Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 30th September, 2018, the bank account of XYZ, according to the bank column of the cash book, was overdrawn to the extent of

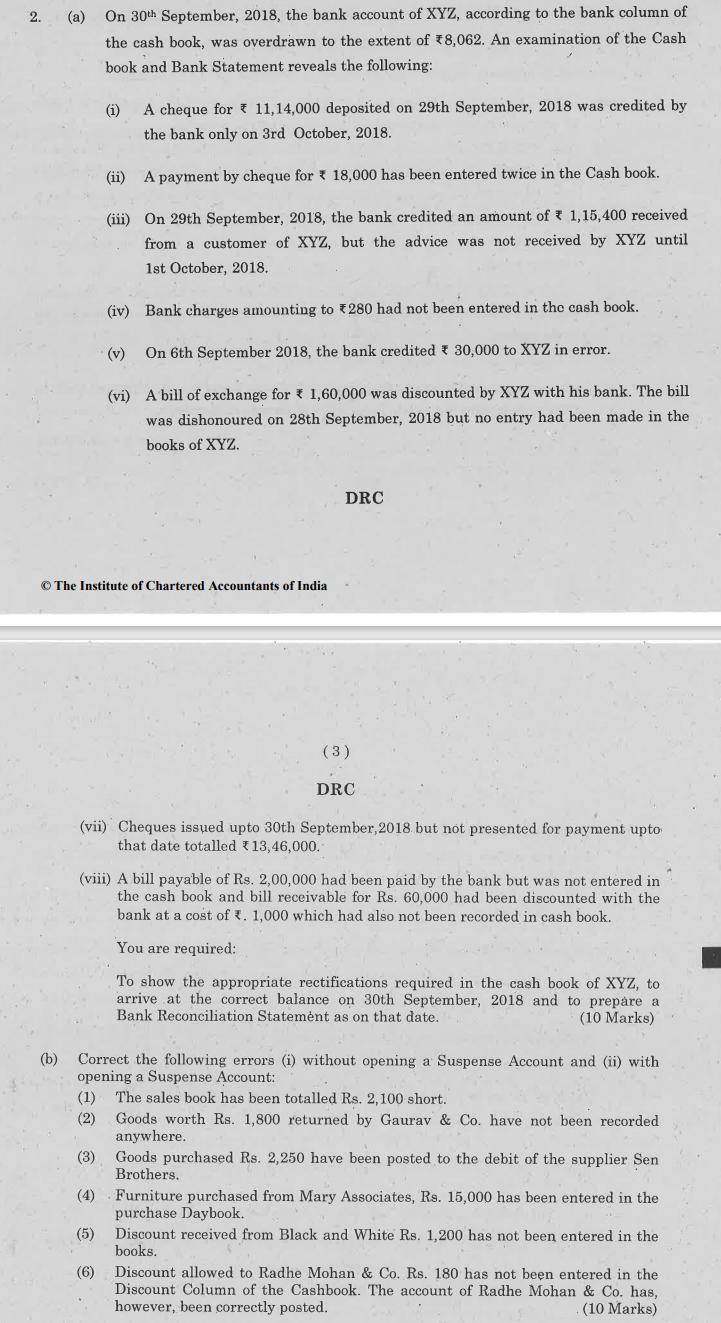

On 30th September, 2018, the bank account of XYZ, according to the bank column of the cash book, was overdrawn to the extent of 8,062. An examination of the Cash. book and Bank Statement reveals the following: (i) A cheque for 11,14,000 deposited on 29th September, 2018 was credited by the bank only on 3rd October, 2018. (ii) A payment by cheque for 18,000 has been entered twice in the Cash book. (iii) On 29th September, 2018, the bank credited an amount of 1,15,400 received from a customer of XYZ, but the advice was not received by XYZ until 1st October, 2018. (iv) Bank charges amounting to 280 had not been entered in the cash book. (v) On 6th September 2018, the bank credited 30,000 to XYZ in error. (vi) A bill of exchange for 1,60,000 was discounted by XYZ with his bank. The bill was dishonoured on 28th September, 2018 but no entry had been made in the books of XYZ. The Institute of Chartered Accountants of India DRC (3) DRC (vii) Cheques issued upto 30th September, 2018 but not presented for payment upto that date totalled 13,46,000. (viii) A bill payable of Rs. 2,00,000 had been paid by the bank but was not entered in the cash book and bill receivable for Rs. 60,000 had been discounted with the bank at a cost of t. 1,000 which had also not been recorded in cash book.. You are required: To show the appropriate rectifications required in the cash book of XYZ, to arrive at the correct balance on 30th September, 2018 and to prepare a Bank Reconciliation Statement as on that date. (10 Marks) (b) Correct the following errors (i) without opening a Suspense Account and (ii) with opening a Suspense Account: (1) The sales book has been totalled Rs. 2,100 short. (2) Goods worth Rs. 1,800 returned by Gaurav & Co. have not been recorded anywhere. (3) Goods purchased Rs. 2,250 have been posted to the debit of the supplier Sen Brothers. (4) Furniture purchased from Mary Associates, Rs. 15,000 has been entered in the purchase Daybook. (5) Discount received from Black and White Rs. 1,200 has not been entered in the books. (6) Discount allowed to Radhe Mohan & Co. Rs. 180 has not been entered in the Discount Column of the Cashbook. The account of Radhe Mohan & Co. has, however, been correctly posted. (10 Marks)

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started