Answered step by step

Verified Expert Solution

Question

1 Approved Answer

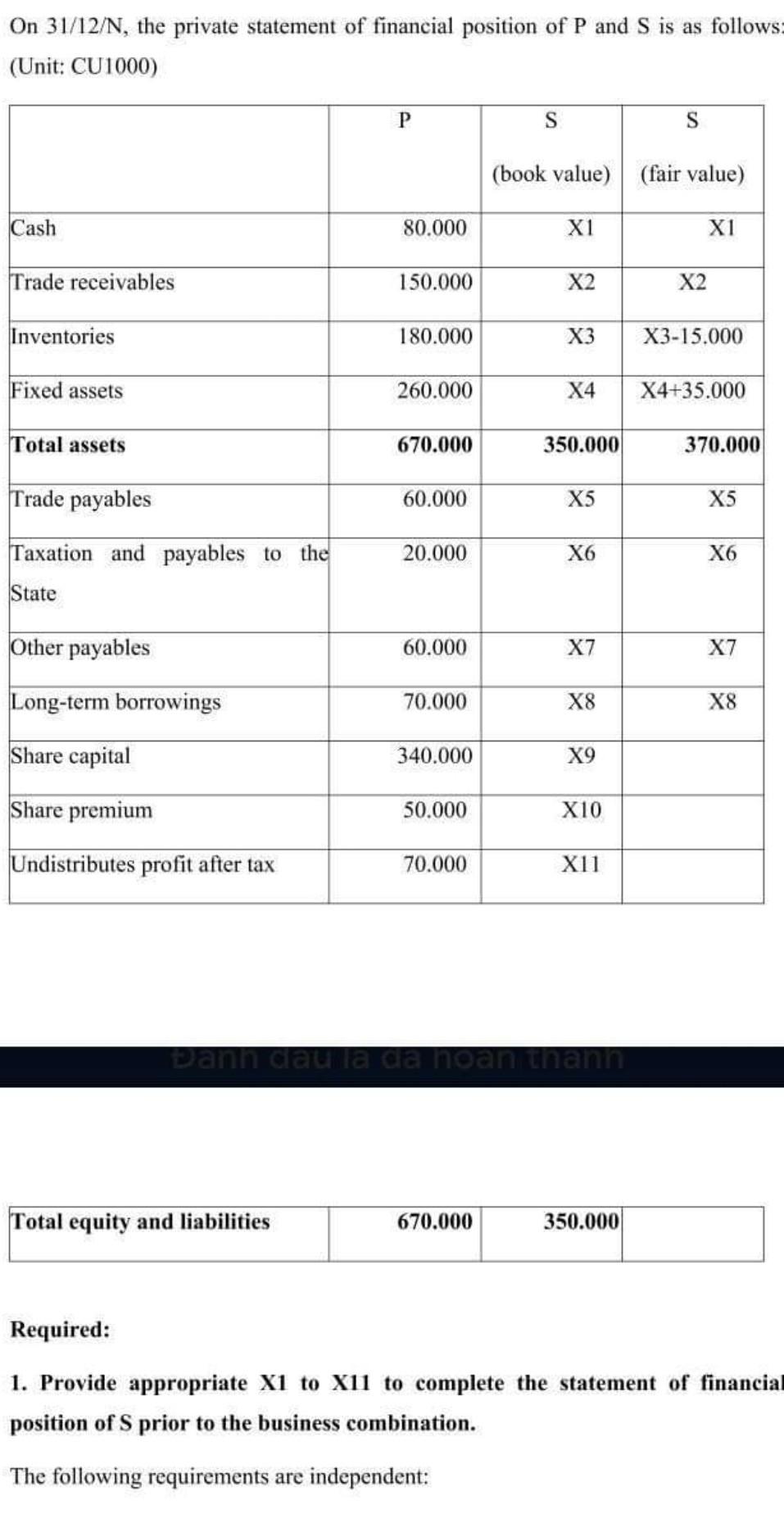

On 31/12/N, the private statement of financial position of P and S is as follows: (Unit: CU1000) P S S (book value) (fair value) Cash

