Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on 6 Assume that you are presented with an analysis of a possible expansion project. In the analysis, projected net cash flows resulting from the

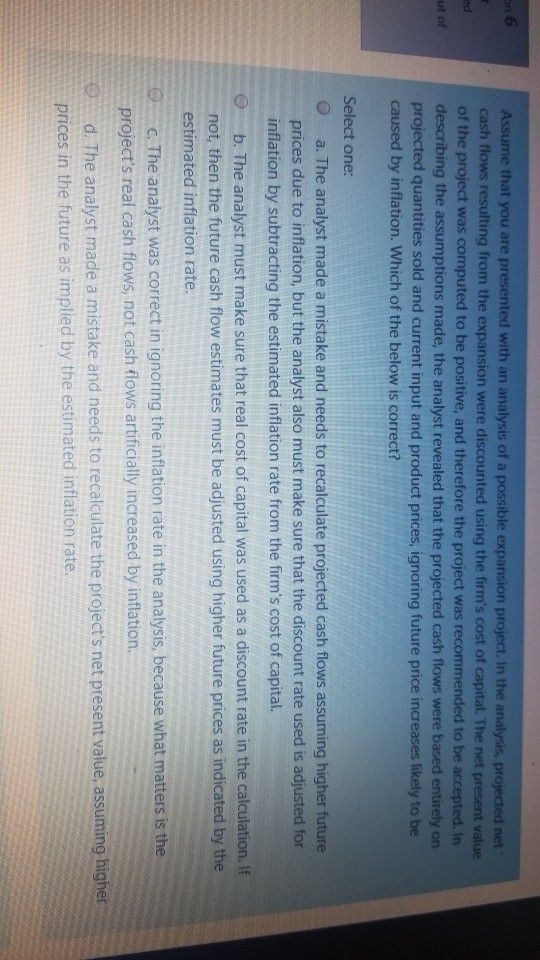

on 6 Assume that you are presented with an analysis of a possible expansion project. In the analysis, projected net cash flows resulting from the expansion were discounted using the firm's cost of capital. The net present value of the project was computed to be positive, and therefore the project was recommended to be accepted. In describing the assumptions made, the analyst revealed that the projected cash flows were based entirely on projected quantities sold and current input and product prices, ignoring future price increases likely to be caused by inflation. Which of the below is correct? ut of Select one: a. The analyst made a mistake and needs to recalculate projected cash flows assuming higher future prices due to inflation, but the analyst also must make sure that the discount rate used is adjusted for inflation by subtracting the estimated inflation rate from the firm's cost of capital. b. The analyst must make sure that real cost of capital was used as a discount rate in the calculation. If not, then the future cash flow estimates must be adjusted using higher future prices as indicated by the estimated inflation rate. C. The analyst was correct in ignoring the inflation rate in the analysis, because what matters is the project's real cash flows, not cash flows artificially increased by inflation. d. The analyst made a mistake and needs to recalculate the project's net present value, assuming higher prices in the future as implied by the estimated inflation rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started