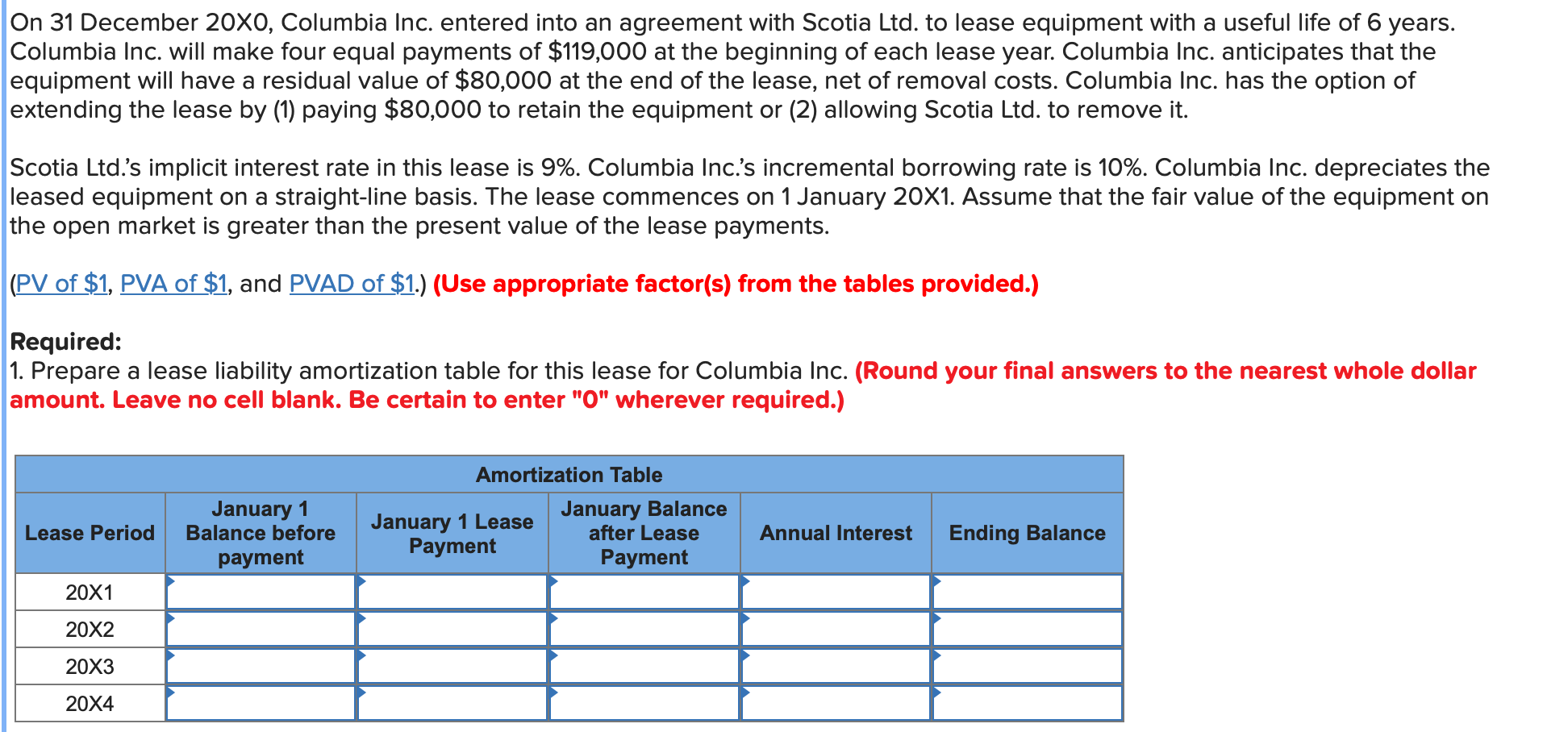

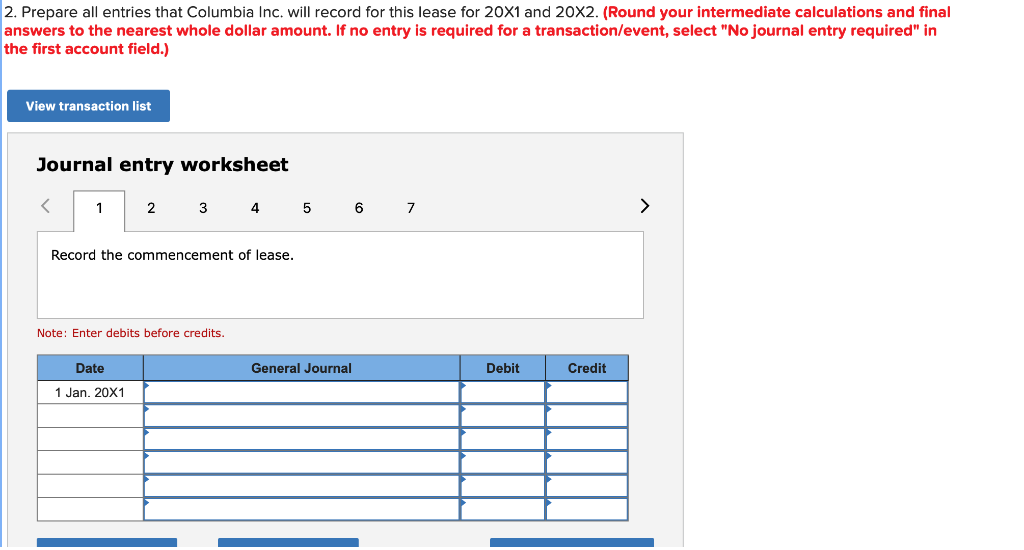

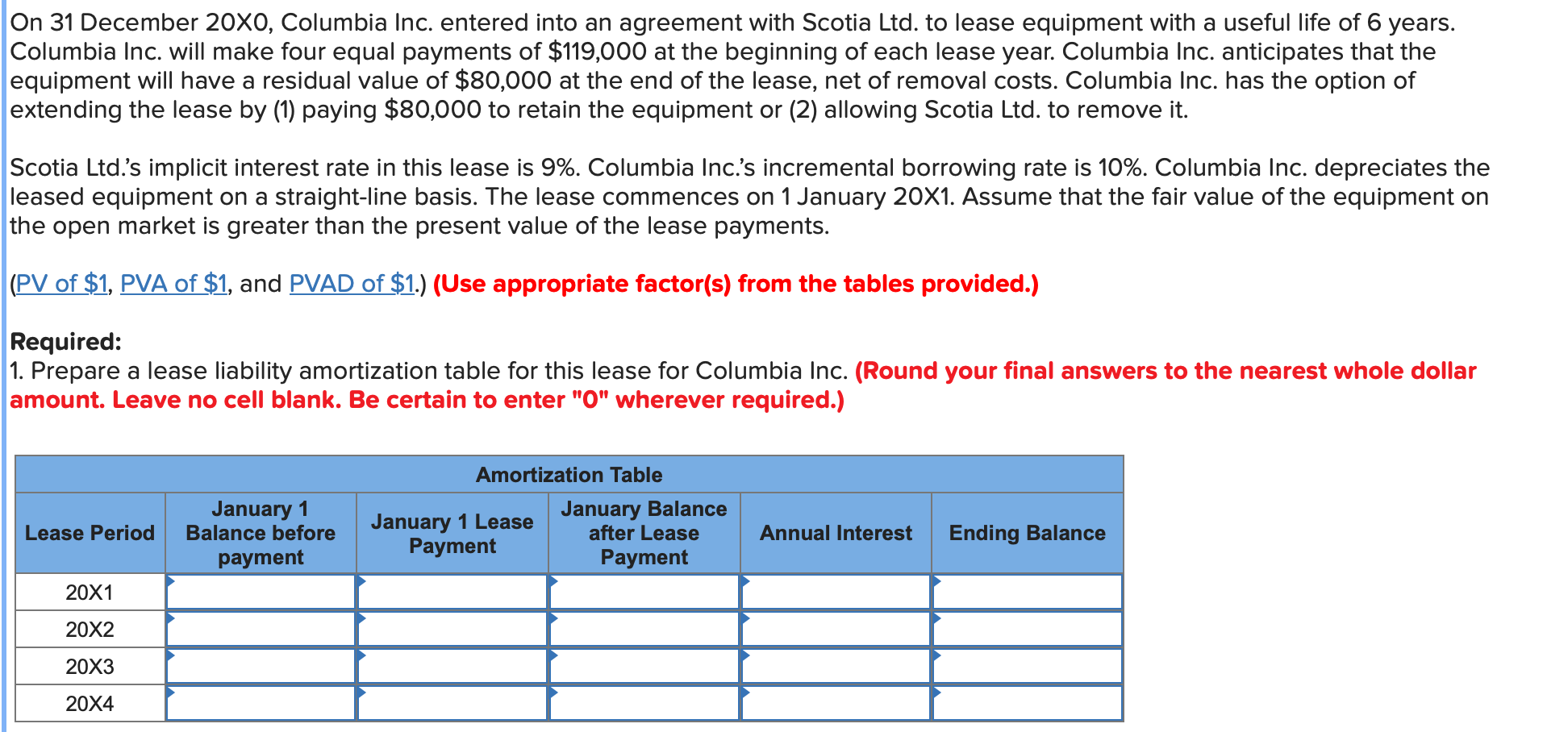

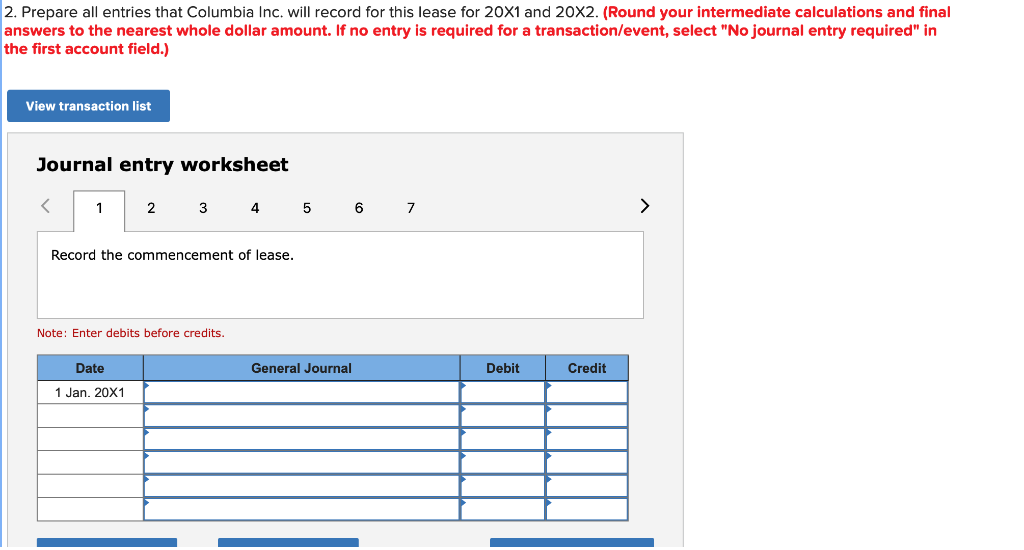

On 31 December 200, Columbia Inc. entered into an agreement with Scotia Ltd. to lease equipment with a useful life of 6 years. Columbia Inc. will make four equal payments of $119,000 at the beginning of each lease year. Columbia Inc. anticipates that the equipment will have a residual value of $80,000 at the end of the lease, net of removal costs. Columbia Inc. has the option of extending the lease by (1) paying $80,000 to retain the equipment or (2) allowing Scotia Ltd. to remove it. Scotia Ltd.'s implicit interest rate in this lease is 9%. Columbia Inc.'s incremental borrowing rate is 10%. Columbia Inc. depreciates the leased equipment on a straight-line basis. The lease commences on 1 January 201. Assume that the fair value of the equipment on the open market is greater than the present value of the lease payments. