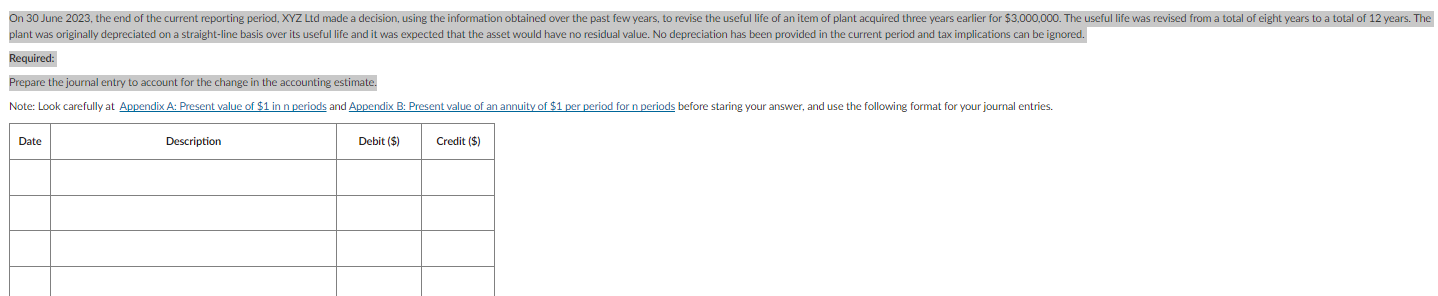

On 30 June 2023, the end of the current reporting period, XYZ Ltd made a decision, using the information obtained over the past few years, to revise the useful life of an item of plant acquired three years earlier for $3,000,000. The useful life was revised from a total of eight years to a total of 12 years. The plant was originally depreciated on a straight-line basis over its useful life and it was expected that the asset would have no residual value. No depreciation has been provided in the current period and tax implications can be ignored.

Required:

Prepare the journal entry to account for the change in the accounting estimate.

Required: Prepare the journal entry to account for the change in the accounting estimate

Required: Prepare the journal entry to account for the change in the accounting estimate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started