Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on 7 t ed A company's payroll for two weeks, ending November 14, is $26,850. The following source deductions were made: Employee income taxes payable,

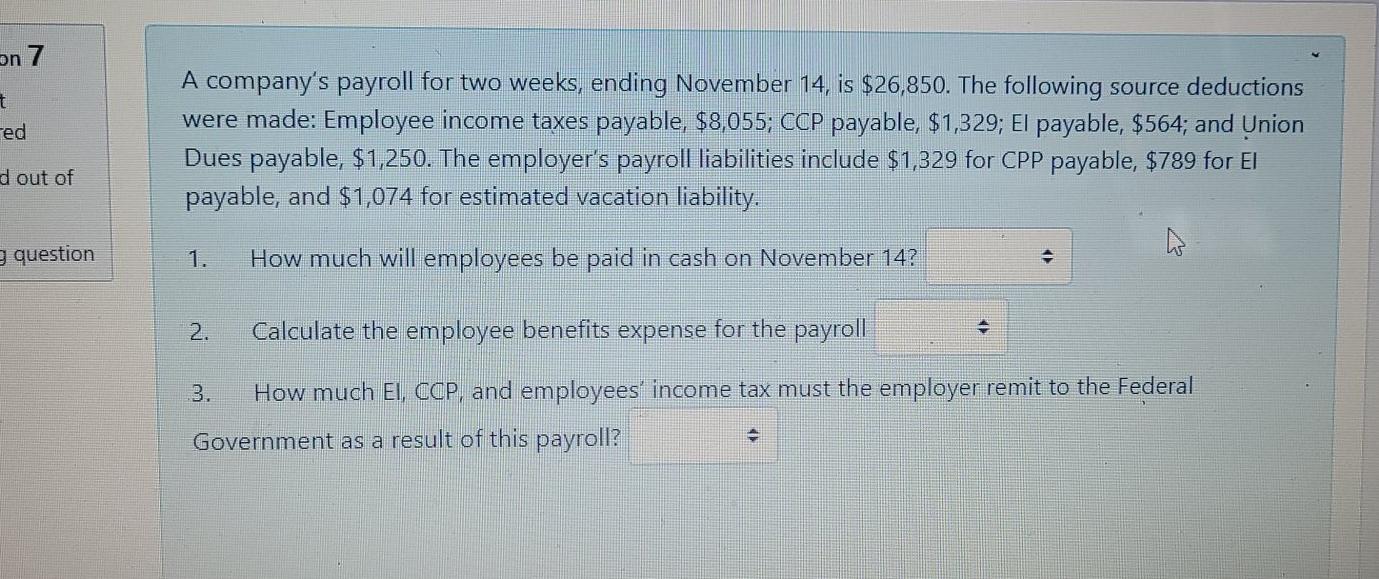

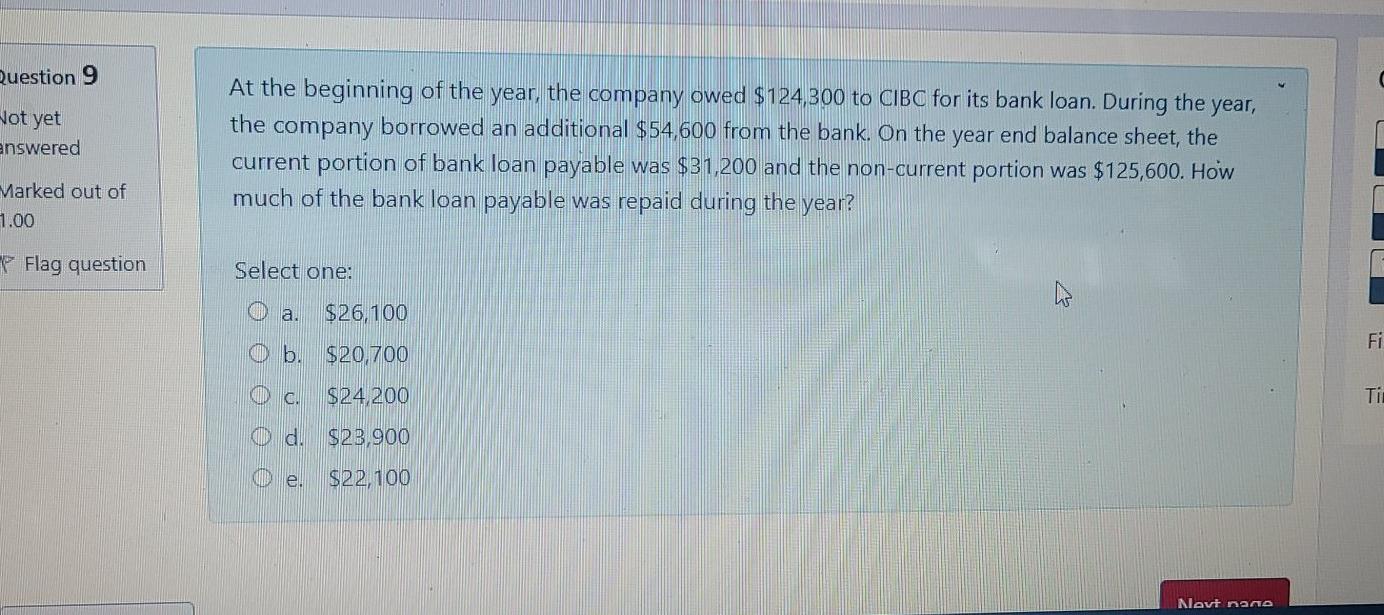

on 7 t ed A company's payroll for two weeks, ending November 14, is $26,850. The following source deductions were made: Employee income taxes payable, $8,055; CCP payable, $1,329; El payable, $564; and Union Dues payable, $1,250. The employer's payroll liabilities include $1,329 for CPP payable, $789 for El payable, and $1,074 for estimated vacation liability. d out of question 1. How much will employees be paid in cash on November 14? . 2. Calculate the employee benefits expense for the payroll 3. How much El, CCP, and employees' income tax must the employer remit to the Federal Government as a result of this payroll? Question 9 Not yet answered At the beginning of the year, the company owed $124,300 to CIBC for its bank loan. During the year, the company borrowed an additional $54,600 from the bank. On the year end balance sheet, the current portion of bank loan payable was $31,200 and the non-current portion was $125,600. How much of the bank loan payable was repaid during the year? Marked out of 1.00 Flag question Select one: a. $26,100 Fi b. $20,700 COD C. $24.200 Ti d. $23,900 e. $22,100 Nevt nano

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started