Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 31 December 2016, the Summary Balance Sheet of John Brown Limited, booksellers, was as follows: Capital 10,000 Shop equipment 3,750 Creditors 5,000 Stock

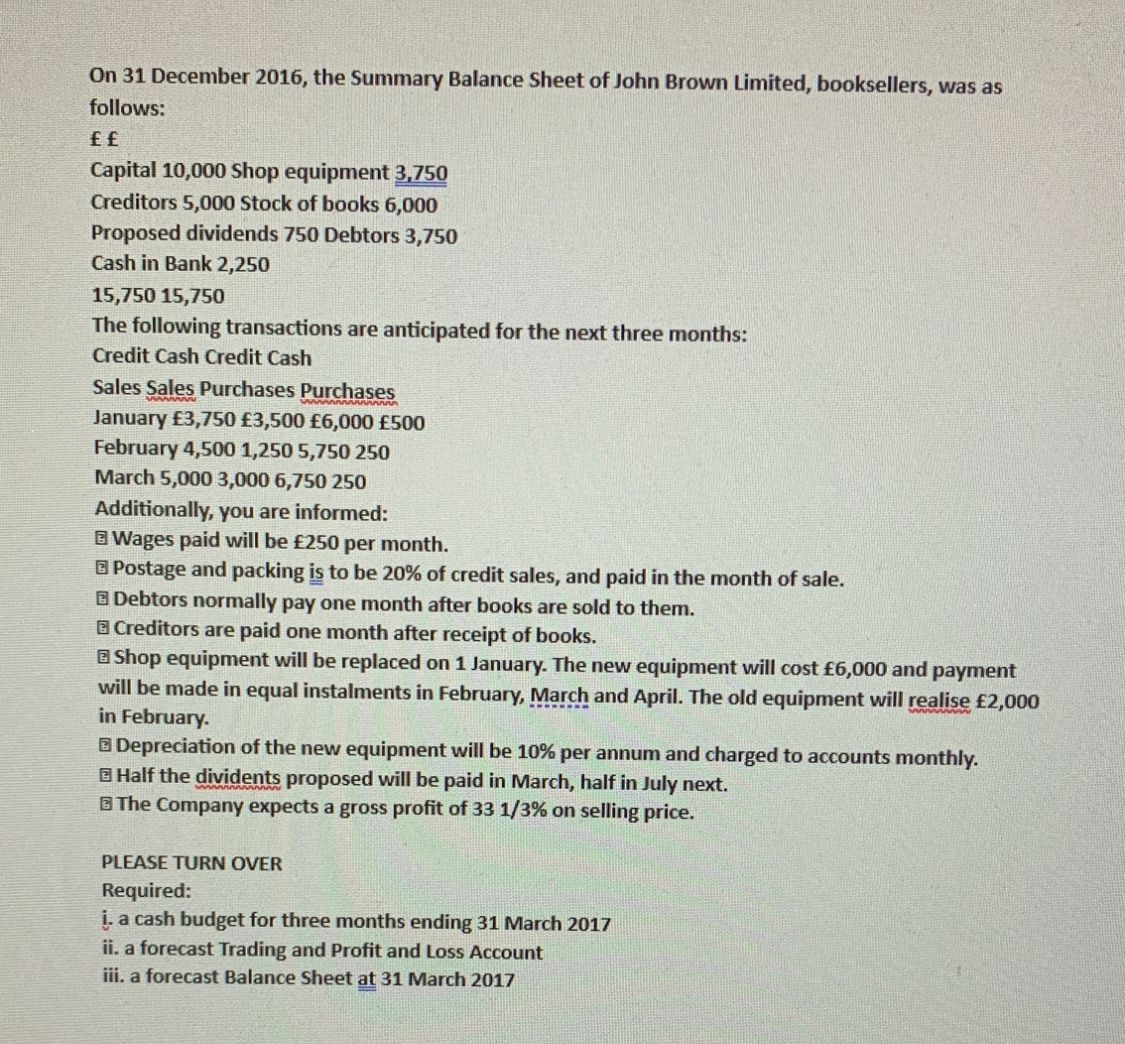

On 31 December 2016, the Summary Balance Sheet of John Brown Limited, booksellers, was as follows: Capital 10,000 Shop equipment 3,750 Creditors 5,000 Stock of books 6,000 Proposed dividends 750 Debtors 3,750 Cash in Bank 2,250 15,750 15,750 The following transactions are anticipated for the next three months: Credit Cash Credit Cash Sales Sales Purchases Purchases www January 3,750 3,500 6,000 500 February 4,500 1,250 5,750 250 March 5,000 3,000 6,750 250 Additionally, you are informed: Wages paid will be 250 per month. Postage and packing is to be 20% of credit sales, and paid in the month of sale. Debtors normally pay one month after books are sold to them. Creditors are paid one month after receipt of books. Shop equipment will be replaced on 1 January. The new equipment will cost 6,000 and payment will be made in equal instalments in February, March and April. The old equipment will realise 2,000 in February. wwwwwwwww Depreciation of the new equipment will be 10% per annum and charged to accounts monthly. Half the dividents proposed will be paid in March, half in July next. The Company expects a gross profit of 33 1/3% on selling price. PLEASE TURN OVER Required: i. a cash budget for three months ending 31 March 2017 ii. a forecast Trading and Profit and Loss Account iii. a forecast Balance Sheet at 31 March 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started