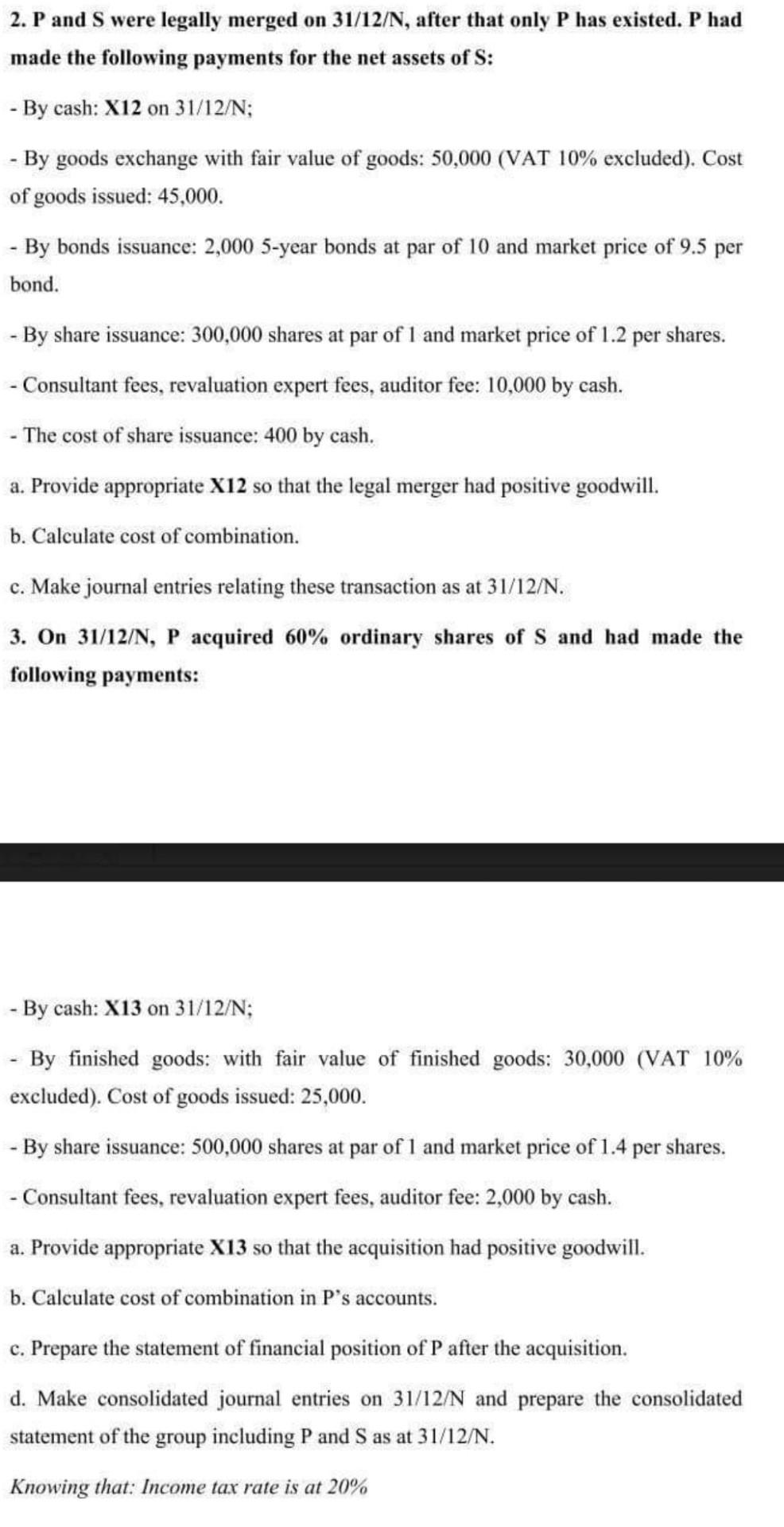

On 31/12/N, the private statement of financial position of P and S is as follows: (Unit: CU1000) P S S (book value) (fair value) Cash 80.000 X1 X1 Trade receivables 150.000 X2 X2 Inventories 180.000 X3 X3-15.000 Fixed assets 260.000 X4 X4+35.000 Total assets 670.000 350.000 370.000 Trade payables 60.000 X5 X5 20.000 X6 X6 Taxation and payables to the State Other payables 60.000 X7 X7 Long-term borrowings 70.000 X8 X8 Share capital 340.000 X9 Share premium 50.000 X10 Undistributes profit after tax 70.000 X11 Dann dau a da noam thann Total equity and liabilities 670.000 350.000 Required: 1. Provide appropriate X1 to Xil to complete the statement of financial position of S prior to the business combination. The following requirements are independent: 2. P and S were legally merged on 31/12/N, after that only P has existed. P had made the following payments for the net assets of S: - By cash: X12 on 31/12/N; - By goods exchange with fair value of goods: 50,000 (VAT 10% excluded). Cost of goods issued: 45,000. - By bonds issuance: 2,000 5-year bonds at par of 10 and market price of 9.5 per bond. - By share issuance: 300,000 shares at par of 1 and market price of 1.2 per shares. - Consultant fees, revaluation expert fees, auditor fee: 10,000 by cash. - The cost of share issuance: 400 by cash. a. Provide appropriate X12 so that the legal merger had positive goodwill. b. Calculate cost of combination. c. Make journal entries relating these transaction as at 31/12/N. 3. On 31/12/N, P acquired 60% ordinary shares of S and had made the following payments: - By cash: X13 on 31/12/N; - By finished goods: with fair value of finished goods: 30,000 (VAT 10% excluded). Cost of goods issued: 25,000. - By share issuance: 500,000 shares at par of 1 and market price of 1.4 per shares. - Consultant fees, revaluation expert fees, auditor fee: 2,000 by cash. a. Provide appropriate X13 so that the acquisition had positive goodwill. b. Calculate cost of combination in P's accounts. c. Prepare the statement of financial position of P after the acquisition. d. Make consolidated journal entries on 31/12/N and prepare the consolidated statement of the group including P and S as at 31/12/N. Knowing that: Income tax rate is at 20% On 