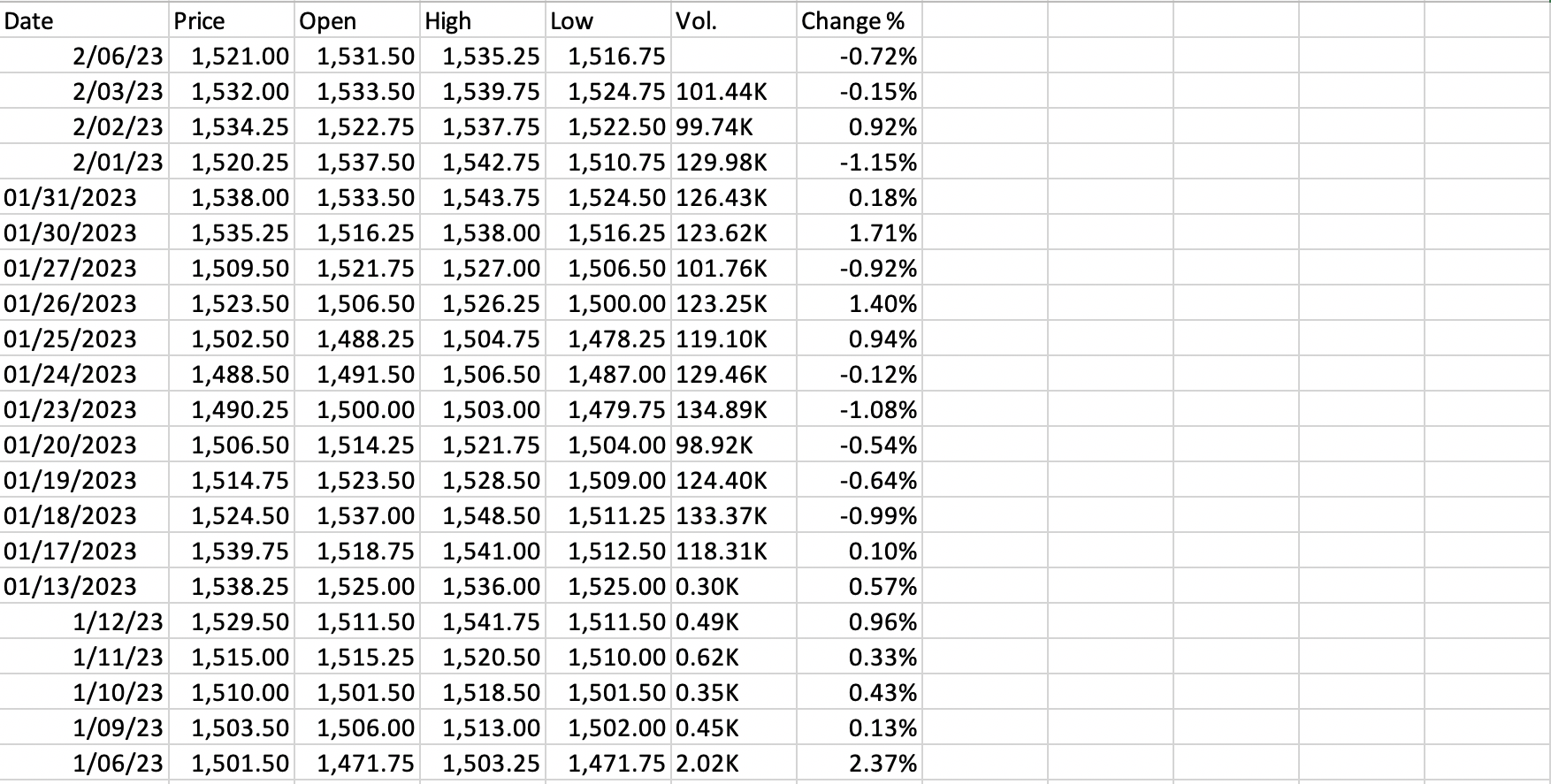

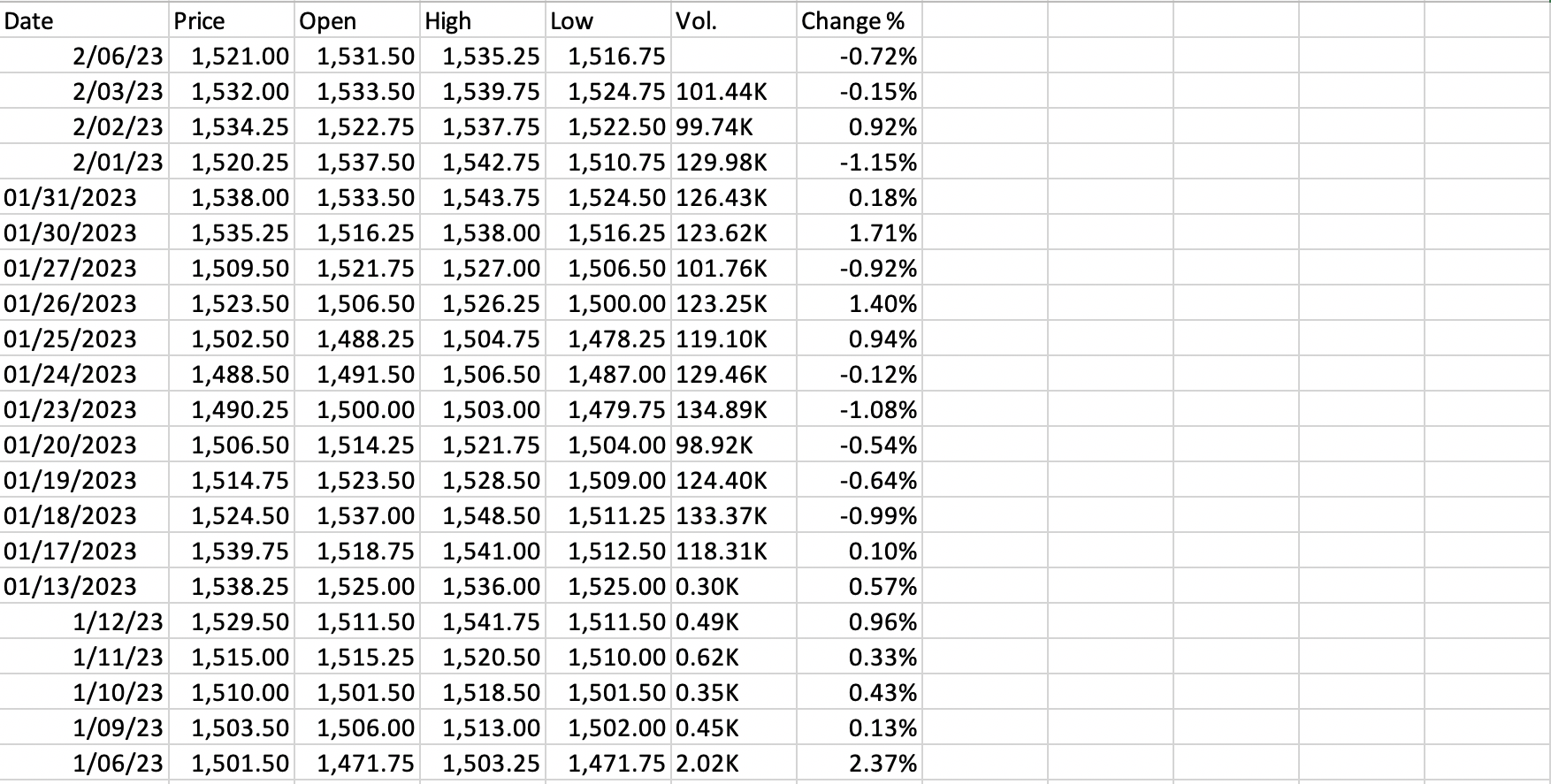

On 6 Jan 2023, a speculator shorts five Mar 2023 US Soybeans futures contracts at a price of 1,485.75 cent per bushel. The speculator closes out her futures position on 6Feb at a price of 1,518.25 cent per bushel. The US Soybeans futures contract is written on 5,000 bushels of soybeans and, for a speculator, the initial and maintenance margins are $4,050 and $3,600 per contract respectively. Assume that the speculator does not withdraw any excess out of their margin account. Data on the daily settlement price for the Mar 2023 US Soybeans futures contract during the period between 6 Jan and 6 Feb 2023 can be found in a spreadsheet titled US Soybeans Futures Prices.xlsx posted on Canvas. Required: (a) At the time the futures position is established, what is the minimum price movement that will generate a margin call? Report your answer in cents with 2 decimal places ( 2dps). ( 2 marks) (b) Construct a table as below to illustrate the daily marking-to-market (and final settlement) of the speculator's overall futures position. Note: the table is identical to Table 2.1 on page 30 of the prescribed textbook. (8 marks) (c) What is the overall profit/loss of the speculator? Decompose the overall profit/loss into two components: (i) total margin calls, and (ii) the change in the margin account balance. (2 marks) \begin{tabular}{|r|r|r|r|r|r|r|} \hline \multicolumn{1}{|l|}{ Date } & Price & Open & High & Low & Vol. & Change \% \\ \hline 2/06/23 & 1,521.00 & 1,531.50 & 1,535.25 & 1,516.75 & & 0.72% \\ \hline 2/03/23 & 1,532.00 & 1,533.50 & 1,539.75 & 1,524.75 & 101.44K & 0.15% \\ \hline 2/02/23 & 1,534.25 & 1,522.75 & 1,537.75 & 1,522.50 & 99.74K & 0.92% \\ \hline 2/01/23 & 1,520.25 & 1,537.50 & 1,542.75 & 1,510.75 & 129.98K & 1.15% \\ \hline 01/31/2023 & 1,538.00 & 1,533.50 & 1,543.75 & 1,524.50 & 126.43K & 0.18% \\ \hline 01/30/2023 & 1,535.25 & 1,516.25 & 1,538.00 & 1,516.25 & 123.62K & 1.71% \\ \hline 01/27/2023 & 1,509.50 & 1,521.75 & 1,527.00 & 1,506.50 & 101.76K & 0.92% \\ \hline 01/26/2023 & 1,523.50 & 1,506.50 & 1,526.25 & 1,500.00 & 123.25K & 1.40% \\ \hline 01/25/2023 & 1,502.50 & 1,488.25 & 1,504.75 & 1,478.25 & 119.10K & 0.94% \\ \hline 01/24/2023 & 1,488.50 & 1,491.50 & 1,506.50 & 1,487.00 & 129.46K & 0.12% \\ \hline 01/23/2023 & 1,490.25 & 1,500.00 & 1,503.00 & 1,479.75 & 134.89K & 1.08% \\ \hline 01/20/2023 & 1,506.50 & 1,514.25 & 1,521.75 & 1,504.00 & 98.92K & 0.54% \\ \hline 01/19/2023 & 1,514.75 & 1,523.50 & 1,528.50 & 1,509.00 & 124.40K & 0.64% \\ \hline 01/18/2023 & 1,524.50 & 1,537.00 & 1,548.50 & 1,511.25 & 133.37K & 0.99% \\ \hline 01/17/2023 & 1,539.75 & 1,518.75 & 1,541.00 & 1,512.50 & 118.31K & 0.10% \\ \hline 01/13/2023 & 1,538.25 & 1,525.00 & 1,536.00 & 1,525.00 & 0.30K & 0.57% \\ \hline 1/12/23 & 1,529.50 & 1,511.50 & 1,541.75 & 1,511.50 & 0.49K & 0.96% \\ \hline 1/11/23 & 1,515.00 & 1,515.25 & 1,520.50 & 1,510.00 & 0.62K & 0.33% \\ \hline 1/10/23 & 1,510.00 & 1,501.50 & 1,518.50 & 1,501.50 & 0.35K & 0.43% \\ \hline 1/09/23 & 1,503.50 & 1,506.00 & 1,513.00 & 1,502.00 & 0.45K & 0.13% \\ \hline 1/06/23 & 1,501.50 & 1,471.75 & 1,503.25 & 1,471.75 & 2.02K & 2.37% \\ \hline \end{tabular} On 6 Jan 2023, a speculator shorts five Mar 2023 US Soybeans futures contracts at a price of 1,485.75 cent per bushel. The speculator closes out her futures position on 6Feb at a price of 1,518.25 cent per bushel. The US Soybeans futures contract is written on 5,000 bushels of soybeans and, for a speculator, the initial and maintenance margins are $4,050 and $3,600 per contract respectively. Assume that the speculator does not withdraw any excess out of their margin account. Data on the daily settlement price for the Mar 2023 US Soybeans futures contract during the period between 6 Jan and 6 Feb 2023 can be found in a spreadsheet titled US Soybeans Futures Prices.xlsx posted on Canvas. Required: (a) At the time the futures position is established, what is the minimum price movement that will generate a margin call? Report your answer in cents with 2 decimal places ( 2dps). ( 2 marks) (b) Construct a table as below to illustrate the daily marking-to-market (and final settlement) of the speculator's overall futures position. Note: the table is identical to Table 2.1 on page 30 of the prescribed textbook. (8 marks) (c) What is the overall profit/loss of the speculator? Decompose the overall profit/loss into two components: (i) total margin calls, and (ii) the change in the margin account balance. (2 marks) \begin{tabular}{|r|r|r|r|r|r|r|} \hline \multicolumn{1}{|l|}{ Date } & Price & Open & High & Low & Vol. & Change \% \\ \hline 2/06/23 & 1,521.00 & 1,531.50 & 1,535.25 & 1,516.75 & & 0.72% \\ \hline 2/03/23 & 1,532.00 & 1,533.50 & 