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare a lease liability amortization table for this lease for Columbia Inc. (Round your final answers to the nearest whole dollar amount. Leave no cell blank. Be certain to enter "O" wherever required.) Prepare all entries that Columbia Inc. will record for this lease for 201 and 202. (Round your intermediate calculations and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in he first account field.) Journal entry worksheet INote: Encer aedics derore creaits. On 31 December 200, Columbia Inc. entered into an agreement with Scotia Ltd. to lease equipment with a useful life of 6 years. Columbia Inc. will make four equal payments of $119,000 at the beginning of each lease year. Columbia Inc. anticipates that the equipment will have a residual value of $80,000 at the end of the lease, net of removal costs. Columbia Inc. has the option of extending the lease by (1) paying $80,000 to retain the equipment or (2) allowing Scotia Ltd. to remove it. Scotia Ltd.'s implicit interest rate in this lease is 9%. Columbia Inc.'s incremental borrowing rate is 10%. Columbia Inc. depreciates the leased equipment on a straight-line basis. The lease commences on 1 January 201. Assume that the fair value of the equipment on the open market is greater than the present value of the lease payments. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare a lease liability amortization table for this lease for Columbia Inc. (Round your final answers to the nearest whole dollar amount. Leave no cell blank. Be certain to enter "O" wherever required.) Prepare all entries that Columbia Inc. will record for this lease for 201 and 202. (Round your intermediate calculations and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in he first account field.) Journal entry worksheet INote: Encer aedics derore creaits