31/12/N, the private statement of financial position of P and S is as follows: (Unit: CU1000) P S S (book value) (fair value) Cash 80.000 X1 X1 Trade receivables 150.000 X2 X2 Inventories 180.000 X3 X3-15.000 Fixed assets 260.000 X4 X4+35.000 Total assets 670.000 350.000 370.000 Trade payables 60.000 X5 X5 20.000 X6 X6 Taxation and payables to the State Other payables 60.000 X7 X7 Long-term borrowings 70.000 X8 X8 Share capital 340.000 X9 Share premium 50.000 X10 Undistributes profit after tax 70.000 X11 Dann dau a da noam thann Total equity and liabilities 670.000 350.000 Required: 1. Provide appropriate X1 to Xil to complete the statement of financial position of S prior to the business combination. The following requirements are independent: 2. P and S were legally merged on 31/12/N, after that only P has existed. P had made the following payments for the net assets of S: - By cash: X12 on 31/12/N; - By goods exchange with fair value of goods: 50,000 (VAT 10% excluded). Cost of goods issued: 45,000. - By bonds issuance: 2,000 5-year bonds at par of 10 and market price of 9.5 per bond. - By share issuance: 300,000 shares at par of 1 and market price of 1.2 per shares. - Consultant fees, revaluation expert fees, auditor fee: 10,000 by cash. - The cost of share issuance: 400 by cash. a. Provide appropriate X12 so that the legal merger had positive goodwill. b. Calculate cost of combination. c. Make journal entries relating these transaction as at 31/12/N. 3. On 31/12/N, P acquired 60% ordinary shares of S and had made the following payments: - By cash: X13 on 31/12/N; - By finished goods: with fair value of finished goods: 30,000 (VAT 10% excluded). Cost of goods issued: 25,000. - By share issuance: 500,000 shares at par of 1 and market price of 1.4 per shares. - Consultant fees, revaluation expert fees, auditor fee: 2,000 by cash. a. Provide appropriate X13 so that the acquisition had positive goodwill. b. Calculate cost of combination in P's accounts. c. Prepare the statement of financial position of P after the acquisition. d. Make consolidated journal entries on 31/12/N and prepare the consolidated statement of the group including P and S as at 31/12/N. Knowing that: Income tax rate is at 20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started