Question: On 30 June 20X1 Black Ltd signed a contract to lease a vehicle from Beauty Ltd. On the day the lease contract was signed,

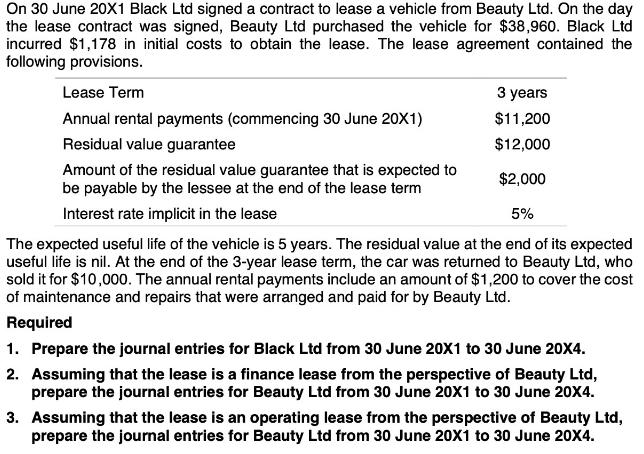

On 30 June 20X1 Black Ltd signed a contract to lease a vehicle from Beauty Ltd. On the day the lease contract was signed, Beauty Ltd purchased the vehicle for $38,960. Black Ltd incurred $1,178 in initial costs to obtain the lease. The lease agreement contained the following provisions. Lease Term Annual rental payments (commencing 30 June 20X1) Residual value guarantee Amount of the residual value guarantee that is expected to be payable by the lessee at the end of the lease term Interest rate implicit in the lease 3 years $11,200 $12,000 $2,000 5% The expected useful life of the vehicle is 5 years. The residual value at the end of its expected useful life is nil. At the end of the 3-year lease term, the car was returned to Beauty Ltd, who sold it for $10,000. The annual rental payments include an amount of $1,200 to cover the cost of maintenance and repairs that were arranged and paid for by Beauty Ltd. Required 1. Prepare the journal entries for Black Ltd from 30 June 20X1 to 30 June 20X4. 2. Assuming that the lease is a finance lease from the perspective of Beauty Ltd, prepare the journal entries for Beauty Ltd from 30 June 20x1 to 30 June 20X4. 3. Assuming that the lease is an operating lease from the perspective of Beauty Ltd, prepare the journal entries for Beauty Ltd from 30 June 20X1 to 30 June 20X4.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

1 Journal entries for Black Ltd a On 30 June 20X1 Lease Commencement Leased Vehicle Right of Use Ass... View full answer

Get step-by-step solutions from verified subject matter experts