1,539.75 & 1,524.75 & 101.44K & 0.15% \\ \hline 2/02/23 & 1,534.25 & 1,522.75 & 1,537.75 & 1,522.50 & 99.74K & 0.92% \\ \hline 2/01/23 & 1,520.25 & 1,537.50 & 1,542.75 & 1,510.75 & 129.98K & 1.15% \\ \hline 01/31/2023 & 1,538.00 & 1,533.50 & 1,543.75 & 1,524.50 & 126.43K & 0.18% \\ \hline 01/30/2023 & 1,535.25 & 1,516.25 & 1,538.00 & 1,516.25 & 123.62K & 1.71% \\ \hline 01/27/2023 & 1,509.50 & 1,521.75 & 1,527.00 & 1,506.50 & 101.76K & 0.92% \\ \hline 01/26/2023 & 1,523.50 & 1,506.50 & 1,526.25 & 1,500.00 & 123.25K & 1.40% \\ \hline 01/25/2023 & 1,502.50 & 1,488.25 & 1,504.75 & 1,478.25 & 119.10K & 0.94% \\ \hline 01/24/2023 & 1,488.50 & 1,491.50 & 1,506.50 & 1,487.00 & 129.46K & 0.12% \\ \hline 01/23/2023 & 1,490.25 & 1,500.00 & 1,503.00 & 1,479.75 & 134.89K & 1.08% \\ \hline 01/20/2023 & 1,506.50 & 1,514.25 & 1,521.75 & 1,504.00 & 98.92K & 0.54% \\ \hline 01/19/2023 & 1,514.75 & 1,523.50 & 1,528.50 & 1,509.00 & 124.40K & 0.64% \\ \hline 01/18/2023 & 1,524.50 & 1,537.00 & 1,548.50 & 1,511.25 & 133.37K & 0.99% \\ \hline 01/17/2023 & 1,539.75 & 1,518.75 & 1,541.00 & 1,512.50 & 118.31K & 0.10% \\ \hline 01/13/2023 & 1,538.25 & 1,525.00 & 1,536.00 & 1,525.00 & 0.30K & 0.57% \\ \hline 1/12/23 & 1,529.50 & 1,511.50 & 1,541.75 & 1,511.50 & 0.49K & 0.96% \\ \hline 1/11/23 & 1,515.00 & 1,515.25 & 1,520.50 & 1,510.00 & 0.62K & 0.33% \\ \hline 1/10/23 & 1,510.00 & 1,501.50 & 1,518.50 & 1,501.50 & 0.35K & 0.43% \\ \hline 1/09/23 & 1,503.50 & 1,506.00 & 1,513.00 & 1,502.00 & 0.45K & 0.13% \\ \hline 1/06/23 & 1,501.50 & 1,471.75 & 1,503.25 & 1,471.75 & 2.02K & 2.37% \\ \hline \end{tabular}