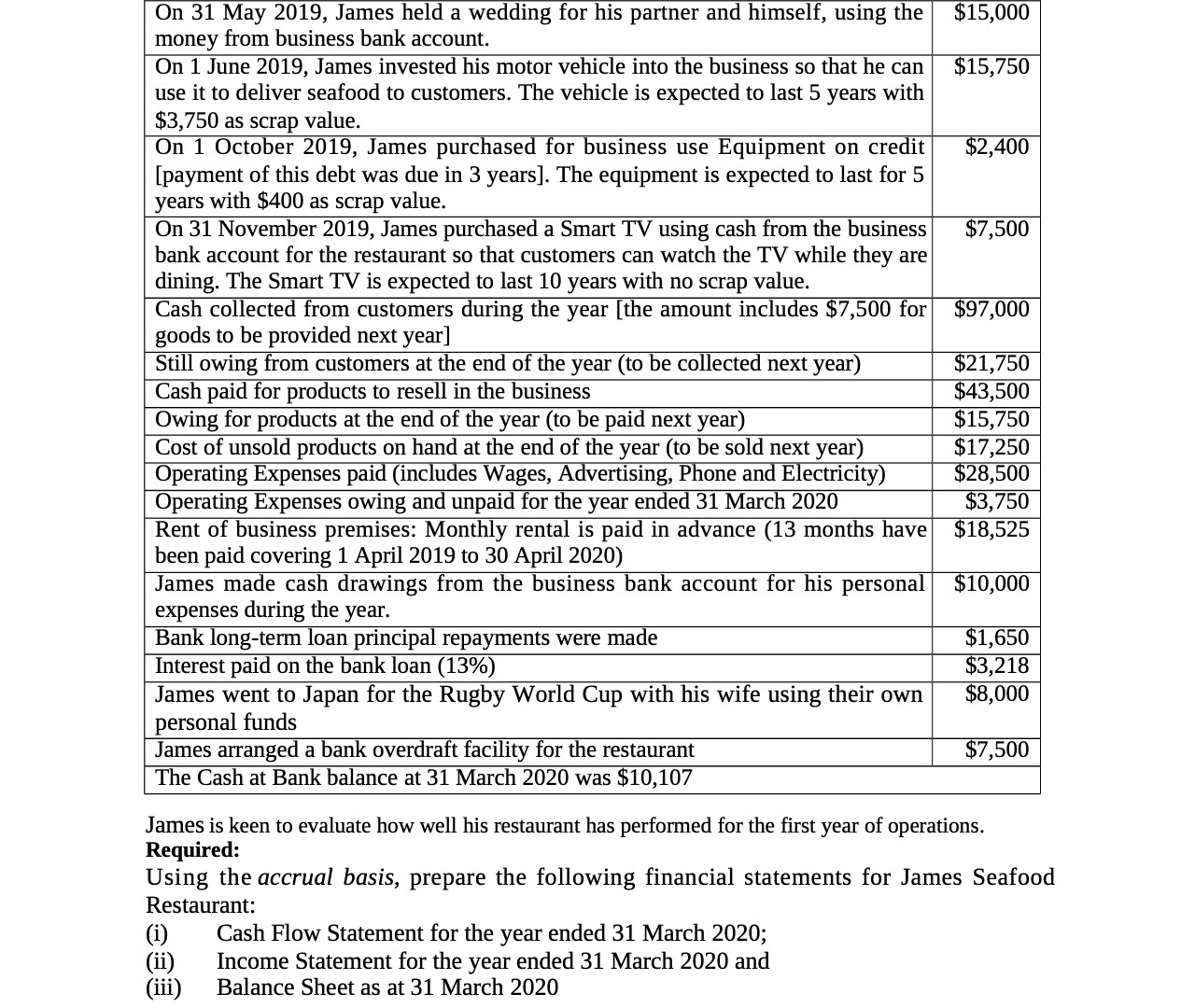

On 31 May 2019, James held a wedding for his partner and himself, using the '-15,000 money from business bank account. On 1 June 2019, James invested his motor vehicle into the business so that he can '-15,750 use it to deliver seafood to customers. The vehicle is expected to last 5 years with $3,750 as scrap value. On 1 Octo - er 2019, James purc ase - or nusiness use Equipment on ere: it '2,400 [payment of this debt was due in 3 years]. The equipment is expected to last for 5 years with $400 as scrap value. On 31 November 2019, James purchased a Smart TV using cash from the business $7,500 bank account for the restaurant so that customers can watch the TV while they are dining. The Smart TV is expected to last 10 years with no scrap value. Cash collected from customers during the year [the amount includes '. 7,500 for H97,000 goods to be provided next year] Still owing from customers at the end of the year (to be collected next year) $21,750 Cash paid for products to resell in the business 4'-3,500 Owing for products at the end of the year (to be paid next year) '- 15,750 Cost of unsold products on hand at the end of the year (to be sold next year) $17,250 Operating Expenses pai- inc u- es Wages, A: ertising, P one an: E ectricity '28,500 Operating Expenses owing and unpaid for the year ended 31 March 2020 $3,750 Rent of business premises: Monthly rental is paid in advance (13 months have H18,525 been paid covering 1 April 2019 to 30 April 2020) James made cash drawings from the business bank account for his personal $10,000 expenses during the year. Bank long-temi loan principal repayments were made $1,650 Interest paid on the bank loan (13%) '3,218 James went to Japan for the Rugby World Cup with his wife using their own '8,000 personal funds James arranged a bank overdraft facility for the restaurant '7,500 The Cash at Bank balance at 31 March 2020 was '- 10,107 James is keen to evaluate how well his restaurant has performed for the rst year of operations. Required: Using the accrual basis, prepare the following financial statements for James Seafood Restaurant: (1) Cash Flow Statement for the year ended 31 March 2020; (ii) Income Statement for the year ended 31 March 2020 and (iii) Balance Sheet as at 31 March 2020