Answered step by step

Verified Expert Solution

Question

1 Approved Answer

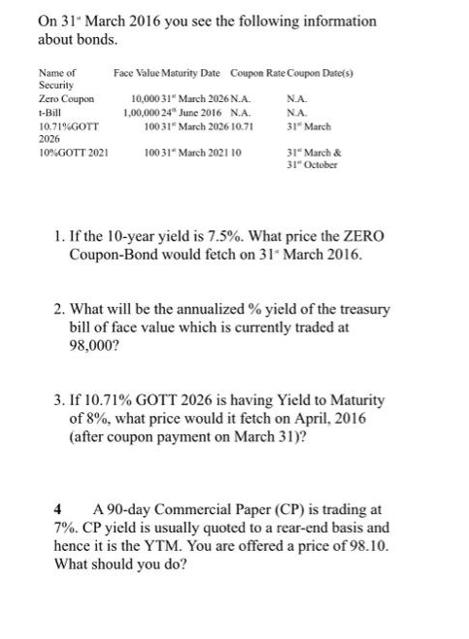

On 31 March 2016 you see the following information about bonds. Name of Security Zero Coupon 1-Bill 10.71%GOTT 2026 10%GOTT 2021 Face Value Maturity

On 31 March 2016 you see the following information about bonds. Name of Security Zero Coupon 1-Bill 10.71%GOTT 2026 10%GOTT 2021 Face Value Maturity Date Coupon Rate Coupon Date(s) N.A. 10,000 31" March 2026 N.A. 1,00,000 24" June 2016 N.A. N.A. 100 31" March 2026 10.71 31 March 100 31" March 2021 10 31" March & 31 October 1. If the 10-year yield is 7.5%. What price the ZERO Coupon-Bond would fetch on 31 March 2016. 2. What will be the annualized % yield of the treasury bill of face value which is currently traded at 98,000? 3. If 10.71% GOTT 2026 is having Yield to Maturity of 8%, what price would it fetch on April, 2016 (after coupon payment on March 31)? 4 A 90-day Commercial Paper (CP) is trading at 7%. CP yield is usually quoted to a rear-end basis and hence it is the YTM. You are offered a price of 98.10. What should you do?

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1If the 10 year yield is 7 5 What price Z ERO Coup on B ond would fetch on 31 st 2016 Price of Zero ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started